AUTHOR : BELLA

DATE : FEBRUARY 23, 2024

Introduction to Payment Processors

Payment processors are third-party entities that facilitate transactions between merchants and customers by securely processing payment information. They act as intermediaries, ensuring that fund are transferred seamlessly from the customer’s account to the merchant’s account.

Importance of Payment Processors in India

India’s rapid digitalization and the government’s push towards a cashless econom have amplified the importance of payment processors. With a large population embracing online shopping and also digital payments, businesses need reliable payment processing solutions to cater to their customers’ needs.

Key Features of Payment Processor Direct Response

Payment processor direct response offers several key features, including real-time transaction processing, multi-currency support, fraud identification mechanisms, and seamless integration with e-commerce platforms. These features ensure smooth and secure payment transactions for both merchants and customers.

Advantages of Using Payment Processor Direct Response

Using payment processor direct response provides numerous advantages, such as increased sales conversion rates, improved customer satisfaction, enhanced security, and streamlined accounting processes. Additionally, it enables businesses to expand their customer base by offering diverse payment options.

Challenges Faced by Payment Processors in India

Despite the benefits, payment processors in India encounter various challenges, including regulatory compliance issues, security concerns, technical glitches, and intense competition. Navigating these challenges requires robust infrastructure, innovative solutions, and strict compliance with regulatory guidelines.

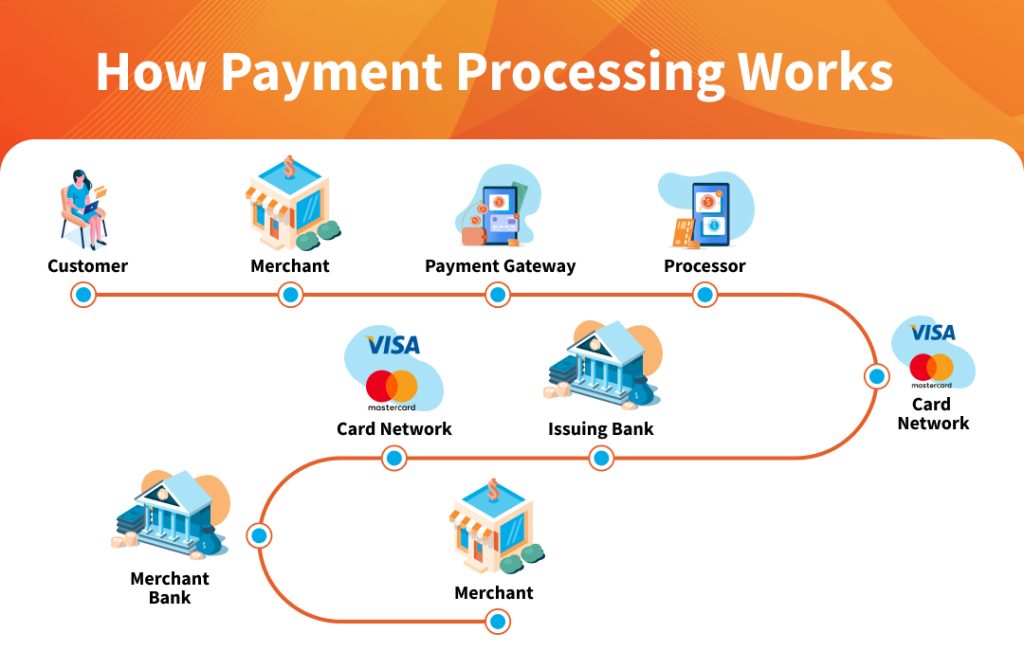

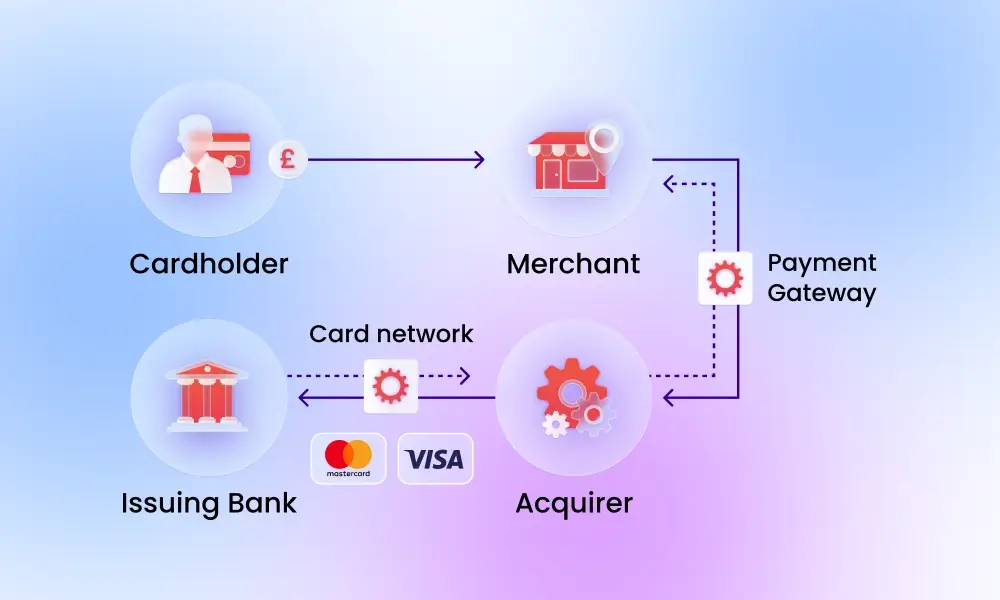

How Payment Processor Direct Response Works

Payment processor[1] direct response works by capturing payment information from customers, encrypting it for security, verifying the transaction details, and facilitating fund transfers between the customer’s bank and the merchant’s account. This process occurs in real time, ensuring quick and reliable transactions.

