AUTHOR: LUCKY MARTINS

DATE: 14/12/2024

Payment Gateway Retail Extended Warranty Partnerships in India

Introduction

In the fast-paced world of retail, especially with the growing e-commerce[1] landscape in India, consumers increasingly expect not only great products but also strong after-sales service. One such aspect is extended warranties. Retailers and e-commerce platforms are offering these warranties in collaboration with payment gateways, creating a unique ecosystem where customers can enjoy both seamless payment experiences and added protection on their purchases. This article explores[2] how the concept of Payment Gateway Retail Extended Warranty Partnerships is evolving in India, its impact on the retail industry, and why it’s a win-win situation for consumers, retailers, and financial institutions[3].

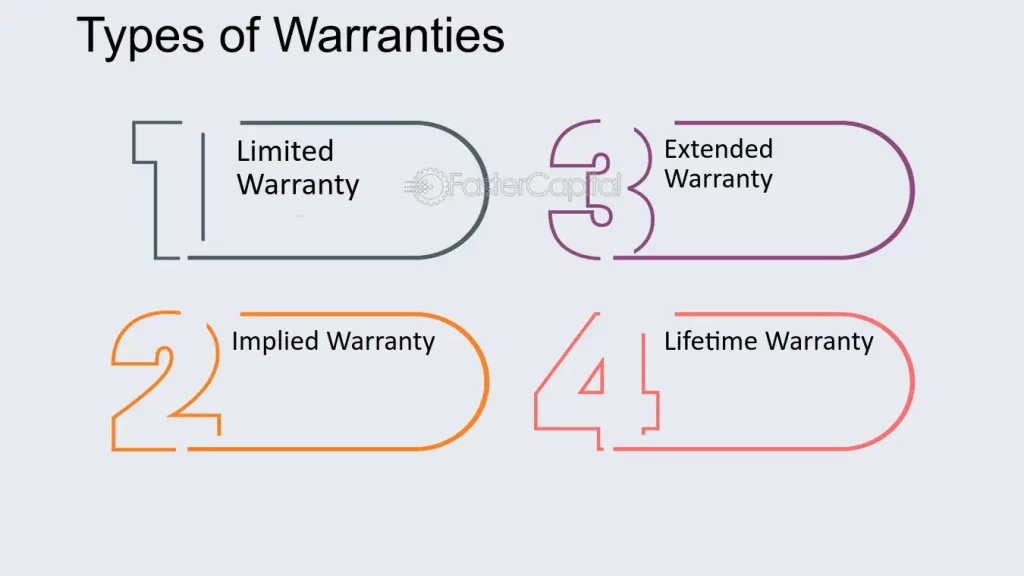

What is an Extended Warranty?

An extended warranty is an additional service[4] contract offered by retailers or third-party companies that extends the manufacturer’s warranty period. Typically, warranties cover repairs or replacements for products in case of defects. However, extended warranties provide[5] customers with peace of mind by offering longer coverage, including damages or issues that might arise after the standard warranty expires.

For example, a smartphone may come with a 1-year manufacturer warranty, but a retailer might offer an extended 2-3 years of coverage, giving the customer additional protection against malfunctioning, accidental damage, or wear and tear.

