Author: Shin Hari

Introduction to Payment Gateway Security in India

India’s digital economy is booming, with payment gateways[1] playing a critical role in enabling online transactions. As more people embrace digital payments, securing these gateways has become a top priority. But what exactly makes a payment gateway secure? Let’s dive in.

Overview of Payment Gateways

What Are Payment Gateways?

Payment gateways act as a bridge between customers and merchants, securely transmitting payment information for online or offline transactions. They handle sensitive data like credit card numbers and user authentication details, making their security indispensable.

Importance of Security in Payment Gateways

Imagine sending your most valuable package through a courier. Wouldn’t you want it wrapped securely? Payment gateway security works the same way—it ensures that your financial data reaches the destination without interference or theft.

Growth of Digital Payments in India

India has seen an unprecedented rise in digital payments[2], thanks to initiatives like UPI, digital wallets, and e-commerce growth. This rapid adoption also brings challenges, especially in ensuring security for millions of daily transactions.

Understanding Payment Gateway Security

Definition of Payment Gateway Security

Payment gateway security refers to the measures, protocols, and technologies implemented to safeguard financial transactions. These ensure that sensitive information like credit card details, bank accounts, and personal data are protected from cybercriminals.

Common Threats to Payment Gateways

Payment gateways face a variety of threats, including phishing attacks, card skimming, man-in-the-middle attacks, and denial-of-service (DoS) attacks. Cybercriminals are constantly evolving, making it essential for security systems to stay one step ahead.

Global and Local Security Compliance Standards

Standards like PCI-DSS (Payment Card Industry Data Security Standard) and compliance with RBI’s guidelines ensure that Indian payment gateways remain secure and trustworthy.

Evolution of Payment Gateway Security in India

From the early days of internet banking to today’s advanced mobile wallets, payment security in India has come a long way. Initially, payment systems struggled with limited user trust due to fraud concerns. However, advancements like OTP-based authentication, tokenization, and AI-driven fraud detection have reshaped the landscape.

Types of Payment Gateways

Hosted Payment Gateways

In a hosted payment gateway, the customer is redirected to a third-party site for payment processing. These gateways offer an added layer of security by ensuring that sensitive information never reaches the merchant’s server.

Integrated Payment Gateways

Integrated gateways are directly embedded into the merchant’s website or app. This provides a more seamless user experience, but it also places more responsibility on the merchant for securing payment[3] data.

Local and International Payment Gateways

Indian businesses use both local (e.g., Razorpay, Paytm) and international (e.g., PayPal, Stripe) payment gateways. While local gateways offer better integration with Indian banks and payment methods, international gateways may provide broader reach, but security measures should be equal across both platforms.

Common Security Threats in Payment Systems

With the rise of digital transactions[4], various security threats have emerged. Let’s look at some of the common risks associated with payment systems:

Cyber-attacks

Hackers target payment gateways to steal sensitive financial data. These attacks may come in the form of Distributed Denial of Service (DDoS) attacks, SQL injections, or malware infections.

Data Breaches

A data breach occurs when unauthorized parties access sensitive information, such as credit card numbers, user credentials, or transaction history. These breaches can lead to financial losses and a tarnished reputation.

Phishing and Social Engineering

Cybercriminals use phishing emails or fake websites to trick users into revealing their payment information. Social manipulation strategies leverage human behavior to obtain sensitive information.

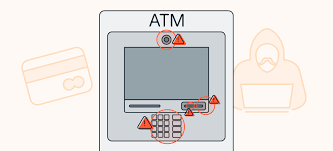

Skimming Devices

Skimming devices are small, undetectable tools placed on ATMs or POS terminals to capture payment card information. These devices can easily go unnoticed and are a serious threat to cardholders.

Secure Socket Layer (SSL) Encryption

SSL encryption is widely used to secure data transmissions. When SSL is enabled, payment information is encrypted, ensuring that only the intended recipient can decrypt and access the sensitive data.

Payment Card Industry Data Security Standard (PCI DSS)

PCI DSS is a set of security standards designed to ensure that all companies processing card payments maintain a secure environment. Compliance with PCI DSS is essential for maintaining secure payment systems.