Popular Payment Processor Direct Response Services in India

Several payment processor direct response marketing[2] services cater to the Indian market, including Razorpay, PayU, Instamojo, and CCAvenue. These platforms offer a range of features tailored to the needs of Indian businesses, such as UPI integration, mobile wallets, and subscription billing.

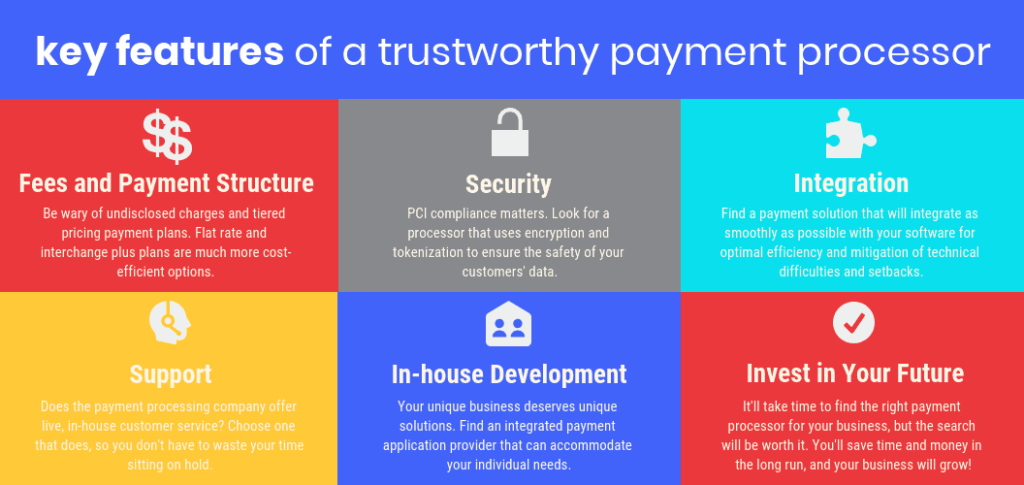

Considerations When Selecting a Payment Processor

When choosing a payment processor companies[3] businesses must consider factors such as transaction fees, payment methods supported, security measures, customer support, and ease of integration. Selecting the right payment processor is crucial for ensuring seamless payment experiences and business growth.

Security Measures in Payment Processor Direct Response

Security is paramount in the payment processor’s direct response to protect sensitive payment information[4] from unauthorized access and fraudulent activities. Industry-standard security measures such as encryption, tokenization, two-factor authentication, and PCI DSS compliance are employed to safeguard transactions.

Integration of Payment Processor Direct Response with E-commerce Platforms

Integration of payment processor direct response with e-commerce platforms such as Shopify, WooCommerce, Magento, and BigCommerce enables businesses to accept online payments seamlessly. API-based integration allows for customization and scalability, catering to the unique requirements of each business.

Impact of Payment Processor Direct Response on Indian Businesses

Payment processor direct response has a profound impact on Indian businesses, empowering them to expand their online presence, reach a wider audience, increase sales revenue, and streamline financial operations. It fosters trust and credibility among customers, driving repeat purchases and brand loyalty.

Future Trends in Payment Processor Direct Response

The future of payment processor direct response in India is characterized by advancements in technology, such as blockchain-based payments, AI-driven fraud detection, contactless payments, and biometric authentication. These innovations aim to enhance security, speed, and convenience in payment processing.

Case Studies of Successful Implementation

Several Indian businesses have successfully implemented payment[5] processor direct response solutions to achieve their business objectives. Case studies highlighting their experiences, challenges faced, and outcomes achieved serve as valuable insights for other businesses considering similar implementations.

Tips for Effective Utilization of Payment Processor Direct Response

To maximize the benefits of payment processor direct response, businesses should focus on enhancing the user experience, optimizing checkout processes, offering multiple payment options, leveraging data analytics for insights, and staying updated on industry trends and regulations.

Conclusion

Payment processor direct response plays a crucial role in facilitating seamless and secure financial transactions in India’s digital landscape. Businesses can leverage its features to boost customer satisfaction, drive sales, and stay competitive.

FAQs

- What is a payment processor’s direct response?

- A payment processor direct response is a service that facilitates real-time transaction processing between merchants and customers, ensuring secure and seamless payment transactions.

- A payment processor direct response is a service that facilitates real-time transaction processing between merchants and customers, ensuring secure and seamless payment transactions.

- How does payment processor direct response benefit businesses?

- Payment processor direct response benefits businesses by increasing sales conversion rates, improving customer satisfaction, enhancing security, and simplifying accounting processes.

- Payment processor direct response benefits businesses by increasing sales conversion rates, improving customer satisfaction, enhancing security, and simplifying accounting processes.

- What are some popular payment processors that offer direct-response services in India?

- Popular payment processor direct response services in India include Razorpay, PayU, Instamojo, and CCAvenue, offering features tailored to the needs of Indian businesses.

- Popular payment processor direct response services in India include Razorpay, PayU, Instamojo, and CCAvenue, offering features tailored to the needs of Indian businesses.

- What factors should businesses consider when choosing a payment processor?

- Businesses should consider factors such as transaction fees, payment methods supported, security measures, customer support, and ease of integration when choosing a payment processor.

- Businesses should consider factors such as transaction fees, payment methods supported, security measures, customer support, and ease of integration when choosing a payment processor.

- What are the future trends in payment processor direct response?

- Future trends in payment processor direct response include advancements in technology such as blockchain-based payments, AI-driven fraud detection, contactless payments, and biometric authentication to enhance security, speed, and convenience.