AUTHOR : AYAKA SHAIKH

DATE: 11/03/2024

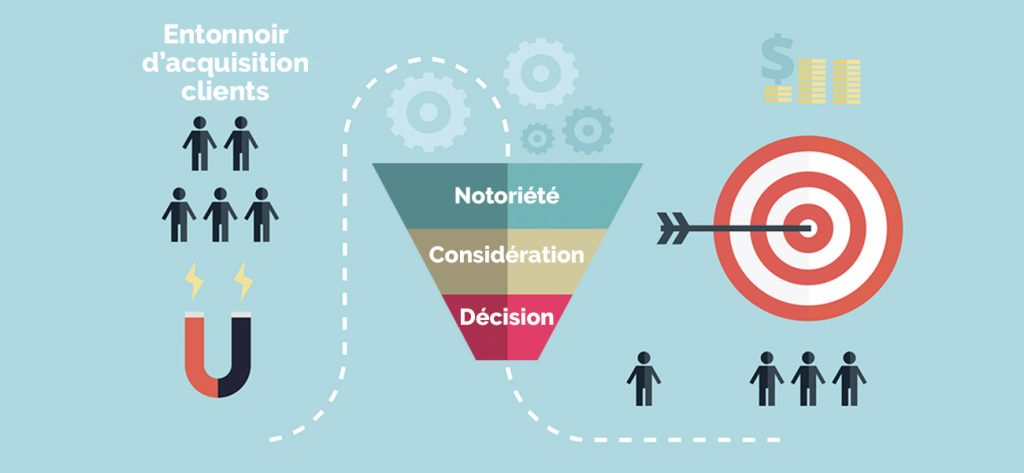

Introduction

In the dynamic world of e-commerce, payment gateways serve as crucial intermediaries for facilitating secure online transactions. In India, where the digital revolution has led to a surge in online shopping, the competition among payment gateway providers to acquire customers is fierce.

Challenges in Customer Acquisition

Despite the vast opportunities, acquiring customers in the Indian payment gateway industry comes with its own set of challenges. Intense competition prevails among numerous providers, each vying for a share of the market. Additionally, navigating through regulatory requirements and ensuring compliance pose significant hurdles.

Strategies for Effective Customer Acquisition

To stand out in this competitive landscape, payment gateway[1]providers need to adopt strategic approaches. Targeting specific industries or niches allows providers to tailor their services to meet the unique needs of different businesses. Offering incentives such as discounted transaction rates or cashback schemes can entice merchants to choose a particular payment gateway.

Building Trust and Credibility

In a sector where trust is paramount, payment gateway providers must prioritize security and transparency. Implementing[2] robust security features instills confidence among users, assuring them of the safety of their financial data. Transparent pricing models and clear policies regarding refunds and chargebacks further enhance credibility.

Utilizing Digital Marketing Channels

Digital marketing [3] plays a pivotal role in customer acquisition. Search engine optimization (SEO) and content marketing can help payment gateway providers improve their visibility online, attracting potential customers actively searching for payment solutions. Social media platforms offer avenues for targeted advertising, reaching out to specific demographics with tailored messages. Email campaigns serve as effective tools for nurturing leads and converting them into customers.

Partnering with E-commerce Platforms

Collaborating with popular e-commerce platforms amplifies the reach of Payment Gateway Customer Acquisition In India providers. Seamless integration with platforms like Shopify, WooCommerce [4], and Magento streamlines the payment process for merchants, making it convenient for them to adopt a particular payment gateway. Joint marketing efforts with e-commerce platforms can also generate awareness and drive customer acquisition.

Case Studies of Successful Customer Acquisition

Several payment gateway providers have successfully navigated the Indian market, employing innovative strategies to acquire customers. Case studies highlighting their approaches [5] and outcomes serve as valuable lessons for others in the industry.

Measuring Success

Measuring the effectiveness of customer acquisition efforts requires tracking key performance indicators (KPIs) such as conversion rates, customer acquisition cost (CAC), and customer lifetime value (CLV). Analyzing these metrics provides insights into the performance of various marketing channels and helps optimize strategies for better results.

Future Trends and Innovations

As technology continues to evolve, Payment Gateway Customer Acquisition In India must stay ahead of the curve. Innovations such as biometric authentication, blockchain-based solutions, and contactless payments are poised to reshape the payment landscape in India. Anticipating these changes and adapting proactively will be crucial for sustaining growth and retaining customers.

