AUTHOR: LUCKY MARTINS

DATE: 20/12/2024

Empowering Students to Study Abroad

The cost of higher education[1] has been rising globally, making it increasingly difficult for students, especially from middle- and lower-income families, to afford international education[2]. In India, where many students aspire to pursue studies abroad, financial planning and securing financial aid have become crucial aspects of their educational journey. Financial aid budget planning services[3] are designed to help students and their families navigate the complexities of financing study-abroad programs, ensuring that they are financially prepared to take on the expenses associated with international education.

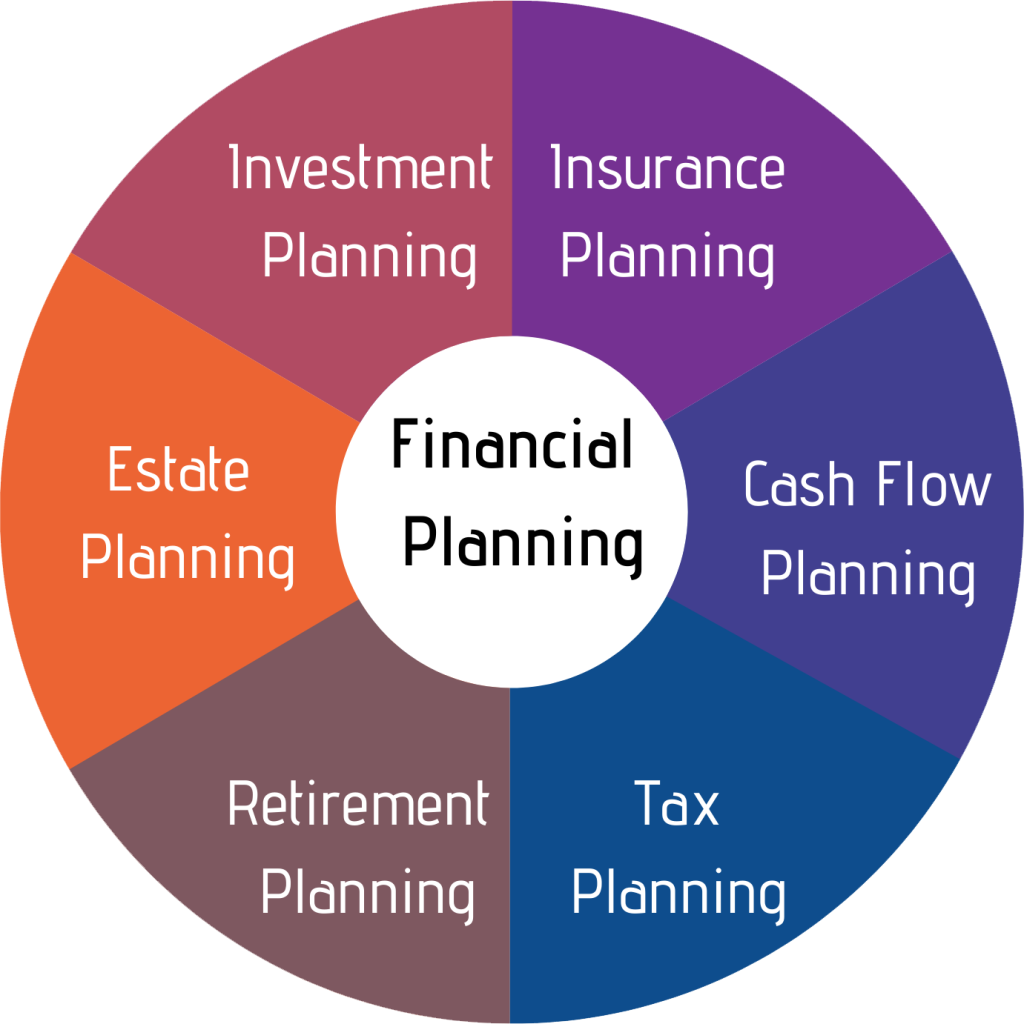

What Are Financial Aid Budget Planning Services?

Financial aid budget planning services[4] are specialized consulting services aimed at helping students manage the costs associated with studying abroad. These services involve providing expert guidance on creating a financial plan that aligns with the student’s educational goals[5], payment gateway financial aid budget planning services in India, travel costs, and other related expenditures.

Budget planning for studying abroad is a crucial part of the process, as it helps students estimate their total expenses and identify potential sources of financial support. These services not only assist in budgeting but also help students access various financial aid opportunities like scholarships, student loans, grants, and sponsorships to make studying abroad more affordable.

Key Aspects of Financial Aid Budget Planning

1. Assessing the Total Cost of Education

The first step in financial aid budget planning is to evaluate the total cost of studying abroad. This includes:

- Tuition fees: The major expense, which varies based on the university and program chosen.

- Accommodation: housing costs, whether on-campus or off-campus.

- Living expenses: daily expenses like food, transportation, and personal items.

- Travel expenses: airfare and other transportation costs.

- Health insurance: a necessary expense when studying in a foreign country.

By breaking down all these potential costs, financial aid consultants help students create a comprehensive budget, ensuring they understand the total financial commitment required.

2. Identifying Financial Aid Opportunities

Financial aid budget planning services also help students identify various sources of funding for their education. These may include:

- Scholarships: Government scholarships, university-specific scholarships, and private scholarships are available for international students.

- Student loans: loans offered by Indian banks or foreign financial institutions to cover education expenses.

- Grants and Sponsorships: Some organizations and foundations provide grants or sponsorships to students pursuing specific fields of study.