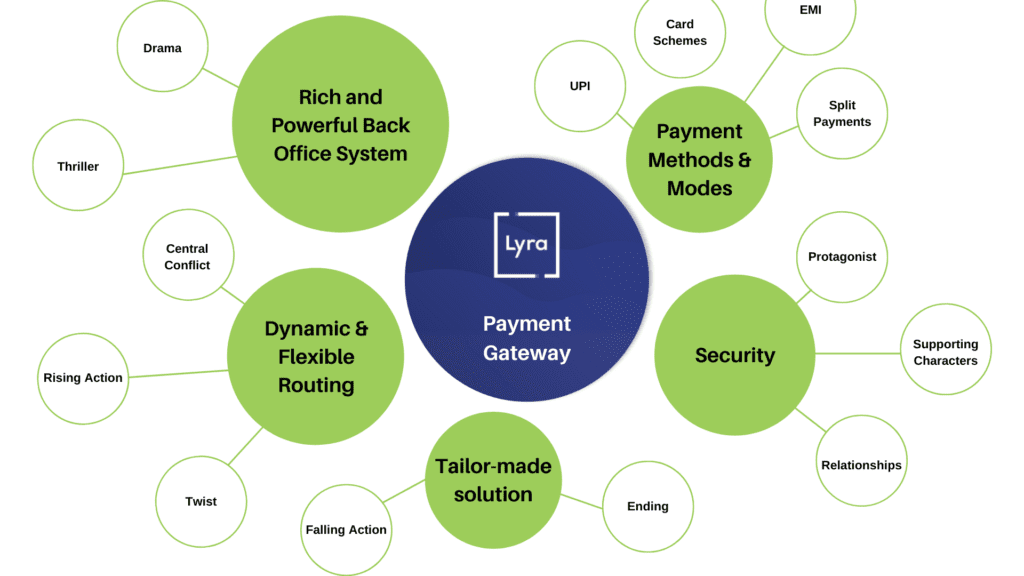

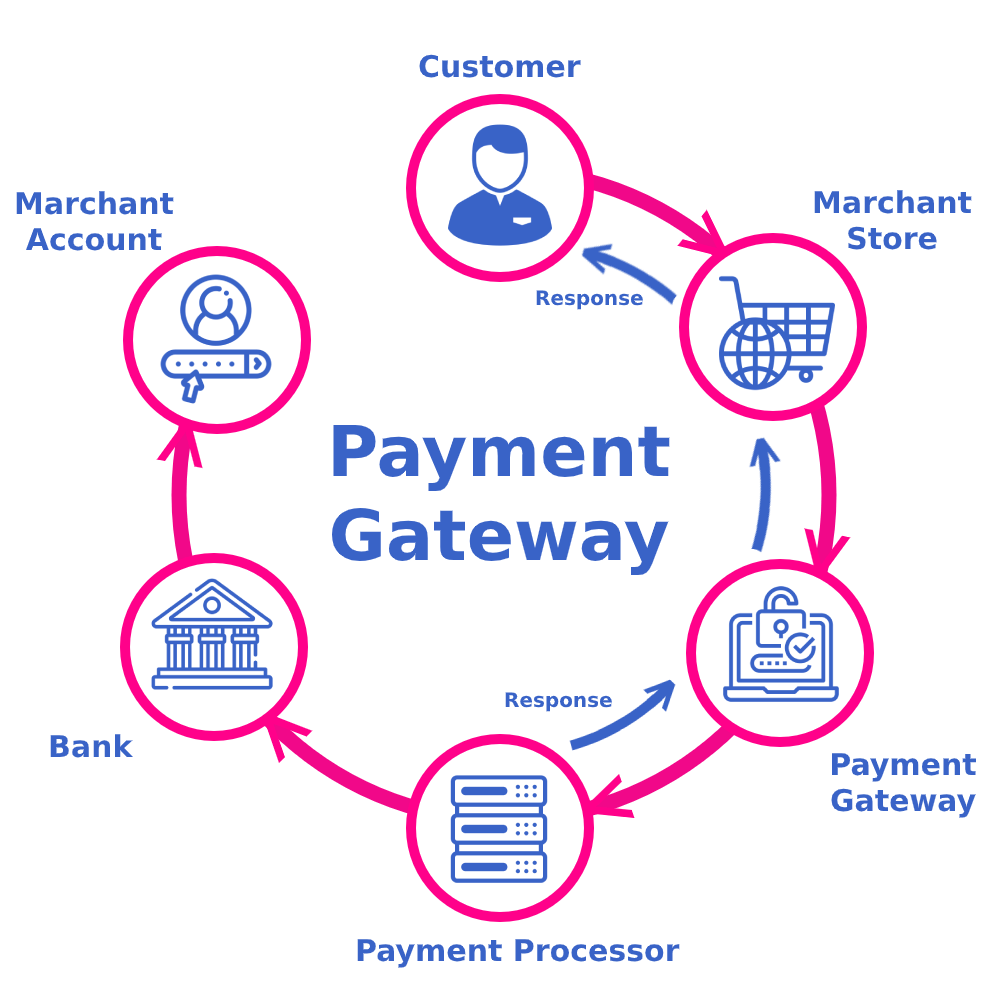

Payment Gateway’s Role in Retail Extended Warranty Partnerships

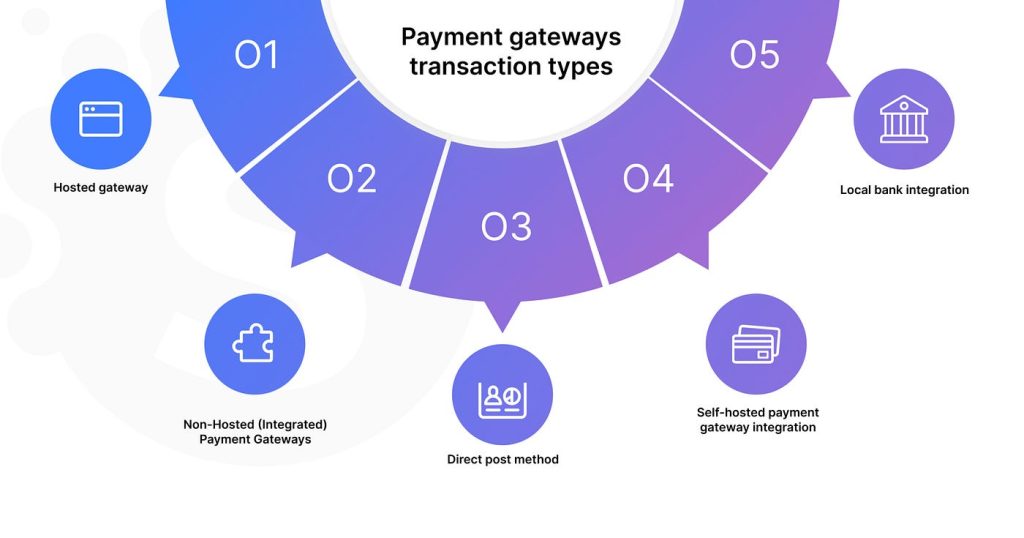

A payment gateway acts as a bridge between the consumer, the retailer, and the payment processor, ensuring that payments are securely processed in real time. But in recent years, payment gateways have expanded their role, integrating with retail extended warranty partnerships. This collaboration allows customers to easily purchase and activate warranties as part of their overall shopping experience.

Integration with E-commerce Platforms

E-commerce giants like Amazon, Flipkart, and Snapdeal often collaborate with payment gateways to offer extended warranty options during the checkout process. This integration is seamless—while paying for a product, the customer is prompted to opt for an extended warranty with a few clicks. The payment gateway handles the transaction smoothly, and the warranty is activated immediately.

Simplified Transactions

Payment gateways such as Razorpay, Paytm, and CCAvenue make it easier for customers to add warranty services by allowing payments to be made in a variety of formats. Whether it’s through credit/debit cards, digital wallets, or UPI (Unified Payments Interface), these payment systems simplify the purchasing process, which benefits both the customer and the retailer.

Benefits of Payment Gateway Retail Extended Warranty Partnerships

1. Enhanced Customer Trust

When retailers partner with payment gateways to offer extended warranties, it adds an extra layer of security for consumers. Knowing that their purchase is covered for a longer period boosts customer confidence, fostering trust in both the retailer and the product itself.

2. Improved Customer Experience

A seamless, one-stop shopping experience is what many consumers now expect. By integrating extended warranties directly into the payment process, retailers ensure a smooth transaction where customers can easily make informed decisions about additional protection. This reduces the friction that customers may face in researching third-party warranty providers or manually activating warranties post-purchase.

