AUTHOR : ZOYA SHAH

DATE : 22-12-2023

In the vibrant landscape of India’s small businesses, navigating the financial ecosystem can be a challenge. However, with the right payment provider, these challenges can transform into opportunities for growth and efficiency. This article explores the crucial role payment providers play in supporting small businesses in India, offering insights into the landscape, the features to look for, and profiles of top providers.

Introduction

Small businesses form the backbone of India’s economy, contributing significantly to employment and innovation. In this digital age, the role of payment providers has become pivotal in ensuring the smooth financial operations of these enterprises.

The Landscape of Small Businesses in India

India boasts millions of small businesses, ranging from local stores to online ventures. Despite their numerical strength, these businesses often grapple with challenges such as limited resources, competition, and technological barriers.

The Role of Payment Providers

Payment providers act as catalysts in the growth of small businesses by offering secure and streamlined financial solutions. From facilitating transactions to integrating with existing systems, these providers play a vital role in simplifying complex financial processes. Payment Provider Small Business Support In India

When evaluating a payment provider for your small business in India

Security, user-friendly interfaces, and seamless integration are key features that small businesses[1] should prioritize when selecting a payment provider. These elements ensure a reliable and efficient financial ecosystem. Payment Provider Small Business Support In India.

Top Payment Providers Supporting Small Businesses in India

- Provider A: Empowering Growth Provider A stands out with its focus on empowering small businesses. With features like instant settlements and a user-friendly dashboard, it caters specifically to the needs of Indian entrepreneurs[2].

- Provider B: Tailored Services Provider B offers a suite of services tailored for small businesses. From customizable payment options to robust security features, it addresses the unique challenges faced by Indian entrepreneurs.

- Provider C: Market-Specific Solutions Provider C specializes in providing market-specific solutions for small businesses in India. Its innovative approach and localized features make it a preferred choice.

Case Studies

Real-world success stories showcase how small businesses in India have overcome financial hurdles with the assistance of Payment service provider[3] providers. These case studies offer valuable insights into the tangible benefits these solutions bring.

Future Trends in Small Business Payments

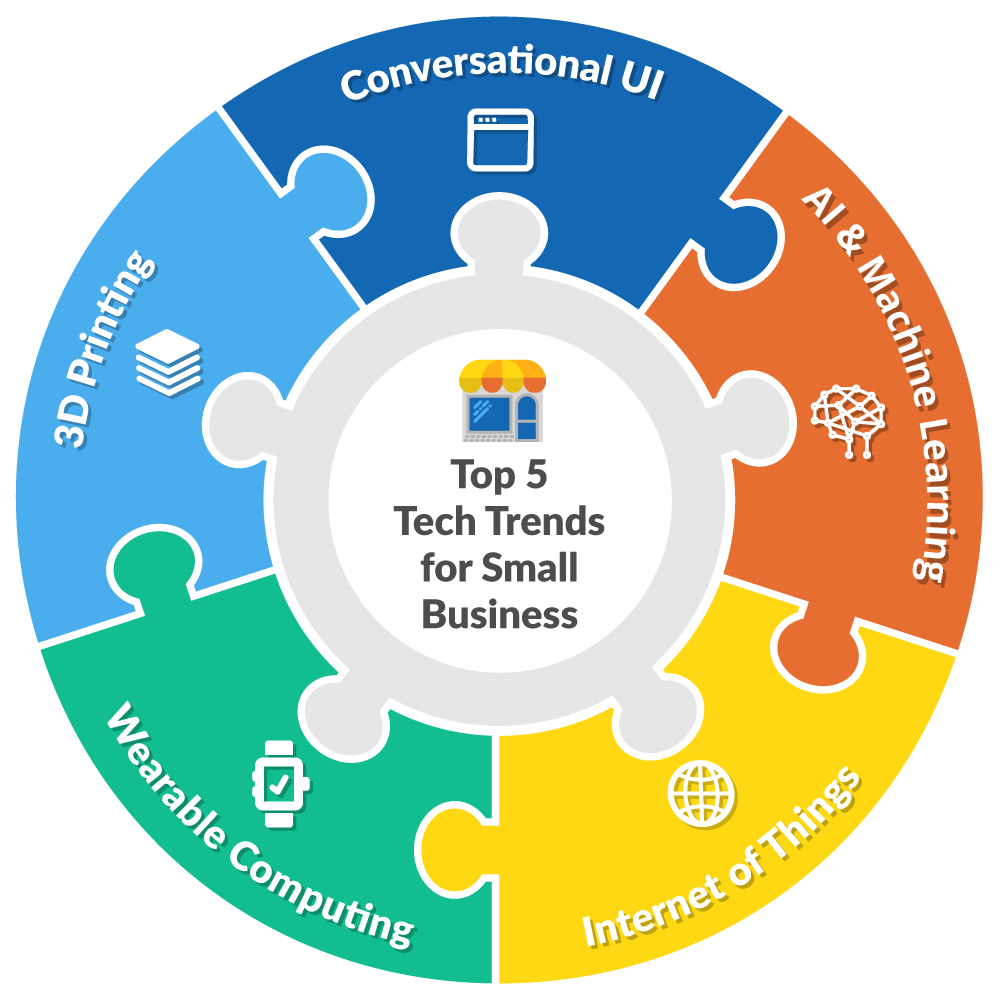

Emerging technologies are shaping the future of small business payments. From contactless transactions to artificial intelligence-driven Business support system[4], staying abreast of these trends is crucial for small businesses to remain competitive.

Tips for Choosing the Right Payment Provider

Assessing business needs, reading user reviews, and considering scalability are essential steps in choosing the right payment provider. This section provides practical tips to guide small businesses in their selection process.

The Impact of Digitalization on Small Businesses

Digitalization brings increased efficiency and productivity, but it also poses challenges. This section explores how small businesses can navigate the digital landscape and harness the benefits of digital payments[5].

Regulatory Considerations

Compliance with regulations is vital for small businesses. Payment providers play a significant role in assisting businesses in adhering to regulatory requirements, ensuring a secure and legal financial environment.

The Future Outlook for Small Business Support in India

As technology continues to evolve, the future outlook for small business support in India is optimistic. Innovations in payment solutions and a growing awareness of digital financial processes contribute to a positive trajectory.

Conclusion

In conclusion, payment providers are integral partners for small businesses in India, offering tailored solutions to navigate the financial landscape. By embracing digitalization and choosing the right provider, small businesses can thrive in a competitive environment.

FAQs

Q1: What are the key benefits of using a payment provider for small businesses?

A: Payment providers offer secure, efficient, and streamlined financial solutions, empowering small businesses to focus on growth rather than administrative tasks.

Q2: How do payment providers contribute to the growth of small businesses in India?

A: Payment providers contribute by simplifying financial processes, offering tailored services, and ensuring compliance with regulations, fostering an environment conducive to growth.

Q3: Are there any specific challenges that small businesses face in adopting digital payment solutions?

A: Yes, challenges include limited resources, technological barriers, and the need for regulatory compliance. However, payment providers often assist in overcoming these challenges.

Q4: What makes a payment provider stand out for small businesses in India?

A: A provider’s focus on localization, user-friendly interfaces, and features catering to the unique needs of Indian entrepreneurs distinguish it in the competitive market.

Q5: How can small businesses navigate regulatory challenges when using payment providers?

A: Small businesses can navigate regulatory challenges by choosing providers with robust compliance features and staying informed about changing regulations.