AUTHOR : AYAKA SHAIKH

DATE:22/12/2023

Introduction to Payment Providers in India

India, a country known for its diverse landscape, culture, and technological advancements, has seen a significant surge in digital transactions. This has given rise to numerous payment providers catering to the growing demands of businesses and consumers alike.

Evolution of Payment Systems in India

Traditional Payment Methods

In the past, cash transactions dominated the Indian market. However, with technological advancements and changing consumer behavior, there has been a gradual shift towards digital payment solutions.

Emergence of Digital Payment Solutions

The introduction of mobile wallets, UPI (Unified Payments Interface), and other online payment platforms has revolutionized the way transactions are conducted in India. This shift has paved the way for numerous payment providers to establish their presence in the market.

Role of Skill Enhancement in the Payment Industry

Importance of Skill Development

As the payment industry continues to evolve, there is a growing need for skilled professionals who can navigate the complexities of digital transactions. Skill enhancement programs play a crucial role in equipping individuals with the necessary expertise to thrive in this competitive landscape.

Impact on Operational Efficiency

Consequently, this plays a pivotal role in bolstering the organization’s overarching expansion and achievements.

Homegrown Companies

Several homegrown payment providers, such as Paytm, PhonePe, and MobiKwik, have gained prominence in the Indian market. Payment Provider Skill Their innovative solutions and customer-centric approach have enabled them to carve a niche for themselves amidst stiff competition.

International Players

International payment providers like PayPal, Google Pay, and Amazon Pay have also made significant strides in the Indian market. Their global expertise and expansive networks have positioned them as formidable competitors in the Digital Payments In India[1] landscape.

Challenges Faced by Payment Providers

Regulatory Issues

Despite the rapid growth of the Payments Industry [2], providers often grapple with regulatory challenges, including compliance issues and licensing requirements. Navigating these complexities requires a deep understanding of the legal landscape and a proactive approach to risk management.

Technological Advancements

The constant evolution of technology presents both opportunities and challenges for payment providers. Enhancement Staying abreast of the latest trends, Payment service provider[3] such as blockchain, AI, and cybersecurity, is essential to maintain a competitive edge in the market.

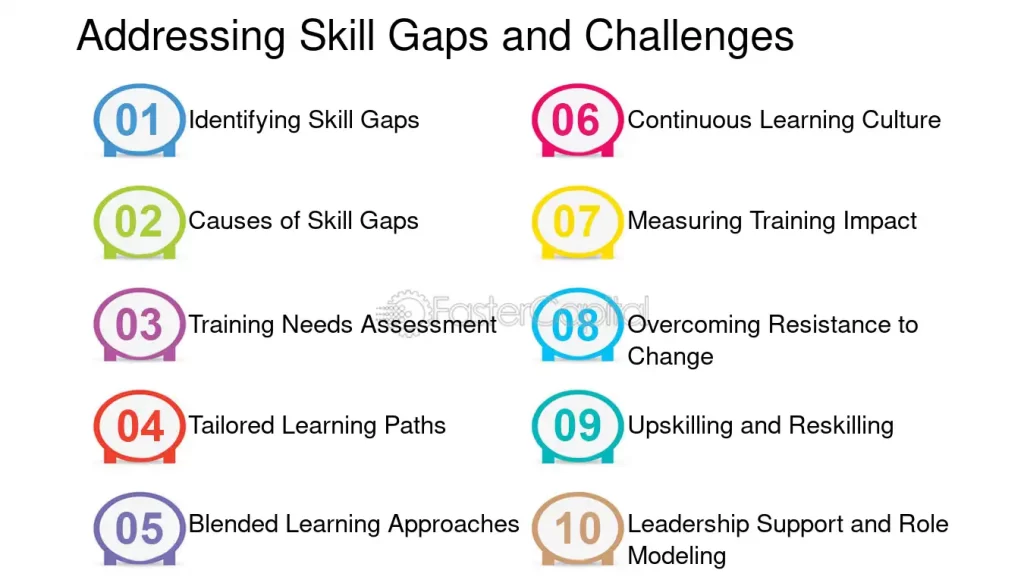

How Skill Enhancement is Addressing Challenges

Training and Development Programs

To address the challenges posed by regulatory issues and technological advancements, payment providers are investing heavily in training and development .programs. These initiatives aim to equip employees with the Payment Processor Skills[4] and knowledge required to navigate the ever-changing landscape effectively.

