AUTHOR = DORA

DATE =19/12/24

India’s financial[1] landscape has undergone significant transformations[2] in recent years, largely due to the rapid adoption of digital payments. As a result, payment providers are now at the forefront of facilitating financial aid, ensuring that funds reach the intended recipients[3] efficiently. However, optimizing these payment systems[4] to enhance financial aid distribution remains a critical challenge[5]. Below are some strategies that payment providers in India can adopt to optimize financial aid distribution effectively.

1. Integration with Government Schemes

The Indian government runs a number of welfare programs aimed at uplifting marginalized communities, such as Pradhan Mantri Jan Dhan Yojana (PMJDY), the Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), and Direct Benefit Transfers (DBT). Payment providers can optimize the process by integrating their platforms with these schemes. Through seamless digital integration, they can ensure that financial aid reaches beneficiaries without delays, and can also offer features such as real-time tracking.

By automating and integrating financial aid disbursement with government schemes, payment providers can ensure faster and smoother transactions. Automation can minimize human error, making the process more efficient. Payment provider Financial aid optimization strategies in India

2. Mobile Wallets and UPI Integration

Mobile wallets and Unified Payments Interface (UPI) are revolutionizing digital payments in India. Payment providers can leverage these technologies to streamline the process of delivering financial aid, especially to rural and underserved populations. Mobile wallets offer an accessible and cost-effective solution for transferring funds without the need for physical bank branches.

In India, a large segment of the population remains unbanked. Payment providers that incorporate mobile wallets and UPI can bypass the need for traditional banking infrastructure, thus reaching millions of individuals who previously had limited access to financial services. The key lies in ensuring mobile-based solutions that are easy to use and require minimal literacy. Payment provider Financial aid optimization strategies in India

3. Collaboration with Fintech Startups

Collaboration between payment providers and fintech startups can yield innovative solutions for financial aid optimization. Fintech companies often bring new ideas, technologies, and approaches that can help streamline financial aid processes. Payment providers can use these innovations to reduce the time and cost of disbursing financial aid.

By collaborating with fintech startups, payment providers can tap into new technologies such as Artificial Intelligence (AI), blockchain, and machine learning, which can further enhance the security, efficiency, and transparency of financial aid disbursements. Payment provider Financial aid optimization strategies in India

4. Multi-Language Support

India is a linguistically diverse country with over 22 languages spoken across its regions. Financial aid programs that offer multilingual support have a higher chance of success, as they ensure that recipients understand the information provided and can navigate payment systems more easily.

Payment providers must ensure that their platforms are accessible in multiple languages. This can be done by integrating language options that reflect the local dialects of different regions, thus enhancing user experience and making it easier for beneficiaries to access financial aid.

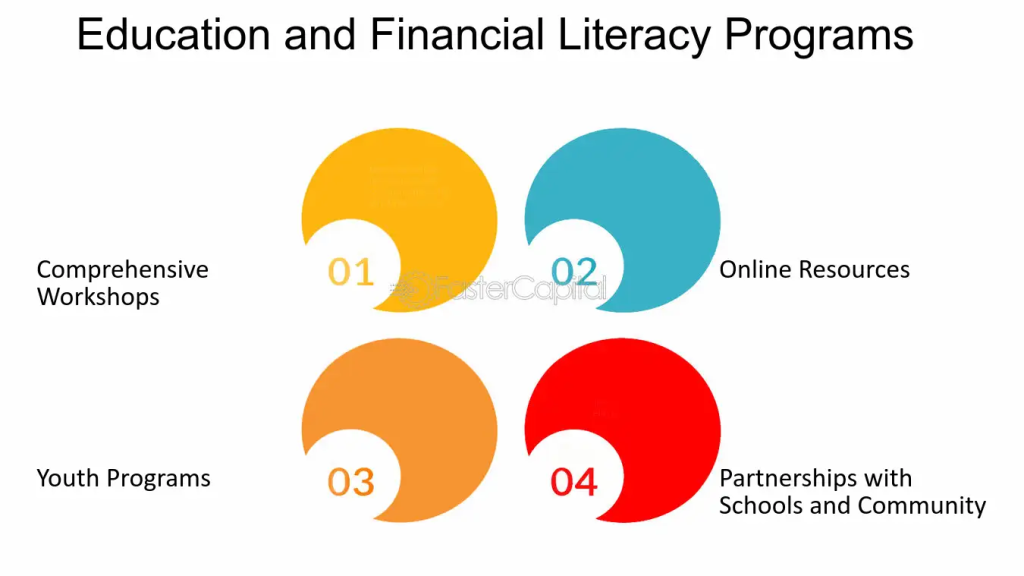

5. Partnership with Financial Literacy Programs

A significant challenge in India is the low level of financial literacy, particularly in rural and underserved areas. Payment providers can collaborate with financial literacy programs to help beneficiaries better understand how to use digital payments effectively. This will empower individuals to access, manage, and use financial aid for their benefit.

By educating recipients on digital payment methods, budget management, and saving strategies, payment providers can enhance the long-term impact of financial aid. This empowers beneficiaries to not only receive but also utilize the aid efficiently, thereby improving their financial inclusion.

Conclusion

Financial aid optimization is crucial for ensuring that funds reach the intended beneficiaries efficiently, especially in a country as large and diverse as India. By adopting advanced technologies, integrating with government schemes, and ensuring security and accessibility, payment providers can play a pivotal role in enhancing the effectiveness of financial aid programs. Implementing these strategies will not only improve the efficiency of aid disbursement but also contribute to the financial inclusion of millions of Indians.

FAQs:

1. What is financial aid optimization in the context of payment providers?

Financial aid optimization refers to the strategies employed by payment providers to ensure that funds are distributed to beneficiaries in a timely, secure, and efficient manner. These strategies include leveraging technology, integrating with government schemes, and ensuring transparency to enhance the impact of financial aid programs.

2. How do payment providers integrate with government welfare schemes in India?

Payment providers can integrate with government welfare schemes like Pradhan Mantri Jan Dhan Yojana (PMJDY), MGNREGA, and Direct Benefit Transfers (DBT) through API-based connections or digital platforms. This integration ensures that financial aid is automatically transferred to beneficiaries’ accounts, reducing delays and administrative overheads.

3. What role do mobile wallets and UPI play in optimizing financial aid distribution?

Mobile wallets and Unified Payments Interface (UPI) provide an easy, fast, and accessible way for recipients to receive and access financial aid. By incorporating these payment methods, payment providers can reach underserved and unbanked populations, ensuring that aid is delivered directly to mobile phones, which are widely accessible in India.

4. How does biometric authentication help secure financial aid transactions?

Biometric authentication, such as fingerprint scanning or facial recognition, ensures that only the rightful beneficiary can access financial aid. This minimizes fraud by verifying the identity of recipients before payments are disbursed, improving the security of the financial aid system.

5. How can data analytics improve financial aid optimization?

Data analytics helps payment providers understand the unique needs of beneficiaries by analyzing transaction history and demographic data. By using these insights, providers can tailor financial aid packages to ensure that the distribution is efficient and meets the specific needs of individuals or communities.

GET IN TOUCH___