Navigating Regulatory Frameworks

One of the significant challenges in the Indian market is navigating the complex regulatory landscape. Payment gateway providers must ensure compliance with various regulations, including data protection laws and financial regulations. Staying abreast of regulatory changes and proactively addressing compliance issues is essential to avoid penalties and maintain trust among customers.

Empowering Merchants with Value-added Services

Beyond facilitating transactions, payment gateway providers can differentiate themselves by offering value-added services to merchants. These services may include analytics tools for tracking sales performance, inventory management integration, or fraud detection services. By empowering merchants with tools to optimize their business operations, payment gateway providers can enhance their value proposition and attract new customers.

Fostering Partnerships and Alliances

Collaborating with other players in the ecosystem can significantly amplify customer acquisition efforts. Payment gateway providers can forge partnerships with banks, financial institutions, and technology companies to expand their reach and offer comprehensive solutions. Joint marketing campaigns, referral programs, and co-branded initiatives can leverage the strengths of each partner to attract a wider audience and drive customer acquisition.

Investing in Customer Education and Support

In a market where digital literacy varies widely, investing in customer education is critical. Payment gateway providers must educate merchants and consumers about the benefits of online payments, security best practices, and the features of their payment solutions. Additionally, offering responsive customer support channels, including live chat, phone support, and comprehensive online resources, can instill confidence and trust among users.

Adapting to Cultural and Regional Preferences

India is a diverse country, with varying cultural and linguistic preferences across regions. Payment gateway providers must tailor their marketing messages and user experience to resonate with different audience segments. Understanding local customs, preferences, and payment habits can help providers build stronger connections with customers and drive adoption.

User reviews and testimonials can serve as powerful tools for building credibility and trust, establishing a positive reputation that resonates with potential customers.

Payment gateway providers should actively encourage satisfied customers to share their experiences through reviews and testimonials on their website, social media platforms, and third-party review sites. Positive feedback from existing customers can serve as social proof and influence potential customers’ purchasing decisions.

Staying Agile and Responsive to Market Dynamics

In a rapidly evolving industry like e-commerce, agility is key to staying competitive. Payment gateway providers must continuously monitor market trends, consumer preferences, and competitor strategies. By remaining agile and responsive to changing dynamics, providers can seize opportunities quickly and adapt their customer acquisition strategies accordingly.

Investing in Long-term Relationships

While acquiring new customers is essential for growth, retaining existing customers is equally important to ensure long-term sustainability and profitability.

Payment gateway providers should focus on building long-term relationships with their customers by delivering exceptional service, continuously adding value, and adapting to their evolving needs. Loyal customers not only contribute to recurring revenue but also serve as advocates who can help attract new customers through word-of-mouth referrals.

Continual Optimization and Experimentation

Customer acquisition is an iterative process that requires continual optimization and experimentation. Payment gateway providers should regularly analyze data, test different marketing channels and messaging strategies, and iterate based on the results. By adopting a data-driven approach and embracing a culture of experimentation, providers can uncover insights and identify opportunities to continuously improve their customer acquisition efforts.

Conclusion

In a rapidly evolving digital economy, customer acquisition remains a top priority for payment gateway providers in India. By understanding the market dynamics, leveraging strategic approaches, and prioritizing trust and innovation, providers can carve a niche for themselves and thrive in this competitive landscape.

FAQs

- How important is customer acquisition for payment gateway providers? Customer acquisition is paramount for payment gateway providers, as it directly impacts their market share and revenue. Acquiring new customers ensures sustained growth and competitiveness in the industry.

- What are some common challenges in customer acquisition for payment gateway providers in India? Intense competition, regulatory hurdles, and building trust are among the common challenges faced by payment gateway providers in India when it comes to customer acquisition.

- How can payment gateway providers build trust with their customers? Payment gateway providers can build trust by prioritizing security features, maintaining transparent pricing and policies, and offering responsive customer support.

- What role does digital marketing play in customer acquisition for payment gateway providers? Digital marketing channels such as SEO, social media advertising, and email campaigns are instrumental in reaching potential customers, nurturing leads, and driving conversions for payment gateway providers.

- What are some emerging trends in the payment gateway industry in India? Emerging trends in the payment gateway industry in India include the adoption of biometric authentication, blockchain-based solutions, and the rise of contactless, signaling a shift towards more secure and convenient payment methods.