Tokenization and Encryption

Tokenization replaces sensitive data with a randomly generated identifier, which reduces the risk of data theft. Encryption further ensures that even if data is intercepted, it cannot be read without the decryption key.

Two-Factor Authentication (2FA)

2FA requires users to provide two forms of verification before completing a transaction, such as a password and an OTP sent to their mobile device. This adds an additional layer of security to online payments.

Advanced Security Measures in Payment Gateways

Machine Learning and AI for Fraud Detection

Payment gateways increasingly use machine learning algorithms to detect unusual patterns in transactions, flagging them for further review. AI can predict fraudulent activities based on historical data, providing real-time protection.

Biometric Authentication

Biometric authentication, such as facial recognition or fingerprint scanning, is becoming an increasingly popular method for securing online payments[5] These systems add a higher level of security since biometrics are unique to each individual.

Real-time Transaction Monitoring

Real-time monitoring allows payment systems to track and analyze transactions as they happen, identifying potential fraud or security breaches quickly.

Blockchain Technology in Payment Systems

Blockchain technology has the potential to revolutionize payment gateway security. With its decentralized nature, blockchain reduces the risk of fraud, ensures transparency, and enhances the security of online transactions.

Payment Gateway Security Devices

To complement online security measures, several physical devices ensure the safe processing of payments:

Hardware Security Modules (HSM)

HSMs are physical devices that manage and store encryption keys securely. They are used to ensure that sensitive data is encrypted and decrypted within a protected environment.

Point of Sale (POS) Terminals with EMV Chip

EMV chip-enabled POS terminals provide a higher level of security than traditional magnetic stripe cards. These terminals use dynamic data for each transaction, making them more resistant to fraud.

Biometric Devices for Payment Authentication

Biometric authentication devices, like fingerprint scanners and facial recognition systems, are increasingly used for verifying the identity of users before processing payments, adding an additional layer of security.

Legal and Regulatory Framework for Payment Security in India

The Reserve Bank of India (RBI) plays a significant role in regulating the security of payment gateways in the country:

RBI Guidelines on Digital Payments Security

The RBI has issued comprehensive guidelines to ensure secure digital payment transactions. These guidelines mandate robust security protocols for both merchants and payment service providers.

Data Protection Laws in India (e.g., PDPB)

The Personal Data Protection Bill (PDPB) aims to protect personal data, ensuring that payment service providers comply with data privacy standards when handling consumer information.

Compliance with Global Standards (GDPR, PCI DSS)

Indian payment gateways also need to comply with global standards like the General Data Protection Regulation (GDPR) in Europe and PCI DSS, ensuring they meet the best security practices.

The Future of Payment Gateway Security in India

With the continuous evolution of technology, payment gateway security will only improve. The integration of artificial intelligence, biometric authentication, and blockchain promises a more secure and seamless experience for users and businesses alike.

Emerging Trends and Technologies

The future will likely see more widespread use of AI-driven fraud detection, blockchain-based transactions, and biometric payments, enhancing security while making payments faster and more efficient.

The Role of Fintech Innovations

Fintech innovations in India are shaping the future of payment security. Startups and established firms are continuously developing new technologies to combat emerging security threats.

Collaborative Security Models

The future will likely see increased collaboration between banks, fintech companies, and regulators to create a unified and secure payment ecosystem in India.

Conclusion

Payment gateway security systems in India have evolved tremendously in response to growing threats and the need for trust in digital transactions. With advancements in technology, new security measures such as AI, biometrics, and blockchain are helping to create a safer digital environment for users. As the digital payment landscape continues to expand, ensuring robust security will be paramount to maintaining consumer confidence and preventing fraud.

FAQs

1. What are the common threats to payment gateways?

Threats include phishing, data breaches, card skimming, and man-in-the-middle attacks.

2. How does tokenization improve payment security?

Tokenization replaces sensitive data with secure tokens, reducing the risk of breaches.

3. Are biometric authentication systems widely used in India?

Yes, many payment apps and digital wallets are integrating biometric features like fingerprint and facial recognition.

4. What role does AI play in payment gateway security?

AI detects fraudulent transactions in real-time using advanced analytics and machine learning.

5. What are the benefits of RBI guidelines for Indian users?

RBI guidelines enhance payment security by mandating tokenization, multi-factor authentication, and data protection.