3. Increased Sales and Revenue

By offering extended warranties as part of the checkout experience, retailers can increase their average order value (AOV). Consumers may be more inclined to purchase additional services when they are conveniently bundled with the original product. Payment gateways help retailers track these purchases and process payments more effectively, ensuring smoother cash flow management.

4. Leveraging Data for Customization

Payments provide valuable insights into consumer behavior, allowing retailers to tailor their warranty offerings to specific segments. For example, data analytics may reveal that certain demographics or product categories (such as electronics or appliances) have a higher demand for extended warranty services. Retailers can use this information to create targeted offers, making the purchasing experience even more personalized.

5. Digital Payment Ecosystem Growth

The rise of digital payments in India has led to an increase in the adoption of online transactions. As digital wallets, UPIs, and credit cards become more common, integrating warranties within these systems benefits both consumers and service providers. The result is the growth of a digital-first payment ecosystem that enhances the overall convenience for the customer.

Types of Extended Warranties Available

While the offerings can vary depending on the retailer and product category, some common types of extended warranties available through these partnerships include:

- Accidental Damage Coverage: extends protection against accidental damage beyond what is covered under the manufacturer’s warranty.

- Extended Repairs and Replacements: Covers repairs or replacements due to product defects for an extended period.

- No Questions Asked: Offers a hassle-free replacement or repair policy, often with minimal documentation required.

- Comprehensive Coverage: Includes both mechanical failures and accidental damages, providing a more extensive safety net for consumers.

Challenges in Payment Gateway and Warranty Partnerships

While this partnership model has proven to be beneficial, there are challenges that need to be addressed to optimize its potential.

1. Consumer Awareness

Many consumers are still unaware of the option to purchase extended warranties. Retailers payment gateways must work together to educate consumers about the benefits of extended warranties, ensuring that they are making informed choices.

2. Data Security and Privacy

As payment gateways collect a vast amount of consumer data during transactions, it is crucial to ensure that this information is handled securely. Both retailers and payment providers must comply with data protection regulations to maintain customer trust.

3. Complex Warranty Terms

Extended warranties can sometimes be difficult for consumers to understand due to complex terms and conditions. Payment gateway partners and retailers must make these terms as transparent as possible to avoid customer dissatisfaction.

4. Dispute Resolution

Handling disputes related to warranty claims can be challenging. Payment gateways need to work closely with warranty service providers to ensure smooth dispute resolution processes, avoiding any customer frustration.

Future of Payment Gateway and Retail Extended Warranty Partnerships in India

With the growth of e-commerce, digital payments, and consumer demand for value-added services, the future of payment gateway retail extended warranty partnerships in India looks promising. Innovations such as artificial intelligence (AI) and blockchain could further streamline warranty management and customer service. AI-powered chatbots could help answer customer queries instantly, and blockchain could ensure transparency and traceability of warranty claims.

Conclusion

The integration of payment gateways in retail extended warranty partnerships in India is a significant development, enhancing the overall customer experience and creating a seamless ecosystem for both consumers and retailers. As e-commerce continues to grow, so will the opportunities for such partnerships, ensuring that Indian shoppers have access to greater security, convenience, and peace of mind when purchasing products online.

FAQ:

1. What is an extended warranty?

An extended warranty is an additional coverage plan that extends the duration of the manufacturer’s warranty. It offers coverage for repairs, replacements, or damages that occur once the original warranty period has ended.

2. How do payment gateways facilitate the purchase of extended warranties?

Payment gateways make it easy for customers to purchase extended warranties during the checkout process by integrating various payment methods like credit cards, digital wallets, and UPI.

3. Are extended warranties worth the cost?

Extended warranties can offer peace of mind, especially for high-value items like electronics or appliances. Whether they are worth the cost depends on factors like the product’s reliability and the warranty terms.

4. What happens if I need to claim a warranty after purchasing an extended one?

If you need to make a claim, the warranty service provider will guide you through the process. You may need to provide the original proof of purchase and warranty details.

5. Can I cancel my extended warranty?

Most extended warranty providers offer a cancellation policy, usually within a specified period after purchase. However, you may be entitled to a refund only if no claims have been made.