Name: Buddy Kim

Date: 26/12/23

Introduction

In the intricate tapestry of India’s financial landscape, effectively managing outstanding debt has emerged as a critical concern for both individuals and businesses. The escalating need for streamlined debt resolution has brought payment processors to the forefront, playing a pivotal role in facilitating seamless transactions and ensuring the security of financial data.

Current Debt Landscape in India

India, much like other nations, grapples with a substantial amount of outstanding debt across various sectors. From personal loans to business debts, individuals and organizations face challenges in navigating the complex web of financial obligations. Debtors often find themselves dealing with high-interest rates and inflexible repayment structures, leading to a growing need for innovative solutions.

Role of Payment Processors

Payment processors have become instrumental in simplifying financial transactions and, notably, in managing outstanding debt. Beyond their conventional role, these processors provide a secure and user-friendly platform that contributes to a smoother debt resolution process. By integrating Digital Payment Methods[1], they address the evolving needs of debtors in a rapidly advancing financial landscape.

Popular Payment Processors in India

Leading the charge in the payment processing realm in India are platforms such as Paytm, Razorpay, and Instamojo. Outstanding Debt Definition[2]

These services offer a spectrum of features, including rapid fund transfers, recurring payment options, and robust security measures. Understanding the unique features and benefits of these processors is essential for individuals and businesses seeking effective debt management solutions.

How Payment Processors Assist in Managing Outstanding Debt

Payment processors play a pivotal role in streamlining the repayment process by offering flexible options to debtors. From setting up automated recurring Payment service provider[3] multiple channels for fund transfer, these platforms empower individuals and businesses to take control of their financial obligations. This flexibility not only eases the burden on debtors but also enhances the likelihood of timely repayments.

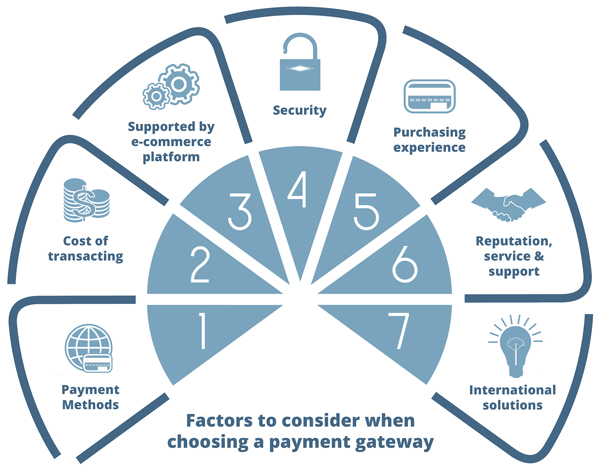

Factors to Consider When Choosing a Payment Processor

Selecting the right payment processor is paramount for effective debt management. Several factors come into play, including security protocols, transaction fees, and a user-friendly interface. Evaluating these aspects ensures a seamless and secure debt resolution[4] experience. For instance, individuals may prioritize platforms with robust security features to safeguard sensitive financial information.

Case Studies

Examining real-life examples of successful debt recovery stories provides tangible evidence of the positive impact of payment processors. These case studies illustrate how individuals and businesses have successfully navigated their outstanding debt challenges through Digital Payment Platforms[5]. Such narratives not only inspire confidence but also provide practical insights into the efficacy of these solutions.

Future Trends in Payment Processing for Debt Management

The future of payment processing for debt management in India is characterized by ongoing technological advancements and evolving consumer preferences. From the integration of artificial intelligence to the rise of contactless payments, staying informed about these trends is crucial for individuals and businesses alike. Adapting to these changes ensures that debt management processes remain efficient and aligned with the evolving financial landscape.

Challenges and Solutions

While payment processors bring significant benefits to debt management, challenges persist. Addressing security concerns and overcoming resistance to digital payments are crucial for wider adoption. Robust security protocols, combined with targeted awareness campaigns, play a pivotal role in mitigating these challenges and fostering trust in digital financial transactions.

Expert Insights

Insights from financial experts further emphasize the importance of payment processors in effective debt management. Through interviews and recommendations, these experts guide individuals and businesses on leveraging payment processors for optimal debt resolution. Their expertise adds a layer of credibility and practical advice, enriching the understanding of the role these processors play in the financial ecosystem.

Conclusion

In conclusion, the role of payment processors in managing outstanding debt in India is undeniably crucial. These platforms, such as Paytm, Razorpay, and Instamojo, not only simplify transactions but also contribute significantly to the evolving landscape of financial management. Embracing digital payment solutions is not just a trend but a necessity for effective and efficient debt resolution in the modern era.

FAQs

1.Q: Can payment processors help in reducing interest rates on outstanding debt?

A: Payment processors don’t directly influence interest rates, but they provide tools for efficient debt management, which can indirectly contribute to lowering overall debt burden.

2.Q: How secure are digital payment platforms for managing outstanding debt?

A: Leading payment processors prioritize security, employing advanced encryption and authentication measures to safeguard financial data.

3.Q: Are there any fees associated with using payment processors for debt resolution?

A: Transaction fees may apply, varying among payment processors. It’s essential to review and understand the fee structures before choosing a platform.

4.Q: Can businesses benefit from payment processors in debt recovery?

A: Absolutely. Payment processors offer businesses streamlined solutions for managing receivables and ensuring timely debt recovery.

5.Q: What trends can we expect in the future of payment processing for debt management?

A: Future trends include the integration of advanced technologies, such as artificial intelligence and blockchain, to enhance the efficiency and security of debt management processes.