Author : Hezal Dsouza

Introduction

India’s small electronics startups are flourishing in the digital economy, offering innovative solutions to consumers. However, with this growth comes the challenge of managing secure and efficient online transactions. Payment gateways play a pivotal role in bridging this gap by enabling seamless and secure payments guide explores the importance of payment gateways for small electronics startups in India, the challenges they address, and the options available.

What is a Payment Gateway?

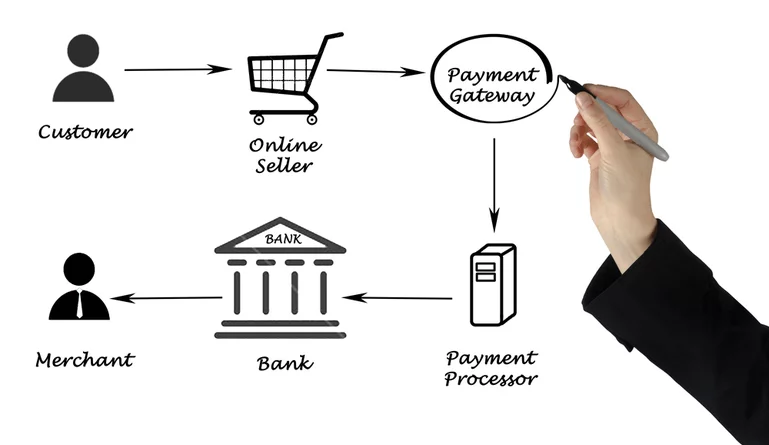

A payment gateway technology that facilitates online transactions by securely transferring payment data between the customer, the merchant, and the bank. It acts as the backbone of e-commerce, ensuring safe and hassle-free payments.

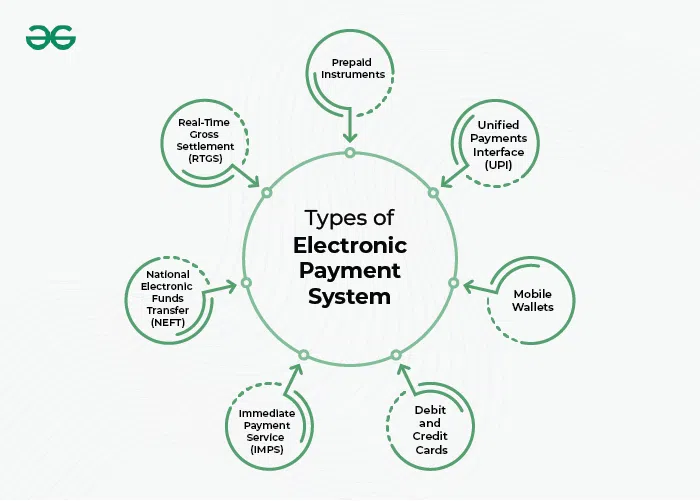

For small electronics startups, a payment gateway simplifies the process of collecting payments, be it from credit/debit cards, UPIs, wallets, or net banking.

Why Payment Gateways Are Crucial for Startups

- Secure Transactions: Protects customers’ sensitive payment information[1] using encryption.

- Improved Customer Experience: A smooth checkout process increases the likelihood of repeat purchases.

- Multi-Channel Payments: Offers flexibility with multiple payment methods[2].

- Faster Settlement: Reduces waiting time for receiving funds, essential for maintaining cash flow.

Challenges Faced by Small Electronics Startups

- Limited Capital: Startups often operate on tight budgets, requiring cost-effective payment solutions.

- Building Customer Trust: Payment gateways[3] with secure features boost customer confidence.

- Integration Complexity: Many startups lack technical expertise to implement advanced payment systems.

Features to Look for in a Payment Gateway

- Security: Ensure compliance with PCI-DSS standards and use fraud prevention tools.

- Ease of Integration: A plug-and-play solution reduces technical barriers.

- Cost-effectiveness: Look for transparent pricing with low transaction fees.

- Support for UPI: As UPI is highly popular in India, having it as a payment option is vital.

- Quick Settlement Cycles: Timely fund transfers help manage cash flow better.

Top Payment Gateways for Small Electronics Startups in India

1. Razorpay

- Features: subscription billing, UPI, and multi-currency support.

- Best For: Tech-savvy startups looking for robust features.

2. PayU

- Features: easy setup, fraud protection, and affordable pricing.

- Best For: Startups focusing on domestic transactions.

3. CCAvenue

- Features: multi-language support and extensive payment options.

- Best For: Startups catering to diverse customer bases.

4. Instamojo

- Features: simple onboarding and additional tools for small businesses.

- Best For: Startups just starting with online payments[4].

5. Cashfree Payments

- Features: Fast settlements and bulk payment options.

- Best For: Startups scaling operations.

Steps to Integrate a Payment Gateway

- Select the Right Gateway: Choose based on your business needs and customer preferences.

- Sign Up and Complete KYC: Most gateways require proper documentation for setup.

- Integrate the Gateway: Use the provided APIs or plugins to link the gateway with your e-commerce platform.

- Test Transactions: Run sample transactions to ensure a seamless payment experience.

- Go Live: Start accepting payments gateway solutions[5] from your customers.

Benefits of Payment Gateways for Small Electronics Startups

- Increased Reach: Enables online sales, expanding the customer base beyond local markets.

- Enhanced Credibility: Using trusted payment gateways boosts customer trust.

- Analytics and Insights: Payment dashboards provide valuable insights into customer behavior.

Emerging Trends in Payment Gateways

- UPI Dominance: UPI has revolutionized payments in India, offering instant and secure transfers.

- AI-Powered Fraud Detection: AI tools help identify and prevent fraudulent activities.

- Blockchain: Blockchain-based payment solutions are gaining traction for their transparency.

Conclusion

Payment gateways are not just a convenience—they’re a necessity for small electronics startups in India. With the right gateway, startups can offer secure, fast, and reliable payment experiences, driving customer satisfaction and business growth By choosing a scalable and cost-effective payment gateway, startups can focus on what they do best—building innovative electronic solutions for their customers.

FAQs

1. What is the most cost-effective payment gateway for startups?

Instamojo and PayU are affordable options for startups.

2. Can small startups use multiple payment gateways?

Yes, using multiple gateways can cater to diverse customer preferences.

3. How secure are payment gateways in India?

Most gateways comply with global security standards like PCI-DSS, ensuring secure transactions.

4. What payment method is most popular in India?

UPI is the most widely used payment method due to its simplicity and speed.

5. How do I choose the best gateway for my startup?

Consider factors like cost, ease of integration, and your target audience’s payment preferences.