AUTHOR : KHOKHO

DATE : 20/12/2023

Introduction

In the dynamic landscape of inter-enterprise relations in India, the way businesses handle payment processing plays a crucial role in defining success. Efficient payment mechanisms are the backbone of smooth collaborations, fostering trust and reliability between enterprises.

Significance of Efficient Payment Processing

Streamlining financial transactions between businesses not only saves time but also strengthens the foundation of their relationships. An efficient payment process enhances business interactions, providing a positive experience for all parties involved Inter-Enterprise Relations.

Challenges in Payment Processing for Inter-enterprise Relations in India

The diversity of payment For Inter-Enterprise in India poses a challenge for seamless transactions. Additionally, navigating through regulatory complexities adds another layer of difficulty. Overcoming these challenges requires a comprehensive understanding of the Indian financial landscape.

Digital Transformation in Payment Processing

The digital transformation wave has significantly impacted payment processing. Relations In India The adoption of Digital Payment Ecosystems[1] not only expedites transactions but also brings forth a myriad of benefits, including transparency, accuracy, and accessibility.

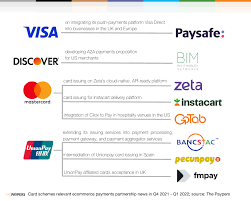

Role of Fintech Companies

Fintech companies are at the forefront of revolutionizing payment processing for inter-enterprise relations. Commercial Payment Processing[2] By offering tailored solutions and facilitating seamless transactions, these companies contribute to the overall efficiency and effectiveness of financial dealings.

Security Measures in Payment Processing

Ensuring the security of financial transactions is paramount. Inter-Enterprise Payment Processing For Inter-Enterprise Relations In India Robust encryption and authentication methods safeguard sensitive information, instilling confidence in businesses engaged in inter-enterprise relations.

Government Initiatives and Regulations

Government Initiatives and Regulations

integration of blockchain technology is changing the game in payment processing. Understanding its role and staying abreast of future trends empowers businesses to adapt and thrive in the evolving financial An overview of these initiatives helps businesses align their practices with legal requirements, ensuring compliance and minimizing risks Commercial Payment Processing[3].

Case Studies

Examining successful case studies provides valuable insights into efficient payment processing. Real-world is focused on optimizing operations in a world which could be considered full of continuous and largely unpredictable change. examples showcase best practices and offer practical learnings that businesses can apply to enhance their own payment systems.

Collaboration and Partnerships

Strengthening inter-enterprise networks[4] through collaboration and partnerships is key to fostering efficient payment processing. Joint efforts in developing customized solutions can address specific challenges faced by businesses.

Adapting to Changing Technologies

The integration of blockchain technology is changing the game in payment processing. Understanding its role and staying abreast of future trends empowers businesses to adapt and thrive in the evolving financial landscape. Enterprise integration[5] is focused on optimizing operations in a world which could be considered full of continuous and largely unpredictable change.

Benefits for Small and Medium Enterprises (SMEs)

Inter-Enterprise Relations In India Efficient payment processing levels the playing field for SMEs, providing them with access to advanced payment technologies. This not only enhances their competitiveness but also opens new opportunities for growth.

Educational Initiatives for Businesses

Conducting workshops and training programs is essential for increasing awareness about efficient payment processing. Educated businesses are better equipped to make informed decisions and implement best practices. authentication methods safeguard sensitive information, instilling confidence in businesses engaged in inter-enterprise relations

Customer Experience and Satisfaction

Smooth and reliable transactions contribute significantly to positive customer experiences. Building trust through efficient payment processing strengthens customer relations and fosters long-term partnerships.

Measuring Success in Payment Processing

Establishing key performance indicators (KPIs) allows businesses to measure the success of their payment processing systems. Continuous improvement strategies based on these metrics ensure ongoing efficiency.

Adapting to Industry-Specific Needs

Understanding and catering to industry-specific requirements is vital for effective payment processing in inter-enterprise relations. Different sectors may have unique demands, and tailoring payment solutions to meet these needs enhances overall efficiency.

Evolving Role of Traditional Banking Institutions

While fintech companies play a significant role, traditional banking institutions are also adapting to the changing landscape. Collaborations between banks and fintech firms bring together the stability of established financial institutions and the innovation of fintech.

The Importance of Data Analytics in Payment Processing

Harnessing the power of data analytics is becoming increasingly crucial in payment processing Analyzing transaction data provides valuable insights that businesses can use to optimize their processes, detect anomalies, and improve overall efficiency.

Conclusion

In conclusion, payment processing is a critical aspect of inter-enterprise relations in India. The journey towards efficient transactions involves overcoming challenges, embracing digital transformation, and staying attuned to evolving technologies. As businesses focus on building robust payment systems, the future holds promising opportunities for seamless and secure financial interactions.

FAQs

- Is digital payment adoption widespread among Indian businesses?

- Yes, many businesses in India are actively adopting digital payment systems to streamline their financial transactions.

- How can SMEs benefit from efficient payment processing?

- SMEs can level the playing field and access advanced payment technologies, enhancing their competitiveness and opening new growth avenues.

- What role does government regulation play in payment processing?

- Government regulations shape the landscape of payment processing, influencing compliance and risk management for businesses.

- Are there specific security measures for inter-enterprise payment transactions?

- Yes, robust encryption and authentication methods are essential to ensure the security of sensitive information in inter-enterprise transactions.

- How can businesses measure the success of their payment processing systems?

- Establishing key performance indicators (KPIs) allows businesses to measure success, enabling continuous improvement strategies