AUTHOR : PUMPKIN KORE

DATE : 15 /12/2023

Introduction

In the dynamic landscape of Indian E-commerce, High Risk PSP E-commerce Payment Services In India payment service providers (PSPs) play a crucial role in facilitating seamless transactions. However, some Fraud Prevention for E-commerce Payment Systems businesses fall into the category of high-risk, posing unique challenges for conventional payment gateways. This article explores the realm of Secure E-commerce Payment Processing High Risk PSP E-commerce Payment Services in India, shedding light on their importance, challenges, benefits, and the evolving regulatory landscape.

Understanding High-Risk PSPs

High-risk PSPs cater to businesses facing elevated levels of risk, often due to the nature of their industry or transaction volumes. High-Risk Payment Gateway Services High Risk PSP E-commerce Payment Services In India Industries such as adult entertainment, online gaming, and nutraceuticals commonly find themselves in the high-risk category. It’s essential to comprehend the distinctive features of these payment services and the industries they serve.

The E-commerce Boom in India

India has witnessed an unprecedented surge in E-commerce activities, with millions of users engaging in online transactions daily. High Risk PSP E-commerce Payment Services In India As the E-commerce market continues to grow, the need for secure and Digital Payment Security[1] reliable payment solutions becomes paramount. High-risk PSPs address this need by offering specialized services tailored to the unique challenges faced by E-commerce merchants.

Challenges Faced by E-commerce Merchants

While E-commerce presents lucrative opportunities, Payment Fraud Detection Services[2] it comes with its set of challenges. Fraudulent activities and chargebacks are perennial concerns for merchants. Additionally, navigating through regulatory High Risk PSP E-commerce Payment Services In India requirements can be a daunting task. High-risk PSPs emerge as strategic partners, helping merchants mitigate these challenges effectively High-Risk Online Transaction[3] Security Solutions.

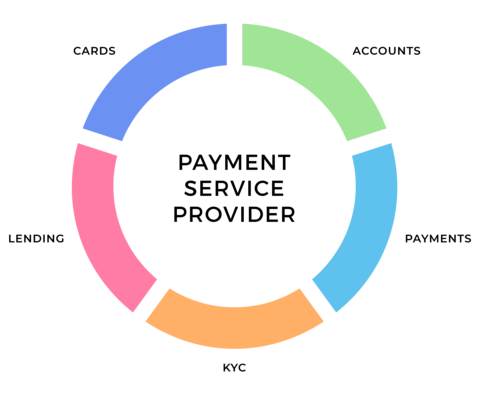

High-Risk PSPs: A Necessity for Some Businesses

Certain industries inherently carry a higher risk due to factors like high chargeback rates or regulatory scrutiny. PSP (Payment service provider)[4] Conventional payment gateways may decline services to such businesses,[5] making high-risk PSPs a necessity. The article delves into the industries that often require high-risk payment solutions and why generic gateways may not suffice.

Benefits of High-Risk PSPs

Contrary to common belief, Payments risk management[5] high-risk PSPs offer more than just risk mitigation. They provide tailored solutions, robust fraud prevention measures, and specialized support to businesses facing unique challenges. Understanding these benefits is crucial for businesses considering high-risk PSPs.

Popular High-Risk PSPs in India

The Indian market boasts several high-risk PSPs catering to diverse industries. This section provides an overview of leading providers, their key features, and the specific services they offer to support high-risk businesses.

How to Choose the Right High-Risk PSP

Selecting the right high-risk PSP is a critical decision for E-commerce merchants. The article outlines key factors to consider, such as transaction fees, security features, and customer support. Real-life case studies illustrate successful partnerships between businesses and high-risk PSPs.

Regulatory Landscape in India

The regulatory environment significantly impacts high-risk PSPs. Compliance requirements, licensing, and ongoing changes in regulations can influence the choice of a payment service provider. This section provides insights into the current regulatory landscape in India and its implications for high-risk businesses.

Case Studies

Examining real-life examples is instrumental in understanding the practical benefits of high-risk PSPs. This section presents case studies of E-commerce businesses that successfully navigated challenges with the support of their chosen high-risk PSPs, offering valuable insights for others.

Security Measures in High-Risk Transactions

Ensuring the security of online transactions is a top priority for high-risk businesses. The article explores advanced security measures like encryption and tokenization, highlighting their role in creating a secure payment environment.

Future Trends in High-Risk PSPs

The landscape of payment services is continually evolving. This section discusses emerging technologies and trends that are shaping the future of high-risk PSPs, providing a glimpse into what the industry may look like in the coming years.

Customer Feedback and Reviews

Customer feedback serves as a valuable resource for evaluating high-risk PSPs. The article emphasizes the importance of online reviews and ratings in gauging the reliability and effectiveness of payment service providers catering to high-risk businesses.

Conclusion

In conclusion, High Risk PSP E-commerce Payment Services in India are indispensable for businesses facing elevated risks. As the E-commerce market thrives, the role of high-risk PSPs becomes more pronounced. By understanding their unique challenges, benefits, and staying abreast of the regulatory landscape, businesses can make informed decisions to foster growth and sustainability.

FAQs

- What defines a high-risk E-commerce business?

- Explanation of factors contributing to the high-risk classification.

- How do high-risk PSPs mitigate fraud?

- Insights into the fraud prevention measures adopted by high-risk PSPs.

- Are there specific industries that commonly require high-risk PSPs?

- Listing industries that often fall into the high-risk category.

- What should E-commerce merchants prioritize when choosing a high-risk PSP?

- Key factors to consider during the selection process.

- How do regulatory changes impact high-risk PSPs in India?

- Understanding the implications of evolving regulations on payment service providers.