AUTHOR : RUBBY PATEL

DATE : 14/12/23

Introduction

In the fast-paced digital era, the landscape of financial transactions has undergone a revolutionary transformation. Digital payment solutions have become an integral part of the Indian economy, reshaping the way individuals and businesses conduct transactions. The convenience and efficiency offered by these solutions have propelled the growth of the payment gateway industry in India.

Evolution of Payment Gateways

The evolution of payment gateways is a fascinating journey marked by technological innovations. From traditional methods to the current sophisticated platforms, the progression has been relentless. Technological advancements, including robust security features and seamless integration capabilities, have played a pivotal role in shaping the present day payment gateway landscape.

Key Features of Payment Gateways

Security is paramount in the digital payment realm. Payment gateways boast advanced security measures, ensuring that every transaction is safeguarded against potential threats. Moreover, user-friendly interfaces make these gateways accessible to a broad audience, while their integration capabilities enable seamless transactions across various platforms.

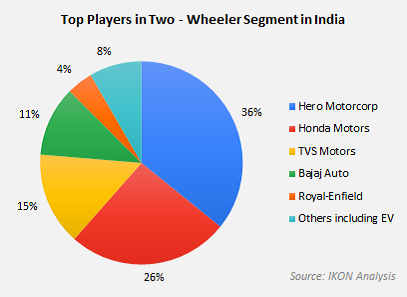

Major Players in the Indian Market

A diverse array of Payment Gateway Comparison[1] for supremacy in the Indian market. Analyzing the strengths and weaknesses of these major players provides valuable insights into the dynamics of the industry. Understanding market share and competition helps both consumers and businesses make informed choices.

Challenges Faced by Payment Gateways

Despite their widespread use, international payment gateways[2] encounter challenges such as security concerns, regulatory hurdles, and technological issues. Addressing these challenges is crucial for ensuring the continued growth and reliability of digital payment solutions.

Digital Payment Trends in India

The rise of mobile wallets, the widespread adoption of UPI, and the increasing popularity of contactless payments are shaping the digital payment landscape in India[3]. These trends reflect the dynamic preferences of consumers and highlight the need for adaptive technologies.

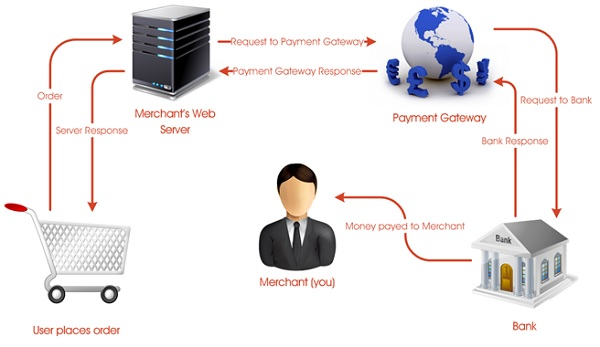

Role of Payment Gateways in E-Commerce

In the realm of e-commerce, payment gateways[4] play a pivotal role in facilitating seamless transactions. The trust and satisfaction of customers hinge on the efficiency and reliability of these gateways, making them an indispensable component of the online shopping experience.

Benefits of Digital Payments for Businesses

Digital payments offer a myriad of benefits for businesses. From cost-effectiveness to increased sales and enhanced customer experience, the advantages are substantial. Embracing digital payment solutions is not just a technological upgrade but a strategic move for businesses aiming for sustained growth.

Security Measures in Digital Transactions

Ensuring the security of digital transactions involves[5] the implementation of robust measures such as encryption technologies, two-factor authentication, and fraud prevention mechanisms. These measures collectively create a secure environment, instilling confidence in users to embrace digital payments.

Government Initiatives and Policies

Government support and regulatory frameworks play a vital role in shaping the landscape of digital payments. Initiatives aimed at promoting digital transactions and creating a conducive environment for innovation contribute significantly to the growth of the payment gateway industry.

Future Outlook of Digital Payment Solutions in India

The future of digital payment solutions in India is exciting, with emerging technologies set to redefine the landscape. As consumer behaviors continue to evolve, the adaptability of payment gateways to these changes will be crucial in sustaining their relevance and effectiveness.

Comparison with Global Trends

Positioning India in the global context of digital payment trends provides valuable insights. Understanding global experiences and trends can offer lessons that can be applied to further enhance the efficiency and adoption of digital payment solutions in India.

Adoption Challenges and Solutions

While the adoption of digital payment solutions is on the rise, challenges such as educating the masses and promoting digital literacy persist. Addressing these challenges requires collaborative efforts from industry stakeholders, government bodies, and educational institutions.

Case Studies of Successful Implementations

Examining real-world examples of successful implementations of digital payment solutions provides a practical understanding of their impact on businesses and consumers. Case studies showcase the transformative power of digital payments in various sectors.

Conclusion

In conclusion, the journey of digital payment solutions in India has been marked by innovation, challenges, and unprecedented growth. The industry’s ability to address challenges, embrace emerging technologies, and adapt to evolving consumer behaviors will determine its future trajectory. As India continues to march towards a digital economy, the role of payment gateways remains central in facilitating secure and efficient financial transactions.

FAQs

- Are digital payment solutions safe for online transactions?

- Answer: Yes, digital payment solutions employ advanced security measures such as encryption and two-factor authentication to ensure the safety of online transactions.

- How do payment gateways contribute to the growth of e-commerce?

- Answer: Payment gateways facilitate seamless transactions in e-commerce, enhancing the overall customer experience and fostering trust.

- What initiatives has the government taken to promote digital payments?

- Answer: The government has implemented various initiatives to promote digital payments, including regulatory frameworks, incentives, and campaigns to raise awareness.

- What are the key challenges faced by payment gateways in India?

- Answer: Payment gateways face challenges such as security concerns, regulatory hurdles, and the need for continuous technological innovation.

- How can businesses benefit from embracing digital payment solutions?

- Answer: Businesses can benefit from digital payment solutions through cost-effectiveness, increased sales, and improved customer experience.