AUTHOR : LISA WEBB

DATE : DECEMBER 22, 2023

Introduction to Payment Gateways

In the digital era, the concept of payment gateways has revolutionized the way businesses operate, particularly in India. A payment gateway serves as a secure bridge between customers and merchants, enabling smooth online transactions. Its significance for profitable ventures in India cannot be overstated.

Key Features of Profitable Payment Gateways

Security Measures in Payment Gateways

Security stands as the foremost priority in any payment gateway. Encryption protocols, secure sockets layer (SSL) certificates, and also robust fraud detection mechanisms ensure safe transactions, earning trust from customers.

Integration Flexibility and Ease of Use

A lucrative payment gateway offers seamless integration across various platforms and also devices. Its user-friendly interface simplifies the checkout process, reducing cart abandonment rates.

Transaction Fees and Pricing Structures

Profitable ventures in India seek cost-effective solutions. Payment gateways with transparent pricing structures and also competitive transaction fees enable businesses to optimize costs effectively.

Popular Payment Gateways in India

India boasts a diverse array of payment gateways[1], each with unique features catering to different business needs. Leaders like Razorpay, Paytm, and also Instamojo offer distinct advantages, prompting a comparative analysis for businesses to make informed choices.

Choosing the Right Payment Gateway

Selecting the most suitable payment gateway integration[2] involves evaluating various factors, such as business size, transaction volume, and also customer base. Startups, SMEs, and also large enterprises have distinct needs, impacting their choices.

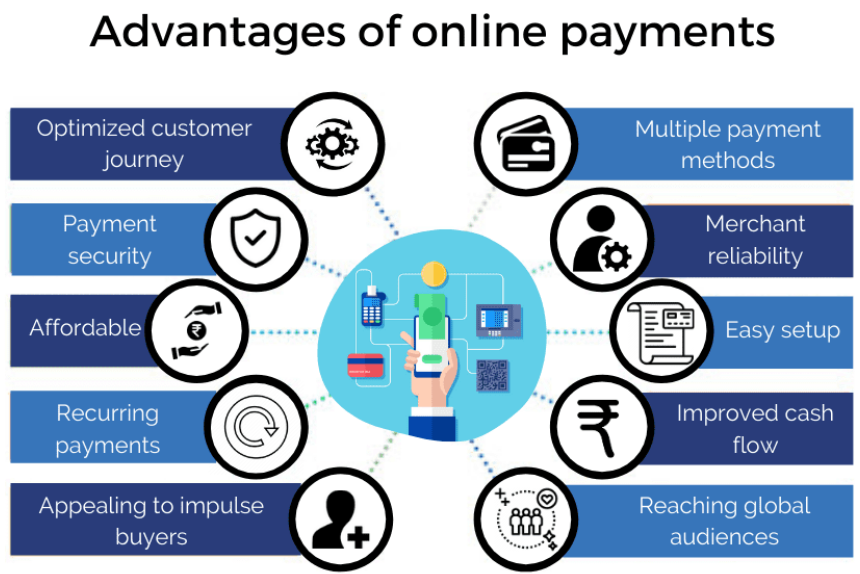

Benefits of Utilizing Payment Gateways

Implementing a robust Elevated Payment Solutions[3] the customer experience, boosts business scalability, and also facilitates efficient transaction management. Its utilization serves as a competitive advantage in the market.

Challenges and Solutions

While payment gateways[4] Profitable Ventures offer immense benefits, concerns related to security breaches and also technical issues persist. Adhering to stringent security measures and also prompt issue resolution are vital solutions.

Integration Process and Technical Support

Integratin a payment gateway[5] demands systematic steps, coupled with reliable technical support. Smooth integration and also round-the-clock assistance ensure uninterrupted transactions.

Impact of Payment Gateways on Indian E-commerce

The exponential growth of online businesses in India owes much to the seamless and hassle-free payment systems offered by these gateways. Trends indicate an increasing reliance on e-commerce platforms.

Regulatory Compliance and Legal Aspects

Adhering to RBI guidelines and legal frameworks is non-negotiable. Ensuring regulatory compliance secures the credibility of businesses and promotes trust among customers.

Case Studies and Success Stories

Numerous case studies demonstrate how businesses, both small and alsolarge, have leveraged payment gateways to expand their reach, streamline transactions, and achieve higher profitability.

Tips for Optimizing Payment Gateway Usage

Maximizing the efficiency of payment gateways involves strategic measures to reduce errors and cart abandonment rates. Tailored strategies enhance the overall transaction experience.

Future Innovations in Payment Gateways

The future of payment gateways in India is poised for exciting advancements. Technological trends like AI, blockchain, and mobile wallets are set to redefine the landscape, ensuring greater convenience.

Conclusion

Payment Gateway For Profitable Ventures In India .PG For Profitable Ventures In India ,Payment gateways serve as the backbone of profitable ventures in India, facilitating seamless transactions, ensuring security, and driving business growth. Their pivotal role in the success of modern businesses cannot be overlooked.

FAQs

Q.1 What is a payment gateway, and how does it work?

A payment gateway acts as a bridge between an online store and the bank, securely authorizing and facilitating the transaction process. It encrypts sensitive information, such as credit card details, ensuring a secure passage of funds from the customer’s account to the merchant’s account.

Q.2 Which payment gateway is best suited for small businesses in India?

For small businesses in India, payment gateways like Razorpay, PayU, and Instamojo are popular choices. These gateways offer user-friendly interfaces, easy integration, and competitive pricing, making them ideal for startups and SMEs.

Q.3 What are the key security features to look for in a payment gateway?

When selecting a payment gateway, key security features include robust encryption protocols, SSL certificates, two-factor authentication, and fraud detection mechanisms. These features ensure the safety of sensitive customer data and transactions.

Q.4 How do payment gateways impact customer satisfaction?

Payment gateways play a significant role in customer satisfaction by offering a seamless checkout experience, secure transactions, and multiple payment options. A smooth payment process enhances trust and satisfaction among customers.

Q.5 What are the emerging trends in payment gateways for Indian businesses?

The emerging trends in payment gateways for Indian businesses include advancements in contactless payments, the integration of artificial intelligence for fraud detection, the rise of mobile wallets, and the adoption of blockchain technology for enhanced security.