AUTHOR : KHOKHO

DATE: 14/12/2023

Introduction

The world of e-commerce has witnessed a revolutionary transformation with the advent of payment gateways. These digital solutions play a pivotal role in accelerating secure and seamless online transactions In this article, we’ll delve into the landscape of payment gateway services in India, inspect their evolution, key features, popular services, working mechanisms, benefits challenges, and the future trends shaping the industry.

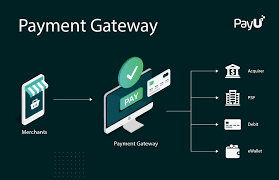

In the dynamic realm of online transactions, payment gateway serves as the bridge between a customer’s purchase and the merchant’s bank. It ensures that sensitive financial information is transmitted securely, fostering trust and convenience in the e-commerce ecosystem. As businesses increasingly embrace digital platforms, the significance of robust payment gateway services becomes paramount.

Evolution of Payment Gateways

Historical Overview

The journey of payment gateways traces back to the early days of online shopping, when security concerns prompted the need for encrypted payment systems. Over the years, technological advancements have propelled these gateways to become sophisticated, offering a myriad of features beyond simple transaction facilitation.

Technological Advancements

The integration of cutting-edge technologies like blockchain and artificial intelligence has further enhanced the capabilities payment gateways[1]. These innovations not only bolster security measures but also contribute to the speed and efficiency of financial transactions.

Key Features of Payment Gateways

Security Measures

Security stands as the cornerstone of any reliable payment gateway. From robust encryption protocols to two-factor authentication, modern gateways employ a multi-layered approach to safeguard sensitive customer data.

Compatibility with Various Payment Methods

A versatile payment gateway in India[2] should seamlessly accommodate various payment methods, including credit/debit cards, digital wallets, and UPI. The flexibility inherent in this characteristic guarantees that enterprises can accommodate a wide-ranging clientele, contributing to a diverse customer base.

Popular Payment Gateway Services in India

India, with its thriving online commerce market, boasts several respected payment gateway services. Notable names include Paytm, Razorpay, and Instamojo, each offering unique features and competitive advantages for businesses.

How Payment Gateways Work

Understanding the intricacies of payment gateway operations is crucial for both merchants and customers. The transaction flow, encryption, and decryption processes form the spine of secure and swift online payments.

Benefits of Using Payment Gateways

Convenience for Customers

Customers appreciate the ease and speed of transactions accelerated by payment gateways. The ability to make Acquire with a few clicks enhances the overall shopping experience.

Enhanced Security for Transactions

The encryption protocols and authentication measures enforced by payment gateways instill confidence among customers, addressing concerns related to fraud and unlawful access.

Challenges and Solutions

Security Concerns

While payment gateways prioritize security, challenges such as manipulation attacks and data violations persist. Continuous upgrades in security protocols are necessary to stay one step ahead of cyber threats.

Technical Glitches

Instances of transaction failures and technical problems can tarnish the reputation of payment gateways. Swift and transparent resolution mechanisms are crucial to sustaining customer trust.

Future Trends in Payment Gateways

Integration with Emerging Technologies

The future holds exciting possibilities as payment entrance integrates with emerging technologies like blockchain for enhanced transparency and decentralized finance (DeFi) for increased financial thoroughness

Enhanced User Experience

User experience will be a focal point for payment gateway providers, with emphasis on intuitive interfaces, faster processing times, and personal features.

Opting for the most suitable payment gateway for your business is a critical decision that requires thoughtful consideration and a tailored approach

Factors to Consider

Businesses must evaluate factors such as transaction fees, security features, and customer support when selecting a payment gateway. Case studies Accent successful implementations can guide decision-making.

Impact of Payment Gateways on E-commerce Growth in India

Statistical Insights

Data Cogitative the correlation between the adoption of robust payment entrance[3] and the growth of e-commerce in India emphasizes the pivotal role these services play in shaping the digital economy.

Success Stories

Examining success stories of businesses that have thrived due to effective exercise of payment access provides valuable insights for aspiring entrepreneurs.

Tips for Secure Transactions

Best Practices for Customers

Customers can contribute to secure transactions by regularly updating passwords, monitoring account activity, and being cautious about phishing attempts.

Merchant Guidelines

Merchants should adhere to industry best practices, conduct regular security audits, and stay informed about the latest threats to fortify their payment gateway integration.

Mobile Payment Gateways

Rise in Mobile Transactions

The increasing prevalence of mobile transactions underscores the importance of mobile-compatible payment access, ensuring a seamless experience for users on smartphones and tablets.

Advantages and Disadvantages

While mobile payment(4) access offers unparalleled convenience, businesses must weigh the advantages against potential drawbacks like security concerns and device compatibility issues.

Comparison of Payment Gateway Services

Fees and Charges

A comparison of fees and charges associated with different payment gateway(5) services enables businesses to make informed decisions aligned with their financial goals.

User Ratings and Reviews

User ratings and reviews provide valuable insights into the real-world experiences of businesses and customers, helping prospective users assess the reliability and performance of payment access

Regulatory Framework for Payment Gateways in India

Conclusion

In conclusion, payment gateway services in India have evolved into essential tools for businesses navigating the digital landscape. From ensuring secure transactions to fostering e-commerce growth, these access play acomplicated role in

Frequently Asked Questions (FAQs)

- Q: Are payment access safe for online transactions?

- A: Yes, payment access employs advanced security measures like cipher and two-factor verification to ensure the safety of online transactions.

- Q: How do I choose the right payment gateway for my business?

- A: Consider factors such as transaction fees, security features, and customer support. Case studies of successful implementations can also guide your decision.

- Q: What is the future of payment access in India?

- A: The future involves integration with emerging technologies, enhanced user experiences, and a pivotal role in shaping the digital economy.

- Q: Are mobile payment access secure?

- While convenient, businesses should be mindful of potential security concerns and device compatibility issues when using mobile payment access.

- Q: How do regulatory authorities contribute to payment gateway services?

- A: Regulatory authorities establish norms and standards, ensuring compliance and contributing to a secure and transparent financial ecosystem.