DATE : 21 DEC, 2024

AUTHOR : HIMARI JONSON

In today’s fast-paced world, professional certifications[1] have become a crucial stepping stone to career advancement. However, the cost of pursuing these certifications can sometimes be a barrier for individuals, especially in a country like India, where access to funding is not always readily available. Payment gateway financial[2] aid programs are emerging as an innovative solution to bridge this gap and provide support for individuals pursuing professional certifications.

What are Payment Gateway Financial Aid Programs?

Payment gateway[3] financial aid refers to funding options offered through digital payment platforms, designed to help individuals cover the costs of professional certification courses. These platforms are integrated with financial institutions and institutions[4] offering certification programs, enabling a seamless transaction and providing financial support at various levels. They are a convenient, tech-savvy solution for professionals[5] seeking career development opportunities without financial constraints.

Importance of Professional Certifications

Professional certifications enhance an individual’s skill set and improve their career prospects. They provide credentials that demonstrate expertise in specific areas, making professionals more marketable to employers. Some of the popular certifications in India include those in fields like IT such as AWS, Microsoft, and Cisco, project management data science, digital marketing, and finance.

By obtaining these certifications, professionals can increase their earning potential, gain access to better job opportunities, and stand out in a competitive job market. However, many individuals struggle to afford the fees associated with such programs, making financial assistance crucial.

How Payment Gateway Financial Aid Works

Payment gateways play a pivotal role in streamlining the process of accessing financial aid for certifications. These platforms often work with educational institutions, lenders, or scholarship providers to offer flexible payment options to students. Here’s a breakdown of how these systems typically operate:

Integration with Financial Institutions

Payment gateways often partner with banks, financial institutions, and fintech companies to provide loans or installment-based payment plans. Students can apply for financial aid via the platform and receive approval within minutes. This helps individuals access funds quickly and pay for the certification courses in easy-to-manage installments.

Easy EMI (Equated Monthly Installments) Options

A common feature of payment gateway financial aid is the ability to pay for certifications through EMIs. Payment platforms allow students to split the cost of their certification fees into monthly payments, making the financial burden lighter. These options often come with low-interest rates, enabling students to pay for their certifications over a fixed period.

Collaboration with Certification Providers

Many educational institutions or certification providers collaborate with payment gateways to offer exclusive financial aid programs to their students. These partnerships help streamline the process of applying for financial aid, reducing the complexity and ensuring that more individuals can access the courses they need without worrying about immediate payment.

Scholarships and Grants Integration

Payment gateways also facilitate easy access to scholarships and grants. Students can apply for various scholarships offered by private organizations, government bodies, or NGOs through the payment gateway platform. Once approved, the funds are directly applied to their certification course fees, allowing them to focus on their learning.

Benefits of Payment Gateway Financial Aid Programs

The integration of payment gateways with financial aid programs offers several key benefits for individuals seeking professional certifications in India:

Accessibility

One of the most significant advantages of payment gateway financial aid programs is their accessibility. Individuals from all walks of life can apply for financial assistance, regardless of their financial background. With the growing reach of digital payment platforms, people from rural areas or smaller towns in India now have better access to these programs.

Flexibility

Payment gateway systems offer immense flexibility in terms of payment options. Students can choose from various payment plans, including EMIs, flexible loan repayment structures, and scholarship options. This allows professionals to select the option best suited to their financial situation, ensuring that they do not face undue financial stress while completing their certifications.

Speed and Convenience

The process of applying for financial aid is significantly faster with payment gateways. Traditional methods of applying for loans or financial aid often involve long documentation and approval processes. In contrast, payment gateways offer a quicker, more efficient system, with funds disbursed almost instantly.

Increased Career Opportunities

By removing the financial burden of certification fees, payment gateway financial aid programs empower individuals to pursue certifications they might have otherwise overlooked. This can help them gain access to new career opportunities, higher salaries, and career growth, ultimately benefiting the broader economy.

Popular Payment Gateways for Financial Aid in India

Several payment gateways have emerged as key players in providing financial aid for professional certifications in India. Some of the most popular platforms include:

Razorpay

Razorpay is a widely used payment gateway in India that provides a range of services, including loan facilities for educational courses. They partner with educational institutions and financial service providers to help students apply for financial aid and pay their course fees in installments.

