AUTHOR :HAANA TINE

DATE :21/12/2023

Introduction

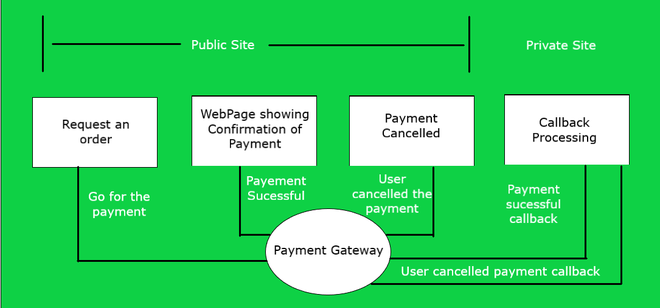

In the ever-evolving landscape of entrepreneurship, mentorship plays a pivotal role in guiding aspiring individuals toward success. Simultaneously, payment gateways act as the financial backbone, ensuring smooth and secure transactions in mentorship programs.

Significance of Payment Gateways in Entrepreneurial Mentorship

Facilitating Seamless Transactions

Payment gateways eliminate the hassle of traditional payment methods, allowing mentors and mentees to focus on their interactions. The ease of transactions fosters a conducive environment for learning and growth.

Ensuring Financial Security

Entrepreneurial Support involves financial transactions, making security paramount. Payment gateways implement robust security measures, safeguarding the financial interests of both mentors and mentees.

Expanding Outreach

By offering diverse payment options, support programs become more accessible. This inclusivity contributes to the expansion of entrepreneurial networks[1], fostering a vibrant ecosystem.

Popular Payment Gateways in India

India boasts a plethora of payment gateways[2] tailored to the needs of entrepreneurs. Notable examples include Razorpay, Paytm, Instamojo, and PayPal India.

Razorpay

Known for its user-friendly interface and advanced features, Razorpay is a preferred choice for many Support platforms.

Paytm

A household name in India, Paytm provides a seamless payment experience[3], making it ideal for Support transactions.

Instamojo

Specializing in simplifying digital transactions, Instamojo is favored for its flexibility and ease of integration.

PayPal India

For Support programs with a global reach, PayPal India offers a secure and international payment Gateways[3].

Integration of Payment Gateways in Mentorship Platforms

Enhancing User Experience

The integration of payment[4] Access Points enhances the overall user experience, allowing mentors and mentees to focus on meaningful interactions.

Streamlining Financial Transactions

Automated financial transactions streamline the administrative aspects of support programs, saving time and resources.

Trust and Credibility

The presence of secure payment options builds trust among participants, fostering credibility and reliability in support platforms.

Challenges and Solutions

Security Concerns

While payment access points offer security, challenges such as data breaches require constant vigilance. Regular updates and encryption are essential for mitigating risks.

Technical Issues

Integration issues and technical glitches may arise. Online Mentorship platforms[5] need a dedicated support system to address and resolve such issues promptly.

User Education

Educating users about the secure usage of payment gateways is crucial. Clear guidelines and tutorials can bridge the knowledge gap.

The Future of Payment Gateways in Entrepreneurial Mentorship

Emerging Trends

Innovation in payment technologies, including blockchain and cryptocurrency, is anticipated to shape the future of financial transactions in Support.

Innovation in Payment Technologies

Continued innovation in payment Access Points will lead to more efficient and tailored solutions for entrepreneurial mentorship.

Case Studies

Successful Integration Stories

Examining successful mentorship platforms and their integration of payment Access Points provides valuable insights for others.

Lessons Learned

Learning from challenges and successes ensures a more refined approach to integrating payment gateways into mentorship programs.

Tips for Entrepreneurs Using Payment Gateways in Mentorship

Choosing the Right Payment Gateway

Consider the specific needs of the Support program and choose a payment gateway that aligns with those requirements.

Security Best Practices

Implement additional security measures, such as two-factor authentication, to enhance the overall security of financial transactions.

Monitoring and Analytics

Regularly monitor transactions and analyze data to identify areas for improvement and optimize the payment process.

Impact on Mentorship Programs

Financial Empowerment

Efficient payment Access Points contribute to the financial empowerment of both mentors and mentees, creating a sustainable Supporte cosystem.

Global Collaboration

With the integration of international payment gateways, Support programs can collaborate on a global scale, fostering diverse perspectives and experiences.

SEO Strategies for Mentorship Platforms

Keyword Optimization

Incorporate relevant keywords to ensure the article reaches a wider audience interested in entrepreneurial Support and payment Access Points .

Quality Content Creation

Create engaging and informative content that adds value to the reader, encouraging them to explore the article in its entirety.

Backlinking

Strategically include backlinks to authoritative sources, enhancing the article’s credibility and SEO ranking.

Conclusion

In conclusion, the symbiotic relationship between payment Access Points and entrepreneurial mentorship in India is reshaping the landscape of business education and growth.Payment Gateway for Entrepreneurial Support in India As technology evolves, so do the opportunities for Support, creating a dynamic environment for aspiring entrepreneurs.

FAQs

How do payment Access Points benefit entrepreneurial mentorship?

Payment Access Points benefit entrepreneurial mentorship by facilitating seamless transactions, ensuring financial security, and expanding outreach.

Are there any risks associated with using payment Access Points in Support programs?

While payment Access Points enhance security, risks such as data breaches exist. Regular updates, encryption, and user education are crucial for mitigating these risks.

What are the top payment gateways recommended for Support platforms?

Top payment Access Points for Support platforms in India include Razorpay, Paytm, Instamojo, and PayPal India.

How can entrepreneurs ensure the security of financial transactions in Support programs?

Entrepreneurs can ensure security by choosing secure payment Access Points, additional security measures, and educating users about secure practices.

What trends can we expect in payment Access Points for entrepreneurial Support?

Emerging trends include innovation in payment technologies such as Digital Ledger and cryptocurrency, shaping the future of financial transactions in Support.