AUTHOR : BELLA

DATE : 21/12/2023

Introduction

Current Payment Landscape in India

In the dynamic landscape of wholesale deals in India, the role of payment providers has become increasingly crucial. These entities play a pivotal role in facilitating secure, efficient, and streamlined transactions. Let’s delve into the world of payment providers and explore how they are transforming the wholesale payment landscape.

In the past, Payment Provider For Wholesale Deals in India predominantly relied on traditional payment methods, leading to various challenges. From delays in processing payments to the lack of customization options, the existing system posed hurdles for businesses. Recognizing the need for specialized solutions, payment providers stepped in to address these pain points.

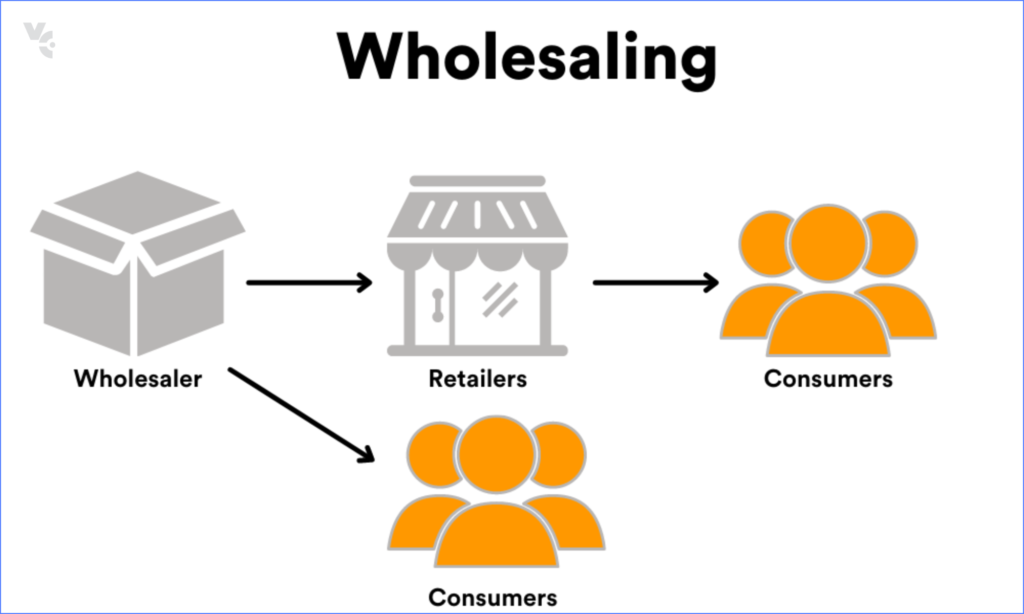

Role of Payment Providers in Wholesale Deals

Payment Provider[1] For Wholesale Deals in India go beyond traditional banking services by offering tailored solutions for wholesale transactions. Their role encompasses facilitating secure financial exchanges, streamlining payment processes, and also providing customized features to meet the unique needs of wholesale[2] businesses.

Top Payment Providers in India for Wholesale Deals

- Provider 1: Revolutionizing Transactions

- Features: Advanced Security Protocols, Real-time Transaction Tracking

- Benefits: Faster Processing, Reduced Risks of Fraud

- Provider 2: Tailored for Wholesale Efficiency

- Features: Bulk Payment Options, Integration with ERP Systems

- Benefits: Seamless Workflow, Enhanced Accounting Accuracy

- Provider 3: Custom Solutions for Diverse Industries

- Features: Industry-specific Modules, Scalable Infrastructure

- Benefits: Adaptable to Unique Business Requirements, Future-ready

How to Choose the Right Payment Provider

Selecting the right payment[3] provider is crucial for wholesale businesses. Factors such as understanding business needs, ensuring security and compliance, and also assessing integration compatibility play a pivotal role in making an informed choice.

Case Studies

Examining successful case studies showcases how businesses have benefited from adopting payment Provider For Wholesale Deals. Real-world examples highlight the efficiency, security, andtability of these solutions, offering valuable insights for prospective users.

Future Trends in Payment Solutions for Wholesale Transactions

As technology continues to evolve, so do payment solutions. Anticipating future trends in wholesale payment providers for wholesale deals in India, businesses can stay ahead of the curve, meeting the changing expectations of customers and also leveraging the latest advancements.

Advantages of Using Payment Providers

The adoption of payment[4] providers brings about several advantages for wholesale businesses, including time efficiency, cost savings, and improved customer trust. These benefits contribute to the overall growth and success of businesses in the wholesale sector.

Challenges and Solutions

Despite the advantages, businesses may face challenges[5] during the adoption of payment providers. Understanding these challenges and implementing effective strategies can ensure a smooth transition and maximize the benefits of these solutions.

Success Stories

Businesses thriving with payment providers exemplify the positive impact on profitability and growth. These success stories serve as inspiration for other wholesale entities considering the adoption of modern payment solutions.

Conclusion

In conclusion, payment providers for wholesale deals in India are the backbone of efficient and secure wholesale transactions in India. The transformative impact they bring, from enhancing security to improving workflow, positions them as essential partners for businesses aiming to thrive in the competitive wholesale landscape.

FAQs

Q1: How do payment providers ensure the security of wholesale transactions?

Payment providers employ advanced security protocols, including encryption and also authentication measures, to safeguard wholesale transactions. These measures reduce the risks of fraud and also ensure the confidentiality of sensitive financial information.

Q2: Are there specific payment providers tailored for certain industries within wholesale?

Yes, many payment providers offer industry-specific modules to cater to the unique needs of different sectors within the wholesale industry. These tailored solutions ensure that businesses receive the most relevant features for their specific operations.

Q3: What integration options do payment providers offer for different business sizes?

Payment providers understand the diverse needs of businesses and also offer flexible integration options. Whether a small-scale enterprise or a large corporation, providers often have solutions that can seamlessly integrate with existing systems, including ERP and also accounting software.

Q4: Can payment providers handle international transactions for wholesale deals?

Yes, many payment providers for wholesale deals in India have the capability to handle international transactions for wholesale deals. Businesses engaging in global trade can benefit from the convenience and efficiency offered by these providers in processing cross-border transactions.

Q5: How can businesses ensure a smooth transition when adopting payment providers?

Payment Provider For wholesale deals in India, to ensure a smooth transition, businesses should conduct thorough research, clearly define their requirements, and also communicate effectively with the chosen payment provider. Training employees and addressing potential challenges proactively can contribute to a successful adoption process.