AYAKA SHAIKH

Introduction

Payment gateways are no longer just a convenience—they are a necessity for businesses, especially in the dynamic landscape of B2B electronics in India. With the rapid digitization of commerce, payment gateways ensure faster, more secure, and reliable financial transactions. India, being one of the largest electronics markets, has seen an unprecedented demand for specialized payment solutions tailored for the B2B ecosystem. Let’s delve into how payment gateways are transforming the future of India’s electronics industry.

Understanding Payment Gateways

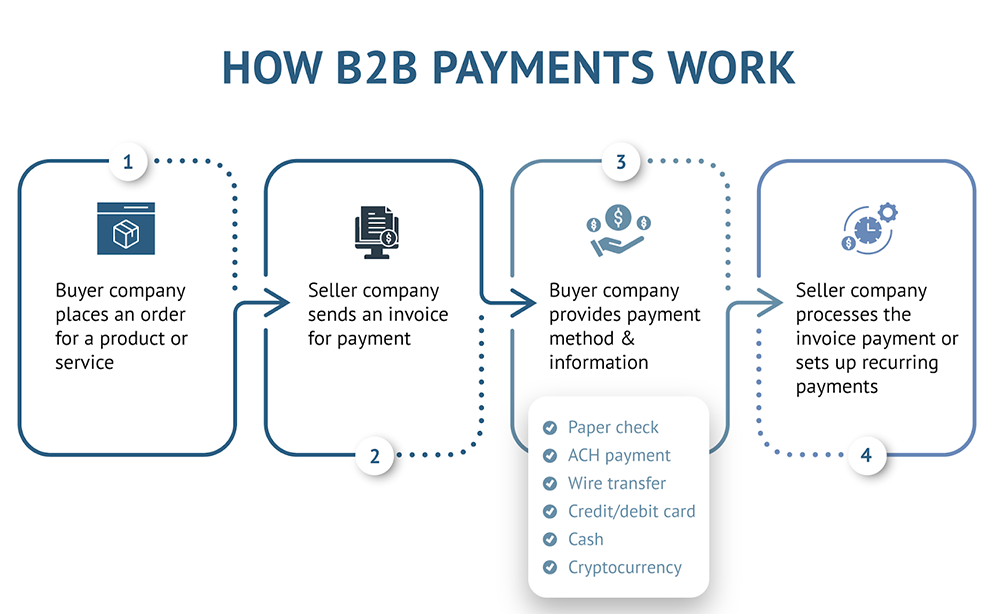

A payment gateway is essentially a middleman in digital transactions, acting as a bridge between the buyer’s bank account and the seller’s bank. In the B2B sector, this role becomes more nuanced as businesses deal with higher volumes, bulk orders, and recurring payments. A payment gateway streamlines the entire process, ensuring that payments are processed quickly and accurately.

How Payment Gateways Work in B2B Transactions

In contrast to gateways designed for consumers, B2B payment gateways are required to manage significantly more intricate workflows. They authenticate the transaction, process payment requests, verify bank details, and transfer funds—all while maintaining strict compliance with local and international regulations. Moreover, they are equipped to manage bulk orders, handle multiple currencies, and generate automated invoices for efficient bookkeeping.

The Growing Demand for B2B Payment Solutions in India

Platforms like IndiaMART, TradeIndia, and Moglix have revolutionized the B2B commerce space. These platforms require robust payment solutions to handle their vast volume of transactions while catering to the unique requirements of the electronics sector, such as high-value orders and credit-based transactions. Payment Gateway B2B Electronics Solutions India.

Adoption of Digital Payment Ecosystems

Government initiatives like “Digital India” and increased internet penetration have encouraged businesses to move away from traditional payment methods. Payment gateways ensure that businesses remain competitive in a rapidly evolving market by offering advanced digital solutions. Modern B2B buyers expect the same seamless experience as they get in B2C transactions. Instant payment options[1], real-time tracking, and multichannel support are no longer optional—they are must-haves. Payment Gateway B2B Electronics Solutions India.

