AUTHOR : ANGEL ROY

DATE : 19-12-2024

Introduction

In India, millions of families and individuals rely on financial aid[1] to access essential services like education, healthcare, and welfare programs. However, one of the biggest challenges lies in determining eligibility for these aid programs. Given the complexity of various government and private financial aid schemes, it is critical for applicants to accurately assess their eligibility before applying. This is where payment provider[2] financial aid[3] eligibility evaluation comes into play, ensuring that the process is streamlined and transparent. Financial aid eligibility evaluation helps individuals and families understand which programs they qualify for, preventing wasted time on applications that may not be successful.

What is Financial Aid Eligibility Evaluation?

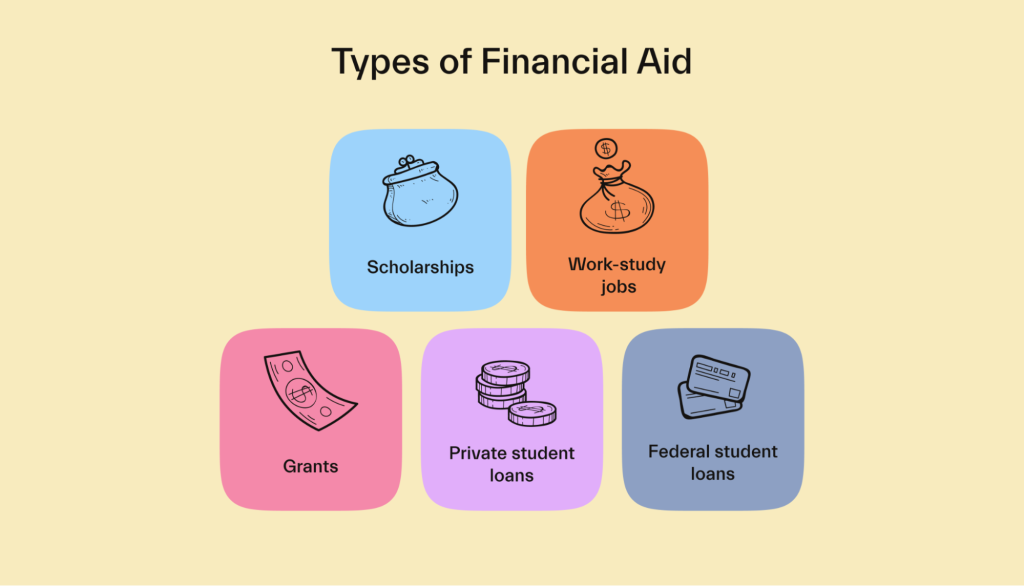

Financial aid eligibility evaluation is the process of assessing whether an individual or family meets the requirements to qualify for various financial assistance programs. These programs are often designed to support people who are financially disadvantaged and need help accessing services like education, healthcare[4], and welfare.

- Income Level: The applicant’s family income is often one of the most significant determining factors.

- Academic Merit: In the case of education-related Payment[5] Provider, the applicant’s academic performance might also be considered.

- Geographical Location: Some programs are targeted specifically at individuals in rural or underserved areas.

- Other Criteria: These could include caste, disability, or other factors that can impact eligibility for certain aid programs in India.

The process can be complex, given the variety of aid programs available, and that’s where payment providers can help. By providing tools and platforms that assist with evaluating eligibility, payment providers ensure that financial aid programs reach the right people.

