AUTHOR:HAZEL DSOUZA

DATE:14/12/2023

Introduction

In the dynamic realm of e-commerce, payment gateways play a pivotal role in facilitating secure and efficient online transactions. The integration of these gateways into websites[1] and applications ensures[4] a smooth payment process, enhancing[2] the overall user experience.

Popular Payment Gateways in India

Razor pay

Razor pay has emerged as a frontrunner, known for its user-friendly[3] interface and robust security features. Its wide range of payment options[5] caters to diverse business needs.

Paytm

A household name in India, Paytm offers a versatile payment gateway with features like QR code payments and seamless wallet integration.

Intramuros

Ideal for small businesses, Intramuros provides a hassle-free payment gateway solution, empowering entrepreneurs to accept payments effortlessly.

CCAvenue

With a strong presence in the market, Caviuna offers a comprehensive suite of payment services, ensuring a secure and reliable payment process.

Advantages of Payment Gateway Integration

Seamless transactions

The integration of payment gateways ensures that transactions occur swiftly, reducing the risk of abandoned carts and enhancing customer satisfaction.

Enhanced security

Security is paramount[1] in online transactions. Payment gateways employ advanced encryption methods, safeguarding sensitive customer information.

Multiple payment options

Diversifying payment options increases customer convenience[2], leading to higher conversion rates and customer loyalty. Real-time payment tracking

Businesses can monitor transactions in real-time, gaining valuable insights into their cash flow and financial health.

Steps for Payment Gateway Integration

Choose the right payment gateway

Selecting a payment gateway[3] that aligns with your business needs is crucial. When choosing a payment processor, think about the price tag (transaction fees), the dance floor (supported payment methods), and the compatibility groove.

Obtain API keys

API keys are essential for integrating the payment gateway into your website. Ensure secure storage and transmission of these keys to prevent unauthorized[4] access.

Implement the gateway into your website

Collaborate with your development team to seamlessly integrate the chosen payment gateway. Test the integration thoroughly to identify and rectify any issues.

Test the integration thoroughly

Before going live, conduct extensive[5] testing to ensure that the payment gateway functions smoothly across various scenarios. Address any glitches promptly.

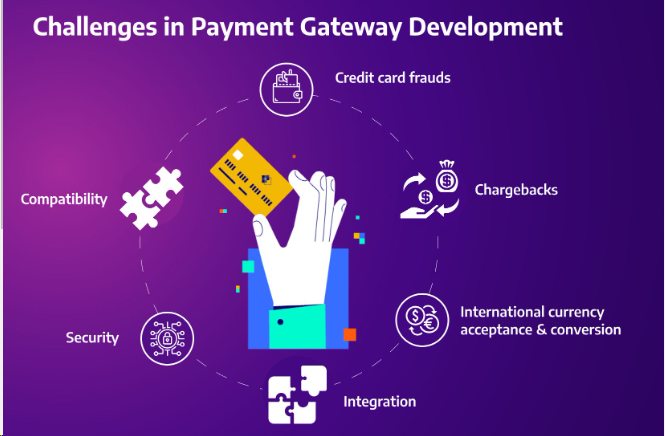

Challenges in Payment Gateway Integration

Technical complexities

Integration may pose technical challenges, requiring skilled developers to navigate and troubleshoot issues.

Security concerns

The handling of sensitive customer data necessitates stringent security measures to prevent data breaches and fraud.

Compatibility issues

Ensuring compatibility with different platforms and devices is crucial for a seamless user experience.

How to Overcome Integration Challenges

Hire professional developers

Investing in experienced developers can streamline the integration process and address technical challenges effectively.

Regular security audits

Conduct regular security audits to identify and rectify vulnerabilities, ensuring the ongoing safety of customer data.

Stay updated with technology trends

Staying informed about technological advancements helps businesses adapt to evolving integration requirements.

Case Studies: Successful Payment Gateway Integration Stories

E-commerce success stories

Explore how e-commerce businesses have thrived after implementing efficient payment gateway solutions, increasing sales and customer trust.

Small business transformations

Witness the positive impact of payment gateway integration on small businesses, empowering them to compete in the digital market.

Future Trends in Payment Gateway Integration

Biometric authentication

The future holds promise for biometric authentication, providing an additional layer of security for online transactions.

Blockchain technology

Blockchain technology is poised to revolutionize payment gateways, offering enhanced transparency and security.

Enhanced user experience

As technology evolves, payment gateways will focus on delivering a more user-friendly and personalized experience.