Paytm

another popular digital payment platform in India that offers financial aid solutions for various educational programs, including professional certifications. Paytm provides easy EMI options and helps students access scholarships, ensuring a smooth and affordable payment process for certification courses.

Simpl

Simpl is a payment gateway that enables instant credit for online purchases and services, including educational courses. They offer interest-free EMIs and flexible payment options to make professional certifications more accessible to a wider audience.

Eduvanz

Eduvanz is a fintech company that partners with education providers to offer easy financing options for certification courses. Their platform helps individuals avail of loans with flexible repayment terms, ensuring that paying for professional development does not become a financial burden.

How to Apply for Payment Gateway Financial Aid

The process to apply for financial aid through payment gateways is typically straightforward. Here’s a general step-by-step guide:

- Visit the Payment Gateway Platform: Start by choosing the payment gateway platform that offers financial aid for your certification program.

- Select Your Course: Choose the course you wish to pursue and check the available payment options.

- Apply for Financial Aid: Fill in the necessary details, including your financial information, to apply for aid.

- Approval and Fund Disbursement: After your application is reviewed and approved, funds will be disbursed directly to the institution offering the certification.

- Payment Management: Manage your payments via the platform, choosing an EMI or loan option that works best for you.

Conclusion

Payment gateway financial aid programs are transforming the way professionals in India access funding for certification courses. By providing accessible, flexible, and quick financial assistance, these programs remove the financial barriers that many individuals face. As more professionals embrace digital platforms to enhance their skills, payment gateway financial aid is set to become an integral part of the Indian educational landscape, paving the way for career advancement and economic growth.

FAQ

What is a payment gateway?

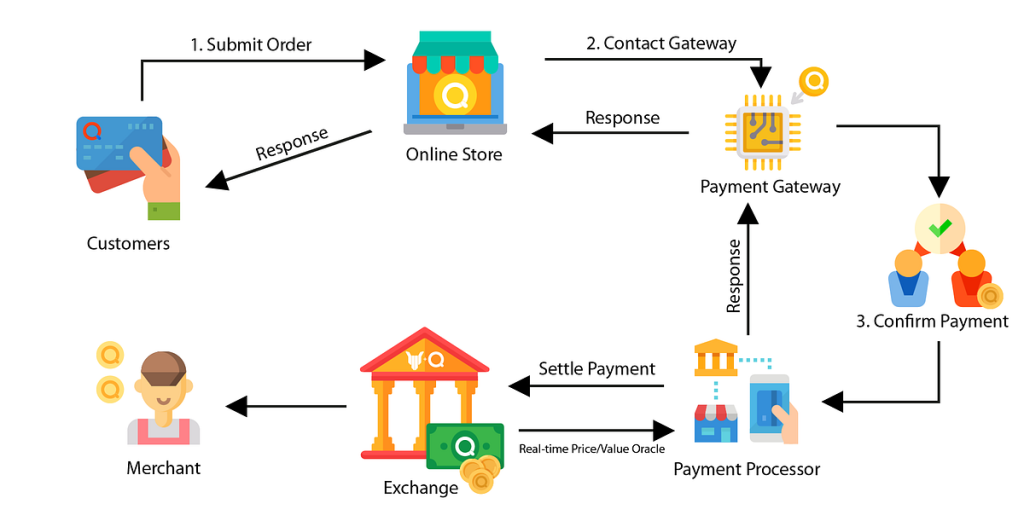

A payment gateway is an online service that facilitates the secure transaction of money between a buyer and a seller (certification provider) on the internet. It ensures smooth processing of online payments using debit/credit cards, net banking, wallets, or other digital payment methods.

How does a payment gateway work for professional certification courses?

When a student registers for a professional certification, they can make payment via various modes. The payment gateway encrypts the transaction details and transfers the money securely to the course provider. Once the payment is processed, the student gains access to the certification course.

Are payment gateways secure for making payments for professional courses?

Yes, payment gateways use secure encryption protocols to protect sensitive information. Certified gateways comply with the Payment Card Industry Data Security Standards to ensure that your financial data remains safe.

Can I pay for a professional certification using installment payments?

Many certification platforms in India offer EMI or installment-based payment options. Some payment gateways have tie-ups with financial institutions to facilitate easy installment options for students, depending on the course provider.

Can I use my UPI or mobile wallets to pay for certifications?

Yes, most payment gateways support UPI and mobile wallets Phone Pe as payment methods for professional certifications in India.