AUTHOR = DORA

DATE = 20/12/24

Vocational training programs in India provide students with specialized skills[1] that help them enter the workforce in various industries[2] such as healthcare, technology, construction, and more. However, the cost of these programs can often be a barrier to access, especially for students from economically[3] disadvantaged backgrounds[4]. To address this challenge, digital payment gateways have become an essential tool in facilitating financial aid, making it easier for students to pay for vocational training[5].

Understanding Vocational Training in India

Vocational education and training (VET) focus on equipping students with practical skills for specific trades or careers. These programs are designed to provide hands-on experience and real-world knowledge, which increases the employability of graduates. Payment gateway Financial aid for vocational training programs in India

The Role of Payment Gateways in Facilitating Financial Aid

1. Simplified Payment Processes

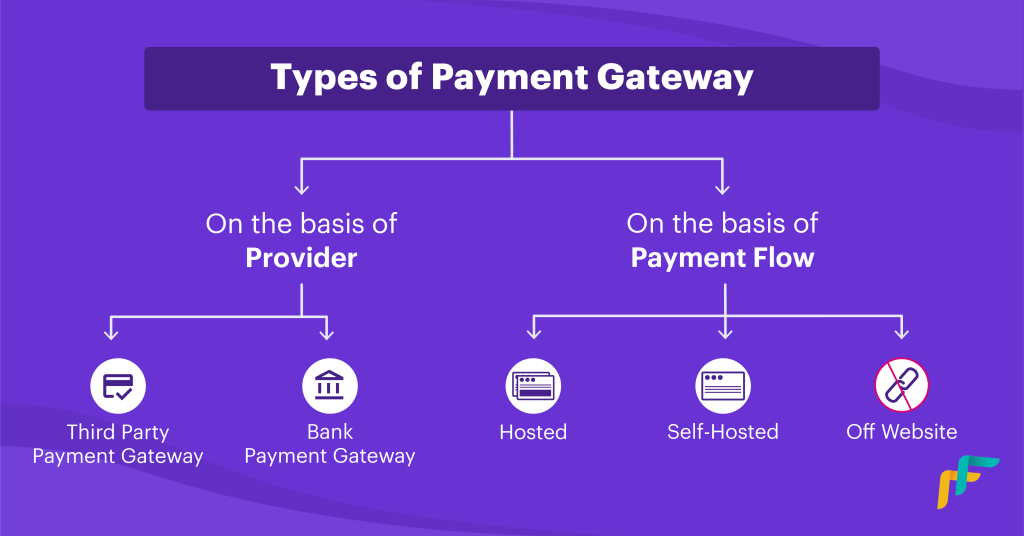

One of the biggest advantages of using a payment gateway is the simplification of the payment process. Students no longer have to deal with the complexities of cash payments or checks. Instead, they can make payments through digital means, including credit and debit cards, online banking, UPI (Unified Payments Interface), and mobile wallets. Payment gateway Financial aid for vocational training programs in India

2. Availability of Multiple Payment Options

Digital payment systems offer flexibility by providing multiple payment methods. This is crucial for students from diverse financial backgrounds. Whether a student has a bank account, a mobile wallet, or uses UPI, the payment gateway allows them to choose the most convenient payment method.

3. Increased Transparency and Security

Payment gateways ensure transparency in all financial transactions. Both students and training institutions can track payments in real-time, minimizing the chances of errors or discrepancies. Furthermore, payment gateways use encryption and advanced security protocols, ensuring that sensitive financial data is protected.

Financial Aid Programs for Vocational Training in India

1. Government Scholarships and Skill Development Schemes

The Indian government has launched various schemes to promote skill development and make vocational training accessible to all. These programs provide financial support for students to pursue training in sectors such as healthcare, retail, IT, and manufacturing.

- Pradhan Mantri Kaushal Vikas Yojana (PMKVY): PMKVY is one of the most prominent government schemes aimed at providing free or subsidized skill development training. Under this scheme, eligible students receive financial support for training and certification. The payment gateway allows students to pay for the courses or receive aid directly through secure digital transactions.

2. Educational Loans and Financing Options

For students who cannot access government scholarships, educational loans from banks and financial institutions provide an alternative route for financing vocational training. Several Indian banks, including public and private sector banks, offer specialized loans for vocational education at competitive interest rates.

3. Corporate Sponsorships and CSR Initiatives

Many large companies in India are actively involved in corporate social responsibility (CSR) programs that focus on skill development. These companies often provide financial support or sponsorships for vocational training programs. Payment gateways facilitate these corporate donations, ensuring that funds are disbursed directly to the vocational institutions or students.