Key Features of Payment Gateways for B2B Electronics

Customizable Workflows

Unlike generic payment solutions, B2B payment gateways[2] allow businesses to customize payment workflows. For instance, they can include payment approvals, multi-level authentication, and recurring billing to suit their operational needs. The electronics industry often relies on credit terms for large orders. Payment gateways now offer features like post-dated payments and credit facilitation to address this need.

Multi-Currency and Cross-Border Support

With India being a major exporter of electronics, payment gateways that support multiple currencies and international transactions are crucial. This ensures that businesses can expand globally without any payment-related barriers. Many payment gateways offer white-label solutions that allow businesses to brand the payment experience under their own name, ensuring a consistent and professional user experience.

Benefits of Payment Gateways for B2B Electronics

Payment gateways allow businesses to track incoming payments, generate real-time reports, and reconcile accounts more efficiently, resulting in better cash flow management. Gone are the days of waiting weeks for a cheque to clear. Payment gateways significantly reduce payment cycles, ensuring that funds are credited to the seller’s account almost instantly. By automating payment processes[3], businesses can save on labor costs and reduce errors, making operations more cost-effective. Every transaction is logged and documented, ensuring complete transparency between buyers and sellers. This is especially important for maintaining trust in long-term business relationships.

Challenges in Implementing Payment Gateways

Many small and medium enterprises (SMEs) in India still lack the technical infrastructure to adopt advanced payment solutions. Bridging this gap requires time and investment. While large corporations can negotiate lower fees, SMEs often find the transaction costs of payment gateways a significant burden. India’s evolving regulatory landscape, including GST and data localization laws, poses challenges for payment gateways operating in the B2B space.

Leading Payment Gateway Solutions in India

A leader in B2B solutions, Razorpay offers tools for subscription billing, bulk payments, and payment link generation, making it ideal for the electronics sector[4]. Paytm is particularly popular for its ability to handle UPI transactions, bulk payouts, and vendor payments, making it an affordable option for SMEs. Instamojo provides easy integration for online and offline transactions, catering to smaller electronics businesses that are transitioning to digital platforms. With advanced fraud detection systems and support for multi-currency transactions, CCAvenue is a go-to solution for businesses dealing with international clients.

How Payment Gateways Cater to B2B Electronics

Payment gateways can handle bulk transactions without delays, ensuring smooth operations for electronics wholesalers and manufacturers.For businesses offering electronics-as-a-service or leasing models, recurring payment options ensure timely collection without manual intervention. Many gateways are integrated with GST and other tax modules, making compliance a breeze for businesses.

The Future of Payment Gateways in India

AI-driven solutions are enabling real-time fraud detection, predictive analytics, and smarter payment routing, paving the way for more efficient gateways. Blockchain technology can enhance transaction transparency, reduce fraud, and streamline international payments, especially for high-value electronics orders[5].As IoT devices become mainstream in the electronics sector, payment gateways will likely evolve to support seamless transactions directly through connected devices.

Conclusion

Payment gateways are more than just transaction facilitators; they are enablers of growth and innovation in the B2B electronics industry. By providing scalable, secure, and feature-rich solutions, these gateways help Indian businesses compete in a global market. The future is bright, and businesses that embrace these technologies will undoubtedly thrive in the coming years.

FAQs

- What is the most secure payment gateway for B2B electronics in India?

CCAvenue stands out for its robust security measures, featuring encryption and sophisticated fraud detection capabilities. - Can payment gateways handle multi-currency transactions?

Gateways such as Razorpay and Paytm offer multi-currency support, making them ideal for handling international payments. - What are the hidden costs of using a payment gateway?

Apart from transaction fees, businesses should look out for setup fees, maintenance charges, and foreign exchange conversion rates. - What is the typical timeframe for integrating a payment gateway into your system?

Integration timelines can range from a few hours to a week, depending on the complexity of the business’s systems and the gateway chosen. - Do payment gateways offer APIs for custom integrations?

Yes, most payment gateways provide APIs, allowing businesses to customize their payment processes according to specific needs.