Role of Payment Provider Financial aid Eligibility Evaluation In India

1. Simplifying the Eligibility Assessment Process

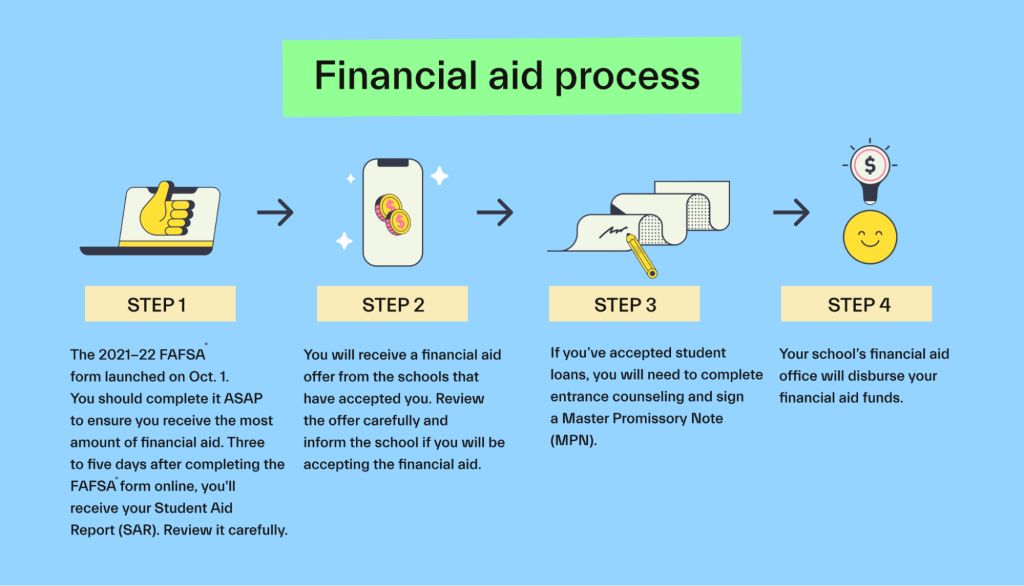

In India, where the diversity of aid programs can create confusion, payment providers simplify the eligibility evaluation by offering centralized platforms. These platforms allow users to input their personal details, income information, and other relevant data to automatically assess eligibility for a range of aid programs. By digitizing the eligibility process, payment providers reduce the administrative burden and minimize human error, which can often lead to delays and confusion.

2. Providing Real-Time Eligibility Status

Through digital platforms, payment providers enable families to receive instant feedback on their eligibility for financial aid programs. This immediate response helps applicants save time, as they don’t need to manually verify their eligibility or wait for long processing periods. Whether for government scholarships, health insurance subsidies, or welfare programs, real-time eligibility status ensures that applicants can move forward with the right aid programs.

3. Secure Data Handling

Payment providers play a crucial role in handling sensitive personal and financial information. By utilizing advanced encryption technologies and secure payment gateways, payment providers ensure that applicants’ data is protected. This security is particularly important in India, where the risk of fraud and data breaches can be high. By safeguarding applicants’ data, payment providers help maintain trust in the financial aid evaluation process.

4. Streamlining Documentation Requirements

One of the major hurdles in applying for financial aid in India is the complex documentation process. Payment providers assist by making the document submission process easier. Through integrated platforms, applicants can upload necessary documents such as income certificates, Aadhaar cards, and other forms of identification directly, reducing the need for physical submission. This simplifies the evaluation process, cutting down on delays and administrative costs.

5. Integration with Government Programs

Many government welfare and financial aid programs in India, such as Direct Benefit Transfers (DBT), require applicants to meet specific eligibility criteria. This ensures that only eligible individuals are selected for assistance, reducing fraudulent claims and ensuring aid reaches those who need it the most.

Benefits of Financial Aid Eligibility Evaluation

1. Improved Access to Financial Aid Programs

By streamlining the eligibility process payment providers enhance access to a wide range of financial aid programs. With automated eligibility checks, individuals and families are able to easily identify which programs they qualify for. This increases the likelihood of families accessing financial aid, improving their ability to afford education, healthcare, and other essential services.

2. Time and Cost Efficiency

The traditional process of applying for financial aid can be time-consuming and costly, especially when multiple applications are involved. Financial aid eligibility evaluation through payment providers reduces the time spent on in-person visits and paperwork. Additionally, it helps families avoid the cost of applying for programs they ultimately do not qualify for.