- Part-time work: In many countries, students are allowed to work part-time while studying, which can help cover living expenses.

Consultants guide students through the process of applying for scholarships and loans, ensuring they have access to the best financial aid opportunities.

3. Developing a Payment Plan

Once the total cost and available financial aid options are determined, a payment plan is created. This includes planning for:

- Upfront payments: Some universities require an initial deposit for tuition or accommodation.

- Ongoing payments: A monthly plan to manage living expenses and other costs during the course of study.

- Repayment schedules: If taking out loans, consultants help students understand loan repayment terms and interest rates, ensuring they have a clear understanding of how to manage their post-graduation debt.

4. Currency Exchange and Banking Considerations

When studying abroad, students must also manage currency exchange rates and international banking. Financial aid budget planning services provide advice on the most cost-effective ways to transfer money, open a foreign bank account, Payment gateway Financial aid budget planning services in India

5. Emergency Funds and Contingency Planning

An important aspect of budget planning is setting aside an emergency fund for unforeseen expenses, such as medical emergencies, sudden changes in living arrangements, or travel-related issues. A well-thought-out emergency fund ensures that students can handle unexpected situations without financial strain.

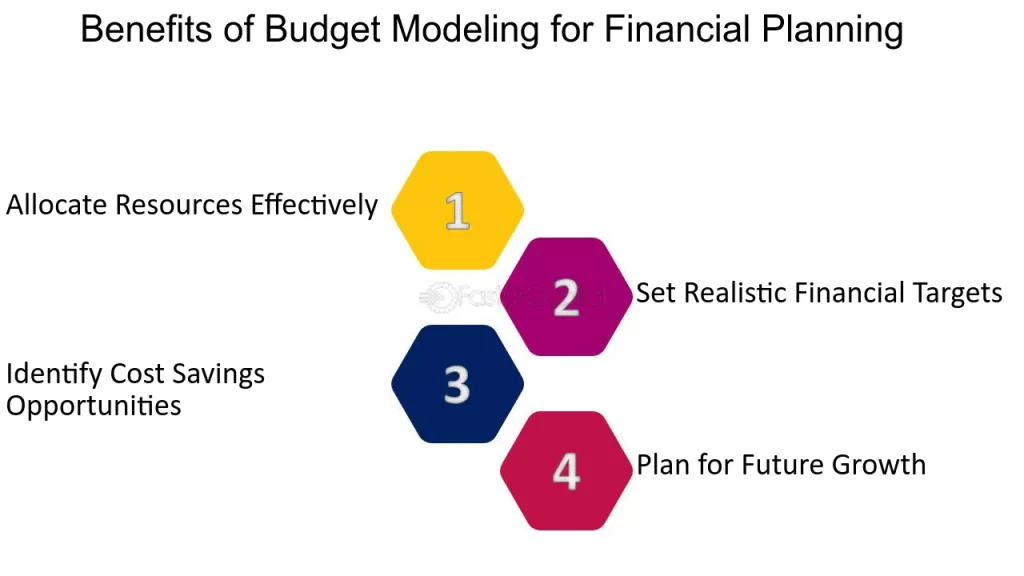

Benefits of Financial Aid Budget Planning Services

1. Comprehensive Financial Understanding

By having a clear understanding of the costs involved and the financial aid available, students are better prepared to make informed decisions. These services help avoid unexpected financial challenges by planning for all possible costs.

2. Maximized Financial Aid Opportunities

Consultants help students access a range of scholarships, grants, and loans, increasing the chances of securing financial aid. With expert guidance, students are more likely to take advantage of opportunities they might have otherwise missed.

3. Stress Reduction

The process of applying for financial aid and managing the budget for studying abroad can be overwhelming. Financial aid budget planning services reduce this stress by offering clear, expert guidance at every step, allowing students and their families to focus on other aspects of the study-abroad process.

4. Long-Term Financial Planning

Financial aid budget planning services not only assist students with immediate education expenses but also offer guidance on managing finances after graduation. This includes loan repayment strategies and advice on managing finances during the initial years of employment.

Conclusion

Financial aid budget planning services are an invaluable resource for students in India looking to study abroad. With expert guidance, students can navigate the complex financial landscape of international education, securing the necessary funding and managing their expenses effectively. By making financial aid more accessible and affordable, these services ensure that students can pursue their dreams of studying abroad without the burden of overwhelming financial stress.

FAQ:

1. What is the role of financial aid budget planning services?

Financial aid budget planning services assist students in assessing the total cost of studying abroad, identifying financial aid opportunities, creating a payment plan, and managing currency exchange and emergency funds. They help students navigate the complexities of financing their international education.

2. How do I find scholarships for studying abroad?

Financial aid consultants can help you find scholarships by researching government scholarships, university-specific opportunities, and private organizations offering financial aid. They also guide you through the application process.

3. Can I get a student loan to study abroad?

Yes, many Indian banks and financial institutions offer education loans to students planning to study abroad. Financial aid budget planning services can help you understand loan terms, interest rates, and repayment schedules.

4. How do I manage living expenses while studying abroad?

Financial aid services can help you create a budget for living expenses and identify ways to save money, such as finding affordable accommodation, using public transportation, and working part-time (if permitted in the host country).

5. What should I do if I face unexpected expenses while studying abroad?

Financial aid budget planning services recommend setting aside an emergency fund to cover unexpected expenses. They also help you explore options for financial support during emergencies, such as accessing additional loans or finding short-term work opportunities.