AUTHOR : RIVA BLACKLEY

DATE : 13/12/2023

Introduction

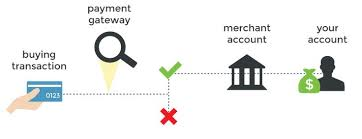

In the dynamic landscape of digital, online payment providers have become the backbone of financial transactions in India. With the ever-growing reliance on digital platforms, the need for seamless, secure, and efficient payment solutions has never been more critical. This article explores the evolution, major players, features, benefits, challenges, and future trends of online payment providers in India.

Evolution of Online Payment Providers

In the nascent stages, online payment providers faced numerous challenges, including skepticism regarding security and user adoption. However, technological advancements, coupled with the surge in smartphone usage, paved the way for the widespread acceptance of digital transactions.

Major Online Payment Providers in India

Features and Services

Several key players dominate the Indian online payment landscape. Paytm, PhonePe, Google Pay, and Razorpay stand out, each offering unique features and services to cater to diverse user needs. Online payment providers offer a range of features, ensuring secure transactions, versatile mobile wallet options, and seamless integration with e-commerce platforms. Additionally, enticing rewards and cashback programs enhance user engagement.

Benefits for Businesses

Businesses, too, reap the rewards of integrating online payment[1]. Enhanced customer trust, streamlined payment processes, and the ability to facilitate global transaction s contribute to the growing popularity of these services.

Challenges and Solutions

Future Trends

Despite their advantages ,Online Payment Companies[2] face challenges such as security concerns, technological glitches, and regulatory compliance issues. The industry responds with innovative solutions to maintain user trust and compliance. Looking ahead, the article delves into emerging trends, including the rise of contactless payments, blockchain applications, and the integration of artificial intelligence in the online payment landscape.

User Experience and Reviews

Comparison of Online Payment Providers

Real user experiences and reviews play a crucial role in understanding the effectiveness of online payment providers. E-commerce payment system[3] Testimonials, ratings, and reviews on popular platforms provide insights into user satisfaction. A detailed comparison helps users make informed choices based on fee structures, user interface, and customer support. Understanding these aspects is vital for selecting the most suitable provider.

Tips for Choosing an Online Payment Provider

Impact of Online Payment Providers on Society

To guide users in their selection process, the article provides tips on evaluating security features, integration options, and cost-effectiveness when choosing an online Payment processor[4] provider. Beyond individual transactions, online payment providers contribute to societal changes, promoting financial inclusion and supporting cashless economy initiatives.

Case Studies

Expert Opinions

Examining successful implementation stories and learning from failures through case studies offers valuable insights for both providers and users. The article features interviews with industry experts who share their perspectives on the current state and future developments in the online Payment system[5] sector.

User Experience and Reviews

Understanding the user experience is crucial in assessing the effectiveness of online payment providers. Real-world testimonials, ratings, and reviews on popular platforms offer a glimpse into the satisfaction levels of users. Positive feedback often highlights the seamless nature of transactions, quick payment processing, and the convenience of mobile wallet features.

Comparison of Online Payment Providers

To make an informed decision, users need to compare different online payment providers. This involves evaluating fee structures, user interfaces, and the quality of customer support. Some providers might offer lower transaction fees, while others excel in user-friendly interfaces. The decision ultimately hinges on personal inclinations and priorities.

Conclusion

In conclusion, online payment providers have revolutionized financial transactions in India. From overcoming challenges to providing innovative solutions, the industry continues to evolve. As we look ahead, the future promises even more advancements, solidifying the role of online payment providers in shaping the digital economy.

FAQS

- Are online payment providers safe to use in India?

- Yes, reputable online payment providers use advanced security measures to ensure the safety of transactions.

- How do online payment providers benefit businesses?

- Businesses benefit from increased customer trust, streamlined payment processes, and the ability to facilitate global transactions.

- What factors should I consider when choosing an online payment provider?

- Consider security features, integration options, and cost-effectiveness when selecting a provider.

- What lies ahead for the future of online payments in India?

- The future includes the rise of contactless payments, blockchain applications, and increased use of artificial intelligence.

- Where can I find user reviews for online payment providers?

- User reviews can be found on popular platforms and the official websites of online payment providers.