3. Greater Transparency

By using secure digital platforms, payment providers ensure greater transparency in the financial aid evaluation process. Applicants can track their progress and understand exactly why they may or may not qualify for a particular aid program. This transparency reduces misunderstandings and fosters trust between applicants and the organizations providing aid.

4. Reduced Errors and Fraud

Automated eligibility assessments help minimize human error in the evaluation process. Since all data is processed through secure, algorithm-driven systems, there are fewer opportunities for mistakes. Moreover, the integration of payment providers with government systems helps to reduce fraud, ensuring that only eligible individuals receive aid.

5. Empowering Families

Financial aid eligibility evaluation platforms empower families by providing them with the tools and information they need to take control of their financial future. Families no longer need to rely on intermediaries or wait for lengthy approvals. Instead, they can easily determine their eligibility for various programs and make informed decisions about their financial aid options.

Challenges in Financial Aid Eligibility Evaluation in India

1. Complex Eligibility Criteria

While payment providers help simplify the eligibility process, some financial aid programs still have complex and stringent eligibility criteria. Many programs require a combination of factors to be met, such as specific income thresholds or educational qualifications. This can be difficult for families to navigate without expert help, especially in rural or underserved areas.

2. Digital Literacy Barriers

In India, digital literacy remains a challenge, particularly in rural regions. Many families may not be comfortable using digital platforms or may not have access to the necessary technology. Although payment providers offer user-friendly interfaces, the digital divide can still limit access to eligibility evaluation tools for some individuals.

3. Documentation Challenges

While payment providers make it easier to upload documents, there are still challenges related to documentation in India. Some families may not have access to official documents like income certificates, identity cards, or proof of residence. This can delay the eligibility evaluation process or prevent families from applying for aid altogether.

4. Coordination with Government Programs

Although payment providers are increasingly integrated with government welfare systems, there can still be challenges with data accuracy and program coordination. For example, discrepancies in government databases can lead to errors in eligibility evaluation, potentially delaying aid disbursement.

How to Improve the Financial Aid Eligibility Evaluation Process

1. Enhancing Digital Literacy

Improving digital literacy, especially in rural areas, would help more families benefit from financial aid eligibility evaluation services. Government and private initiatives to provide digital education and access to technology can bridge the gap and ensure that all families have equal access to these services.

2. Simplifying Eligibility Criteria

Simplifying the eligibility requirements for financial aid programs would make it easier for families to understand and apply. Payment providers can work with governments and institutions to ensure that the criteria are clearly communicated and that the evaluation process is straightforward.

3. Expanding Documentation Access

Improving access to necessary documentation is crucial for families in rural areas. Governments and payment providers can work together to ensure that families have easy access to the documents they need to apply for aid, reducing delays in the eligibility evaluation process.

Conclusion

Payment provider financial aid eligibility evaluation in India is a game-changer for millions of families in need of financial assistance. By providing automated, secure, and transparent eligibility checks, payment providers ensure that families can easily determine which aid programs they qualify for, saving time and resources. While challenges remain, the continuous development of digital platforms and integration with government systems promises to improve access to financial aid and empower families across the country.

FAQs

1. What is Payment Provider Financial aid Eligibility Evaluation In India?

Financial aid eligibility evaluation is the process of assessing whether an individual or family qualifies for a particular financial aid program based on specific criteria.

2. How do payment providers help in this evaluation?

Payment providers streamline the process by offering digital platforms for automated eligibility checks, secure data handling, and real-time status updates.

3. What are the key benefits of eligibility evaluation?

The benefits include improved access to aid, time and cost efficiency, greater transparency, and reduced errors and fraud in the evaluation process.

4. What challenges exist in the evaluation process?

Challenges include complex eligibility criteria, digital literacy barriers, documentation issues, and coordination problems with government systems.

5. How can the process be improved?

Improving digital literacy, simplifying eligibility criteria, and expanding access to necessary documentation can enhance the evaluation process and help more families access financial aid.