AUTHOR : SELENA GIL

DATE : 27/12/2023

The digital revolution in India has significantly transformed the way transactions occur, especially in the realm of digital media. With the rise of online content consumption, the need for reliable and efficient payment processors has become increasingly paramount.

Introduction

In recent years, India has witnessed a surge in digital media consumption, encompassing streaming services, online publications, e-books, music platforms, and more. As this landscape evolves, the means of monetary transactions have adapted to suit the digital era.

Understanding Payment Processors

Payment processors act as intermediaries, facilitating online transactions between the buyer and seller. In the context of digital media, these processors play a crucial role in ensuring seamless transactions for various forms of content.

Importance of Payment Processors for Digital Media in India

The significance payment processors lies in their ability to offer secure and efficient transactions. They enable businesses to expand globally by facilitating international payments, benefiting both content creators and consumers.

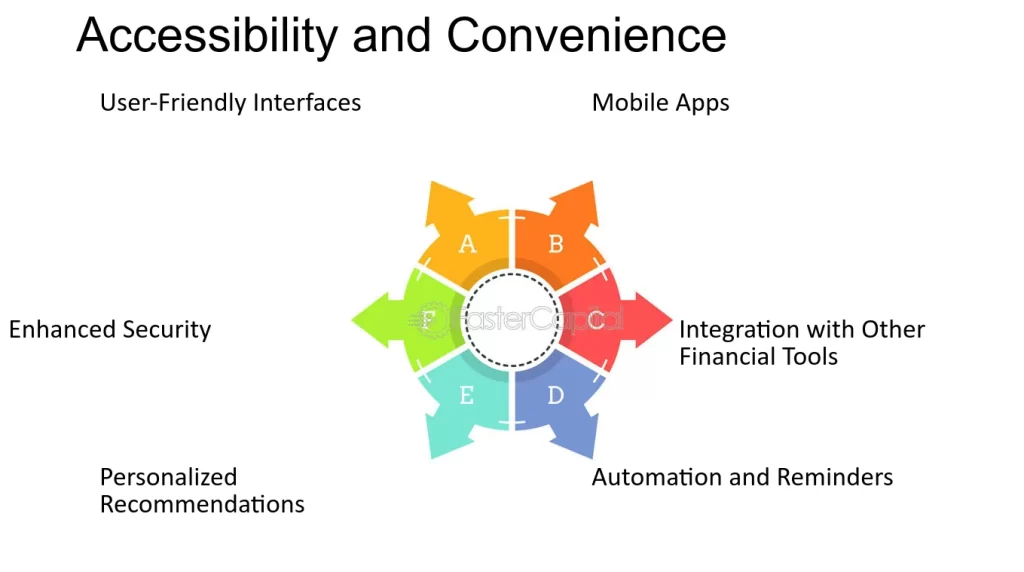

Key Features of Payment Processors in India

Notably, payment gateway in India[1] boast accessibility, easy integration with diverse digital platforms, and robust security measures. These features contribute to a user-friendly experience and instill trust among users.

Top Payment Processors for Digital Media in India

Several payment processors[2] have emerged as leaders in India’s digital media landscape. Platforms like Paytm, Razorpay, Instamojo, and PayU offer diverse features tailored to content creators and businesses.

Comparison of Payment Processors

Analyzing fee structures, user interfaces, and support for different digital media formats[3] allows users to make informed decisions based on their specific needs and preferences.

Challenges and Future Trends

Despite advancements, challenges like regulatory hurdles persist. However, the industry anticipates promising trends, including innovative payment solutions[4] and evolving regulations conducive to digital transactions.

Emerging Trends in Payment Processing

The landscape of payment processing digital media[5] in India is undergoing continuous evolution.

A significant trend involves amalgamating artificial intelligence (AI) with machine learning algorithms. Technologies are being employed to enhance security measures, detect fraudulent activities, and provide personalized user experiences.

Moreover, the simplification of payment processes is gaining traction. Companies are focusing on streamlining the payment experience for users across different devices and platforms. This includes one-click payments, intuitive interfaces, and seamless integrations with various digital media services.

Regulatory Challenges and Innovations

While the industry witnesses remarkable advancements, regulatory challenges persist. The regulatory framework for digital transactions in India continues to evolve, impacting how payment processors operate within the country.

To tackle these challenges, there’s been a surge in innovative solutions. Companies are actively collaborating with regulatory bodies to establish compliant frameworks. Additionally, advancements such as blockchain technology are being explored to create more transparent and secure payment ecosystems.

Future Prospects

Looking ahead, the future of payment processors in India’s digital media seems promising. The industry is poised for further growth, with a focus on user-centric innovations, tighter security measures, and expanding global accessibility.

Furthermore, with the continuous rise of digital content consumption, payment processors are expected to diversify their services to cater to the specific needs of various content creators and consumers. This could involve tailored payment plans, subscription models, and enhanced support for emerging digital media formats.

Of course! Let’s explore the impact and significance of payment processors for various stakeholders within India’s digital media ecosystem:

Impact on Content Creators

Payment processors have revolutionized the way content creators monetize their work. For creators, these platforms offer a streamlined means to receive payments for their digital content, ranging from articles, videos, music, and artistic creations. The ease of use and diverse payment options empower creators to monetize their content effectively, enabling them to focus on producing quality work without worrying about complex transaction procedures.

Consumer Convenience and Accessibility

From a consumer standpoint, payment processors provide unmatched convenience. Users can access a myriad of digital content and services seamlessly with secure and user-friendly payment gateways. The ability to choose from various payment methods, including credit and debit cards, digital wallets, and UPI, ensures a hassle-free experience, enhancing overall user satisfaction.

Supporting Business Growth

For businesses operating in the digital media sector, payment processors serve as catalysts for growth. These platforms facilitate global transactions, enabling businesses to reach a wider audience beyond geographical boundaries. Moreover, the integration of these processors across different digital platforms allows businesses to expand their market presence, enhancing revenue streams and fostering business expansion.

Security Measures and Trust

The implementation of robust security measures by payment processors is fundamental to establishing trust among both content creators and consumers. Encryption protocols, two-factor authentication, and fraud detection mechanisms reassure users about the safety of their transactions, contributing significantly to building a trustworthy digital ecosystem.

Empowering Digital Economy

The collective impact of payment processors in India’s digital media landscape extends beyond individual transactions. It fuels the growth of the digital economy by facilitating financial inclusion and empowering small businesses and creators to thrive in a digital-first environment. This democratization of the digital space enables a diverse array of content and services to flourish, contributing to the overall economic landscape of the country [5].

Conclusion

Payment processors serve as the backbone of India’s digital media economy, fostering secure transactions and driving growth. As technology advances, these processors are expected to evolve, catering to the ever-changing needs of the digital landscape.

FAQs

- Are payment processors secure for digital media transactions?Yes, top payment processors employ robust security measures to ensure safe transactions.

- Which payment processor is best for small content creators?Platforms like Instamojo and Razorpay offer user-friendly features suitable for smaller-scale creators.

- Do payment processors in India support international transactions?Yes, many processors facilitate international payments, expanding the reach of content creators.

- How do payment processors benefit consumers?They offer convenience, security, and diverse payment options for accessing digital content.

- What innovations can we expect in payment processing for digital media?Anticipate advancements in AI-driven payment solutions and enhanced user experiences.