AUTHOR : ISTELLA ISSO

DATE : 19/122023

Introduction

India’s taproom culture is experiencing a remarkable surge, with people increasingly seeking unique and immersive experience. As this trend gains momentum, it becomes imperative for taproom owners to streamline their operations, and one critical aspect is payment processing Secure payment systems[1]. In this article, we delve into the intricacies of payment processing for taproom events in India and explore how efficient systems can contribute to a seamless customer experience.

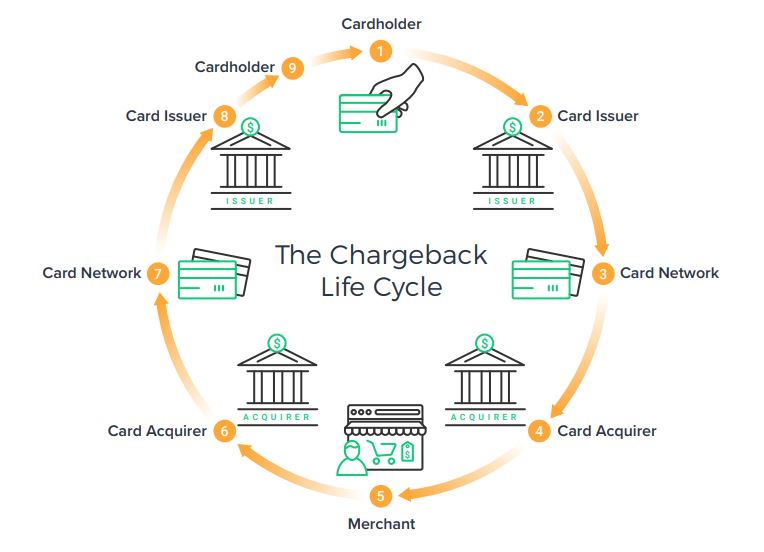

Understanding Payment Processing

Payment Processing For Taproom is the backbone of any business, facilitating the exchange of money for goods or services. In the context of taproom events, this involves handling transactions swiftly and securely, ensuring a positive interaction between customers and the establishment. Key components include point-of-sale (POS) systems, payment gateways, Events In India and secure networks.

Challenges in Payment Processing for Taproom Events

Running a taproom event comes with its own set of challenges in the payment processing realm. From dealing with cash intricacies to addressing security concerns, Taproom Events for payment owners must navigate these hurdles to ensure smooth operations. Limited payment options can also pose a hindrance to customer satisfaction.

Emerging Trends in Payment Technology

The landscape of payment technology is evolving rapidly. Contactless payments, mobile wallet integrations, and online payment gateways have emerged as game-changers for taproom events Cross-border payments[2] These innovations not only offer convenience but also align with the modern customer’s preference for seamless transactions.

Benefits of Efficient Payment Processing

Efficient Online payment processing[3] goes beyond mere convenience; it directly impacts customer experience and a taproom’s bottom line. From faster transaction to heightened security measures, the benefits are manifold. Taproom owners stand to gain increased revenue and customer loyalty by investing in robust payment processing solutions.

Choosing the Right Payment Processor

Selecting the right payment processor is a crucial decision for taproom owners. Brewers Association Events[4]

Factors such as transaction fees, security features, and compatibility with taproom operations must be carefully considered. Beer measurement[5] Popular payment processing solutions in India, such as Razorpay and Paytm, offer diverse options tailored to specific business needs.

Steps to Implement Efficient Payment Processing

Implementing efficient payment processing involves a strategic approach. From setting up secure POS systems to integrating online payment options, taproom owners must ensure a seamless transition. Educating staff and customers about the new payment process is equally vital for a successful implementation.

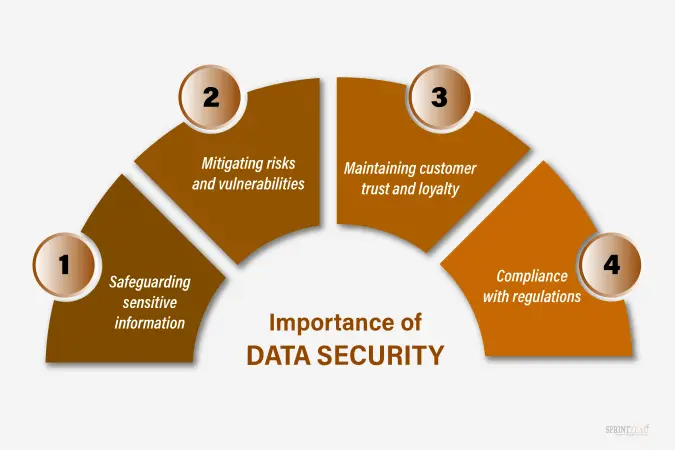

Regulatory Compliance in Payment Processing

Adhering to regulatory standards is non-negotiable in payment processing. This section provides an overview of relevant regulation in India and emphasizes the importance of compliance to build trust among customers and avoid legal complications.

Case Studies

Real-world examples showcase the success stories of taproom events that have overcome payment processing challenges. These case studies offer insights into practical solutions and inspire other taproom owners to adopt efficient payment processing systems.

Future of Payment Processing in Taproom Events

The article explores predictions for the future of payment processing in taproom events. From the integration of advanced technologies to evolving customer expectations, taproom owners need to stay ahead of the curve to remain competitive in the market.

Customer Testimonials

Quotes from taproom event attendees provide a human touch, offering perspectives on their payment experiences. These testimonials highlight the impact of efficient payment processing on customer satisfaction and loyalty.

Tips for Taproom Owners

Practical tips guide taproom owners on maximizing profits through effective payment processing. Building customer trust and loyalty is explored, emphasizing the role of seamless transactions in fostering a positive relationship with patrons.

Common Misconceptions about Payment Processing

This section addresses common myths and misconceptions surrounding payment processing. By providing clarity on these issues, taproom owners can make informed decisions and debunk any misunderstandings among customers.

The Importance of Data Security

Safeguarding customer information is paramount in payment processing. Measures to ensure data security are discussed, highlighting the significance of building trust through secure payment practices.

Conclusion

In conclusion, the article synthesizes key insights into the critical role of payment processing in the success of taproom events. Efficient systems not only enhance customer experience but also contribute to increased revenue and long-term sustainability.

FAQs

- Do taproom events really need advanced payment processing systems?

- Yes, efficient payment processing enhances customer satisfaction and contributes to the overall success of taproom events.

- What are the most popular payment processors in India for taproom events?

- Razorpay and Paytm are among the popular choices, offering diverse options for taproom owners.

- How can taproom owners ensure data security in payment processing?

- Taproom owners should implement secure POS systems and follow best practices for data protection.

- Are contactless payments widely accepted in taproom events in India?

- Yes, contactless payments are gaining popularity, providing a convenient and hygienic option for customers.

- What steps can taproom owners take to educate customers about new payment processes?

- Taproom owners can use signage, staff training, and social media to effectively communicate changes to customers.