AUTHOR: RUBBY PATEL

DATE: 29/12/23

Introduction

In the dynamic landscape of digital subscriptions in India, the emergence of high-Peril payment service providers (PSPs) has become a noteworthy phenomenon. These PSPs, offering digital subscription servicesbring both challenges and opportunities to the forefront . This article delves into the complexities of danger. PSP digital subscriptions, their characteristics, regulatory implications, challenges faced, and strategies for mitigating risks .

Understanding High-Risk PSPs

Characteristics of High-Risk PSPs High-risk PSPs exhibit distinctive features that set them apart in the digital payments sphere. Their services often cater to industries with elevated chargeback [1] risks and require a unique approach to payment processing. Digital subscription platforms, in particular, find themselves relying on these perilous. PSPs due to the nature of their recurring billing models.

Regulatory Landscape in India

RBI Guidelines for Digital Payments The Reserve Bank of India (RBI) plays a pivotal role in shaping the regulatory framework for digital payments. Understanding the guidelines set by the RBI is crucial and dangerous. PSPs operating in the Indian market. Compliance with these regulations becomes the key to navigating the complexities associated with digital transactions.

Challenges Faced by High-Risk PSPs

Payment Security Concerns One of the primary challenges faced by dangerous. PSPs are a constant threat to payment security. With the increasing sophistication of cyber threats, these providers must adopt robust security measures to safeguard user data and financial transactions.

Advantages and Disadvantages

Benefits of High-Peril PSPs in Digital Subscriptions Despite the challenges, high-Peril PSPs offer distinct advantages to digital subscription platforms. Their flexibility in handling high recompense ratios and customized solutions for recurring payments make them indispensable for businesses [2] in this sector.

Strategies for Mitigating Risks

Compliance with Regulatory Standards To thrive in the Indian market is dangerous. PSPs must comply with regulatory standards. This involves staying abreast of any changes in the regulatory landscape and adapting their processes accordingly. High-Risk PSP Digital Subscriptions in India

Success Stories in the Indian Market

Examples of High-Risk PSPs Thriving in India Several dangerous. PSPs have successfully navigated the challenges and established themselves as key players in the Indian digital subscription space. Examining their success stories provides valuable insights for others in the industry.

Future Outlook

Emerging Trends in Digital Subscriptions The future is dangerous. PSP digital subscriptions in India hold exciting possibilities. As technology evolves, new trends are likely to emerge, reassembling. the landscape and presenting fresh opportunities for innovation.

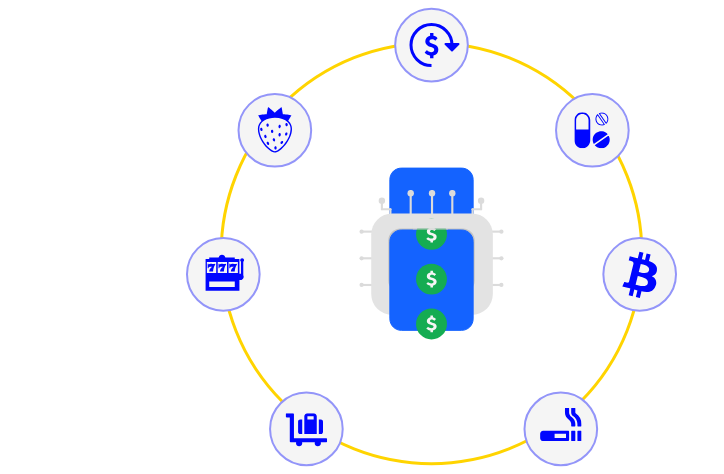

The Role of Cryptocurrencies in High-Risk PSPs

Exploring Alternatives in Digital TransactionsThe integration of cryptocurrencies is dangerous. PSP operations present an intriguing avenue. The decentralized nature of cryptocurrencies can offer an additional layer of security and privacy, addressing some of the concerns associated with traditional digital payment methods.

Customer Support Strategies

Building a Robust Support System Recognizing that customer [2] support is integral is dangerous. PSPs are investing in comprehensive support strategies. This includes 24/7 customer service, responsive c-ommunication channels, and user-friendly interfaces, creating a positive customer experience.

Data Privacy Concerns in the Digital Subscription Realm

Safeguarding User Information [3] As high-risk PSPshandle vast amounts of user data, contacting them about data privacy concerns becomes paramount. Implementing stringent data protection measures and transparent privacy policies is essential to maintaining user trust in digital acceptance.ecosystem.

Conclusion

In conclusion,dangerous. PSPs in the realm of digital subscriptions in India [4] represent a double-edged sword. While they bring innovation and flexibility, the associated risks require careful navigation. Striking a balance between risk management and innovation is essential for the sustainable growth of dangerous industries. PSPs in the Indian market [5].

FAQs

- Are dangerous. PSPs are legal in India. dangerous. PSPs are legal in India but must adhere to regulatory guidelines set by the RBI.

- What measures can digital subscription platforms take to enhance payment security? Platforms can implement encryption, two-factor authentication, and regular security audits to enhance payment security.

- How do high-risk PSPs handle chargebacks effectively? dangerous. PSPs employ specialized tools and strategies to manage and minimize chargeback ratios.

- What role does customer trust play in the success of danger? PSPs? Customer trust is crucial; hence, high-risk PSPs must prioritize transparent communication and robust security measures.

- Are there specific industries that are dangerous? PSPs are more prevalent. Yes, industries with higher chargeback risks, such as online gaming and adult entertainment, often rely on danger. PSPs.

Error: Contact form not found.