Tips for Selecting the Right Payment Gateway for Your Business

Consider transaction fees

Evaluate the transaction fees associated with each payment gateway, keeping in mind your business’s budget and financial goals.

Compatibility with your platform

Ensure that the chosen payment gateway is compatible with your website or application, minimizing technical issues.

Customer support and reviews

Opt for payment gateways with responsive customer support and positive reviews, indicating reliability and customer satisfaction.

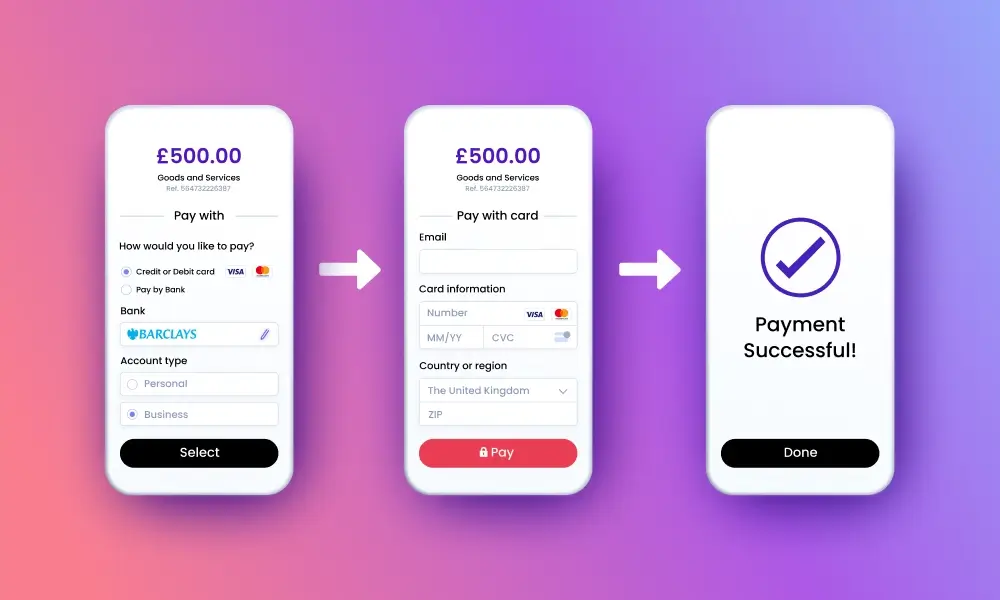

Importance of Mobile-Friendly Payment Gateways

Rise in mobile transactions

The surge in mobile transactions emphasizes the need for payment gateways optimized for mobile devices.

User preferences for mobile payments

Adapting to user preferences for mobile payments enhances the accessibility and convenience of your payment gateway.

The Impact of Payment Gateway Integration on Conversion Rates

Simplifying the checkout process

A streamlined checkout process encourages users to complete transactions, positively impacting conversion rates.

Building customer trust

A secure and efficient payment gateway builds trust, fostering repeat business and positive word-of-mouth.

Regulatory Compliance in Payment Gateway Integration

RBI guidelines in India

Adhering to Reserve Bank of India (RBI) guidelines is imperative for legal compliance and the seamless operation of payment gateways.

Data protection laws

Compliance with data protection laws ensures the ethical handling of customer information, building trust and credibility.

Conclusion

In the ever-evolving landscape of digital transactions, payment gateway integration stands as a crucial element for businesses aiming to thrive in the online market. By selecting the right payment gateway, overcoming integration challenges, and staying abreast of future trends.

Frequently Asked Questions (FAQs)

Q: What is the significance of payment gateway integration for small businesses? A: Payment gateway integration empowers small businesses to accept online payments, expanding their reach and competitiveness in the digital market.

Q: How can businesses ensure the security of customer data during payment gateway integration? A: Regular security audits, encryption protocols, and adherence to data protection laws are essential for safeguarding customer data.

Q: Are there any regulatory guidelines businesses need to follow for payment gateway integration in India? A: Yes, businesses must adhere to Reserve Bank of India (RBI) guidelines to ensure legal compliance and smooth operation.

Q: What are the future trends in payment gateway integration? A: Future trends include the adoption of biometric authentication, blockchain technology, and a focus on enhancing user experience.

Q: How can businesses choose the right payment gateway for their specific needs? A: Consider factors such as transaction fees, security features, compatibility, and customer support when selecting a payment gateway.