AUTHOR: BABLI gupta

DATE: 03/01/24

Introduction

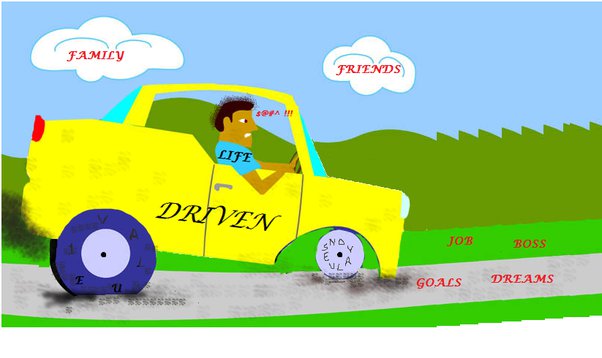

In the ever-evolving landscape of the Indian market, entrepreneurs are constantly exploring innovative avenues for business growth. One such intriguing intersection is the utilization of high-risk payment service providers (PSPs) in the context of . Let’s delve into this dynamic relationship, understanding the challenges, High-Risk PSPs in Value-Driven Buying Clubs strategies for success, and future outlook for entrepreneurs venturing into this space.

Definition of High-Risk PSP

High-risk PSPs are financial entities that cater to businesses deemed riskier due to various factors such as industry type, transaction volume, or regulatory compliance challenges. They play a crucial role in facilitating transactions for businesses that may face hurdles with traditional payment processors.

Importance of Value-Driven Buying Clubs

Value-Driven Buying Clubs focus on providing consumers with unique benefits, such as discounts, exclusive offers, and a sense of community. This article explores the connection between these buying clubs and the utilization of high-risk PSPs for their operations.

Understanding High-Risk PSP

Explanation of High-Risk Payment Service Providers

High-risk PSPs function by assessing the risk associated with a business and tailoring their services to meet the specific needs of these ventures. This involves implementing robust security measures and compliance protocols.

Factors Contributing to High-Risk Classification

Various factors contribute to a business being classified as high-risk, including the industry’s nature, the region of operation, and the history of chargebacks. Understanding these factors is crucial for entrepreneurs considering such payment service providers.

Value-Driven Buying Clubs in India

Overview of the Concept

Value-driven buying Clubs have gained significant traction in India, capitalizing on the growing trend of consumers seeking exclusive deals and a sense of belonging. The unique concept of these clubs brings forth opportunities for entrepreneurs willing to navigate the challenges.

Rising Popularity in the Indian Market

As the Indian consumer becomes more discerning, the demand for exclusive benefits and personalized experiences has fueled the rise of value-driven buying clubs. This section explores the reasons behind their popularity and their growth potential.

Challenges in the Indian Market

Regulatory Framework

The Indian market presents regulatory challenges that businesses must navigate, High Chargeback[1] Thresholds especially when dealing with financial transactions. Entrepreneurs in the realm of value-driven buying clubs need to be aware of and adhere to these regulations.

Customer Trust and Security Concerns

For consumers to engage with value-driven buying clubs, Risk Management[2] trust and security are paramount. High-risk PSPs need to implement stringent security measures to address these concerns and ensure a positive user experience.

Strategies for Mitigating Risks

Compliance Measures

Navigating the high-risk landscape requires strict adherence to compliance measures. Payment Gateway[3] Entrepreneurs must implement robust systems to ensure regulatory requirements are met, mitigating potential risks associated with high-risk PSPs.

Building Customer Trust

Establishing and maintaining customer trust is vital for the success of value-driven buying clubs. This involves transparent communication, secure payment gateways, and a commitment to providing value to club members. Value-Driven[4] Membership

Tips for Entrepreneurs

Considering High-Risk PSP for Value-Driven Buying Clubs

Entrepreneurs contemplating this unique combination can benefit from practical tips and considerations. From due diligence in selecting a high to tailoring offerings for value-driven buying clubs, this section provides actionable advice.

Key Steps to Success

Success in this space requires a strategic approach. Multi-Layered Security[5] This section outlines key steps entrepreneurs should take to ensure the successful integration of high-risk PSPs into their

In-Depth Analysis of Successful Ventures

Examining case studies provides a deeper understanding of how businesses have overcome challenges and achieved success. This section presents in-depth analyses of ventures that have effectively implemented high-risk PSPs in their value-driven buying club models.

Real-World Applications

Practical Implementations of High-Risk PSP in Value-Driven Buying Clubs

Understanding how high-risk PSPs can practically enhance value-driven buying clubs is crucial. This section explores real-world applications, showcasing how businesses have integrated these services seamlessly.

Expert Opinions

Insights from Industry Experts

Gaining insights from industry experts provides a valuable perspective. This section features opinions and advice from experts in the fields of high-risk PSPs and value-driven buying clubs.

Common Misconceptions

Addressing Myths Surrounding High-Risk PSP and Value-Driven Buying Clubs

Dispelling common myths is essential for entrepreneurs entering this space. This section addresses misconceptions and provides clarity on the realities of integrating into value-driven buying clubs.

Recommendations for Improvement

Enhancing the Ecosystem for Entrepreneurs

To foster a thriving ecosystem, there is a need for continuous improvement. This section offers recommendations to enhance the overall landscape for entrepreneurs exploring the integration of high-risk PSPs into value-driven buying clubs.

Conclusion

In conclusion, the dynamic intersection of high-risk PSPs and value-driven buying clubs in the Indian market presents exciting opportunities for entrepreneurs. Navigating the challenges, implementing effective strategies, and staying attuned to industry trends are key to unlocking success in this unique space.

FAQs

- Is it risky to use high-risk PSPs for value-driven buying clubs?

- Understanding and mitigating risks is crucial. High-risk PSPs can be beneficial when approached strategically.

- What regulatory challenges do entrepreneurs face in the Indian market?

- Entrepreneurs need to navigate complex regulatory frameworks, especially in financial transactions.

- How can value-driven buying clubs build customer trust?

- Transparent communication, secure payment gateways, and delivering consistent value are essential.

- Are there specific industries where the combination works better?

- The synergy between high-risk PSPs and value-driven buying clubs can be leveraged across various industries.

- What technological trends should entrepreneurs watch for in this space?

- Staying updated on evolving technologies is crucial for sustained success. Embracing innovation is key.