Advantages of Payment Gateways in Vocational Training Financial Aid

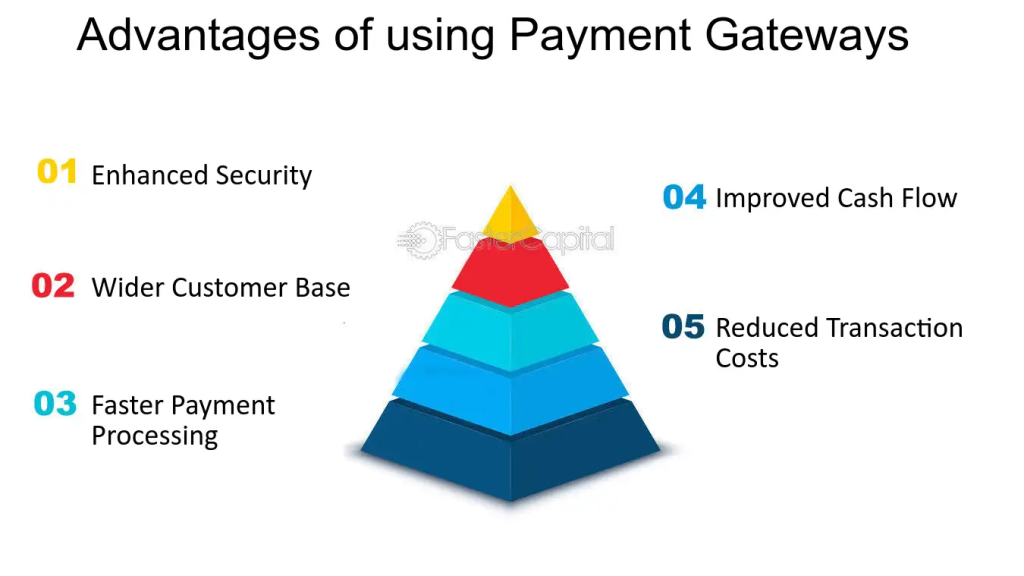

1. Accessibility and Convenience

One of the major benefits of payment gateways is the increased accessibility they offer. Students from rural or remote areas who may not have easy access to physical banks or ATMs can make payments or receive financial aid through their smartphones or computers. This eliminates geographical barriers, making vocational training more accessible to everyone.

2. Cost-Effectiveness

By digitizing the payment process, vocational training institutes can reduce administrative costs associated with manual payment collection and verification. Additionally, digital payments streamline the financial aid disbursement process, allowing institutions to allocate funds more effectively and efficiently.

3. Timely Transactions

Payment gateways allow for instant processing of transactions, ensuring that students receive financial aid on time and that their course fees are paid promptly. This helps avoid delays in course registration or access to study materials, which can impact students’ learning experiences.

Conclusion

The integration of payment gateways in the financial aid process for vocational training programs is transforming how students in India access education. With easy-to-use digital platforms, students can now apply for, receive, and manage financial aid more efficiently. Government schemes, educational loans, corporate sponsorships, and crowdfunding efforts are now streamlined through digital payment systems, improving the overall accessibility and affordability of vocational training in India.

FAQs:

1. What is a payment gateway in the context of vocational training programs?

A payment gateway is an online system that enables secure, digital transactions between students and vocational training providers. It allows students to make payments for their courses, receive financial aid, and process tuition fees through various digital methods such as credit/debit cards, UPI, mobile wallets, and net banking. Payment gateways streamline and simplify the financial transactions involved in vocational training.

2. How do payment gateways facilitate financial aid for vocational training?

Payment gateways facilitate financial aid by offering a seamless platform for students to receive and use funds for their vocational training. Whether the financial aid comes from government scholarships, corporate sponsorships, crowdfunding, or educational loans, payment gateways ensure that the funds are securely and directly transferred to students or training institutes.

3. What are the types of financial aid available for vocational training in India?

Several financial aid options are available to students pursuing vocational training in India, including:

- Government scholarships and schemes (such as Pradhan Mantri Kaushal Vikas Yojana or PMKVY).

- Bank loans specifically tailored for vocational education.

- Corporate sponsorships through CSR (Corporate Social Responsibility) initiatives.

Payment gateways ensure these funds are received and processed efficiently for the students.

4. How secure is the payment process when using a payment gateway?

Payment gateways use advanced encryption technology and security protocols to protect sensitive financial data. They are designed to provide a secure environment for both students and institutions, ensuring that payments and financial aid transfers are completed without the risk of fraud or unauthorized access.