AUTHOR : RIVA BLACKLEY

DATE : 15/12/2023

Introduction

In the ever-expanding world of e-commerce, where online transactions are the norm, businesses need reliable payment solutions. High Risk PSP Payment Integration Services In India Payment Service Providers (PSPs) act as intermediaries, ensuring seamless transactions between businesses and their customers. As the digital landscape evolves, High-Risk Transaction Management the demand for specialized payment integration services, especially in high-risk industries, has witnessed a significant surge.

Understanding High-Risk PSPs

High-risk PSPs are specialized service providers that cater to businesses Recurring Payment Solutions involved in industries with a higher likelihood of risky financial transactions. These industries may include online gaming, adult entertainment, and pharmaceuticals, among others. High Risk PSP Payment Integration Services In India Understanding the unique characteristics of high-risk transactions is essential to appreciate the need for specialized payment services in these sectors.

Challenges in Payment Integration

One of the primary challenges in payment integration, especially for high-risk transactions, is ensuring the security of financial data. As cyber threats continue to evolve, businesses face the constant challenge of safeguarding sensitive information. Additionally, high-risk industries often grapple with stringent regulatory compliance, adding another layer of complexity to payment processes.

Emergence of High-Risk PSP Payment Integration Services in India

With the exponential growth of e-commerce Real-Time Payment Processing[1] in India, businesses are increasingly recognizing the need for tailored payment solutions. High-risk PSPs have emerged to fill this niche, providing specialized services that address the unique challenges faced by businesses in high-risk industries.

Key Features of High-Risk PSP Payment Integration Services

These specialized services come with advanced security Mobile Payment Integration[2] protocols [2] to ensure the confidentiality and integrity of financial transactions. Customized solutions tailored to the specific needs of different industries further set high-risk PSPs apart, making them a crucial partner for businesses navigating complex payment landscapes.

Benefits for Businesses

The adoption of high-risk API Payment Integration[3] PSP payment integration services brings several benefits for businesses. By minimizing fraud risks and providing streamlined payment processes, these services contribute to the overall efficiency and security of financial transactions.

Choosing the Right High-Risk PSP

Selecting the right high-risk PSP is a critical decision for businesses. Factors such as the provider’s track record, adherence to security standards, and industry Subscription Billing Solutions[4] expertise should be carefully evaluated. Trustworthy and reliable service providers can significantly impact the success of a business’s financial transactions.

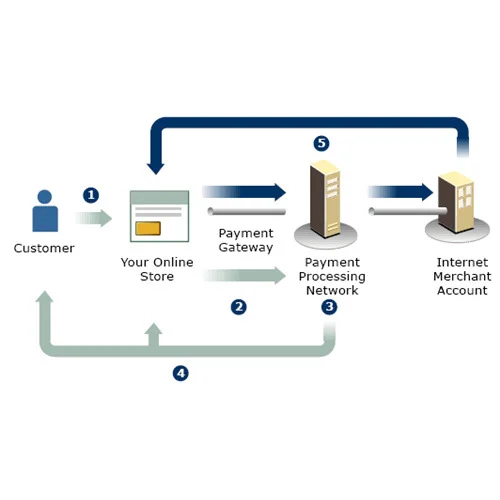

Integration Process

Integrating high-risk PSP services into existing systems requires a strategic approach. A step-by-step guide can effectively help businesses navigate the integration process, while simultaneously addressing common challenges and ultimately ensuring a smooth transition to enhanced payment solutions.

Case Studies

Future Trends in High-Risk PSP Payment Integration

Examining real-life examples of businesses that have successfully integrated high-risk PSP services provides valuable insights. As technology Payment Aggregator Solutions[5] continues to advance, the future of high-risk PSP payment integration holds promising developments.

Customer Testimonials

To offer a human touch to the discussion, we reached out to businesses that have benefited from high-risk PSP services. Their firsthand experiences not only shed light on how these services have significantly improved their financial processes, but also highlight the ways in which they foster trust and enhance security in online transactions.

Risks and Precautions

While high-risk PSPs offer significant advantages, businesses must be aware of potential risks. This section explores the challenges associated with high-risk transactions and provides precautions that businesses

Comparative Analysis of High-Risk PSPs in India

For businesses considering high-risk PSPs, a comparative analysis of popular service providers is essential. This section reviews and compares different providers, highlighting their strengths and weaknesses to assist businesses in making informed decisions.

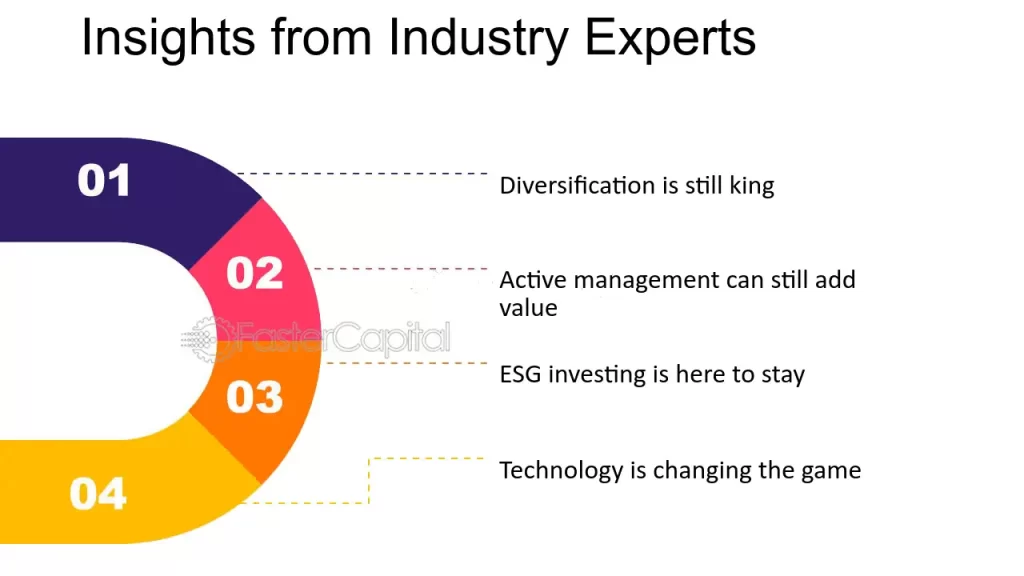

Industry Expert Insights

To gain a deeper understanding of the high-risk PSP landscape, we sought insights from industry experts. Their perspectives provide valuable guidance for businesses navigating the complexities of payment integration in high-risk industries.

Conclusion

In conclusion, the integration of high-risk PSP payment services in India is a strategic move for businesses seeking secure and efficient financial transactions. By understanding the challenges, benefits, and key considerations, businesses can make informed decisions that positively impact their bottom line.

FAQS

- Are high-risk PSPs suitable for all businesses? High-risk PSPs are best suited for businesses in industries with a higher likelihood of risky transactions, such as online gaming or adult entertainment.

- What security measures do high-risk PSPs employ? High-risk PSPs implement advanced security protocols to ensure the confidentiality and integrity of financial transactions.

- How does the integration process work for high-risk PSPs? The integration process involves a step-by-step guide to seamlessly incorporate high-risk PSP services into existing systems.

- Can businesses in traditional industries benefit from high-risk PSPs? While high-risk PSPs are designed for specific industries, businesses in traditional sectors can benefit from enhanced security measures.

- What future trends can we expect in high-risk PSP payment integration? Future trends may include technological advancements in payment security and anticipated changes in regulations.