Innovation in Payment Solutions

Skill enhancement also fosters innovation within the payment providers payment industry. By encouraging employees to think creatively and explore new avenues, organizations can develop innovative solutions that meet the evolving needs of their customers.

Future Prospects and Trends

Adoption of Advanced Technologies

The adoption of advanced technologies, such as AI, machine learning, and biometrics, is expected to drive the next phase of growth in the payment industry. These technologies promise to enhance security, improve efficiency, and create new opportunities for innovation.

Expansion in Rural Areas

As internet penetration continues to grow, payment providers are increasingly focusing on expanding their reach in rural areas. By leveraging technology and partnering with local stakeholders, organizations can tap into the vast potential of this untapped market.

The Need for Consumer Education

Educating the Masses

One critical aspect that often gets overlooked in the payment landscape is consumer education. As digital transactions become more prevalent, there is a pressing need to educate consumers about the benefits, risks, and best practices associated with online payments. Skill enhancement programs can play a crucial role in this regard by empowering consumers with the knowledge and skills[5] they need to make informed decisions.

Building Trust and Confidence

Consumer trust is paramount in the payment industry. By investing in consumer education initiatives, payment providers can build trust and confidence among their user base. This, in turn, can lead to increased adoption rates, higher transaction volumes, and ultimately, greater success for the organization.

Strengthening Ecosystems.

Collaboration and partnerships are essential for fostering innovation and driving growth in the payment industry. Payment providers can leverage skill enhancement programs to forge strategic partnerships with fintech startups, financial institutions, and other stakeholders. These collaborations can lead to the development of innovative solutions, expanded service offerings, and enhanced customer experiences.

Leveraging Expertise

By collaborating with industry experts and thought leaders, payment providers can leverage their expertise and insights to address key challenges and seize new opportunities. This collaborative approach fosters knowledge sharing, promotes best practices, and accelerates the pace of innovation within the payment industry.

The Role of Government and Regulatory Bodies

Creating a Favorable Environment

Government and regulatory bodies play a pivotal role in shaping the payment landscape in India. By creating a favorable regulatory environment, policymakers can encourage innovation, foster competition, and ensure consumer protection. Skill enhancement programs can help payment providers navigate the regulatory landscape effectively and comply with applicable laws and regulations.

Promoting Financial Inclusion

One of the key objectives of government and regulatory bodies is to promote financial inclusion and ensure access to affordable financial services for all. Payment providers can support these efforts by developing tailored solutions for underserved communities, leveraging technology to reduce costs, and expanding their reach in rural and remote areas.

Conclusion

In conclusion, skill enhancement plays a pivotal role in shaping the future of payment providers in India. By investing in training and development programs, addressing regulatory challenges, and embracing technological advancements, organizations can position themselves for long-term success in this dynamic landscape.

FAQs

- What are the major challenges faced by payment providers in India?

- Regulatory issues and technological advancements are the primary challenges faced by payment providers in India.

- How are skill enhancement programs benefiting the payment industry?

- Skill enhancement programs are equipping professionals with the necessary expertise to navigate regulatory complexities and drive innovation within the payment industry.

- Which are the major players in the Indian payment landscape?

- Both homegrown companies like Paytm, PhonePe, and MobiKwik, and international players like PayPal, Google Pay, and Amazon Pay, are prominent players in the Indian payment landscape.

- What role does technology play in the future of payment providers?

- Advanced technologies such as AI, machine learning, and biometrics are expected to drive the next phase of growth and innovation in the payment industry.

- How is the payment industry evolving in rural areas?

- As internet penetration continues to grow, payment providers are focusing on expanding their reach in rural areas by leveraging technology and partnering with local stakeholders.