AUTHOR : SELENA GIL

DATE : 15/12/2023

Introduction

In the digital age, payment gateways have become the chief support of online transactions, facilitating the secure transfer of buyers and sellers. Payment Gateway Payment Processing Companies in India In India, the realm of payment processing has witnessed a remarkable evolution, with several companies emerging as key players in this domain.

Importance of Payment Processing Companies

The seamless functioning of payment gateways is crucial for businesses to thrive in the digital landscape. These gateways enable swift and secure monetary transactions, Payment Gateway Payment Processing Companies in India fostering trust and convenience among consumers and merchants alike.

Evolution of Payment Gateways in India

The journey of payment gateways in India has been marked by significant technological advancements and regulatory changes. From traditional Transaction Processing Gateway methods to innovative solutions, the landscape has evolved to cater to diverse consumer needs.

Top Payment Gateway Companies in India

Overview of Each Company

Several leading payment processing companies Payment Gateway Integrators dominate the Payment Gateway Payment Processing Companies in India Indian market, including Paytm, Razorpay, and CCAvenue. Each entity boasts distinct features, catering to various business sizes and industries.

Services Offered

Market Position

These companies offer a spectrum of services, including seamless payment integration, diverse payment modes, and advanced security measures to safeguard transactions. Analyzing the market standing of these companies provides insights into their user base, transaction volume, and technological advancements.

Factors to Consider When Choosing a Payment Gateway

When selecting a payment gateway, various factors warrant consideration. Security features, transaction fees, and ease of integration are pivotal aspects influencing a merchant’s decision.

Security Features

Transaction Fees

Robust encryption protocols and fraud prevention mechanisms are imperative to ensure secure transactions and protect sensitive customer data. Understanding the fee structure, including setup costs, transaction fees, and recurring charges, is essential for businesses to manage costs effectively.

Integration Ease

Challenges Faced by Payment Processing Companies

The ease of integrating the payment gateway into existing systems and platforms significantly impacts operational efficiency. Despite their advancements, payment gateways encounter challenges such as cybersecurity threats, regulatory compliance, and technological disruptions that necessitate continual adaptation.

Role of Payment Gateways in E-commerce Growth

The symbiotic relationship between payment gateways and Payment Gateway Payment Processing Companies in India e-commerce growth is undeniable. These gateways facilitate a seamless customer experience, thereby fostering the expansion of online businesses.

Future Trends in Payment Gateway Industry

The future of payment gateways Transaction Processing Companies[1] in India looks promising, with trends indicating increased adoption of mobile wallets, AI-powered fraud detection, and enhanced user experiences.

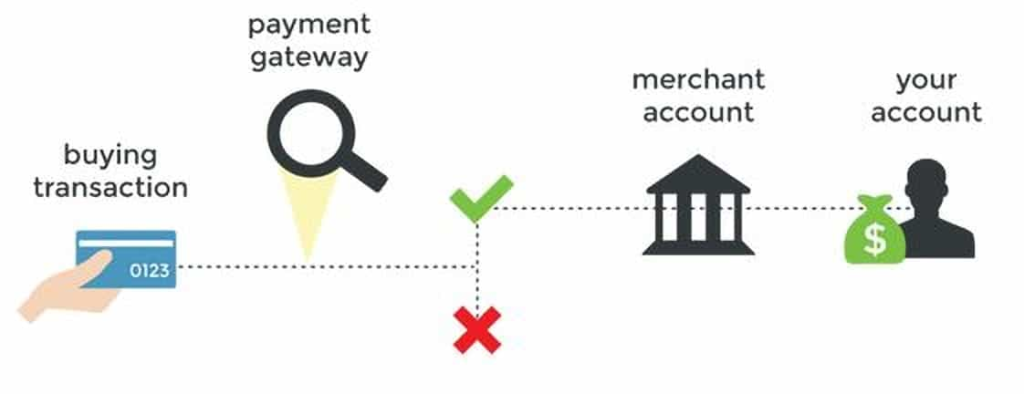

Understanding Payment Gateways

Payment gateways act as intermediaries between merchants and customers, ensuring secure transactions for online purchases. These gateways encrypt sensitive information, like credit card Payment Service Providers (PSPs)[2] details, making online transactions safe and convenient. In India, the evolution of these gateways has been instrumental in driving the digital economy’s growth.

Significance of Payment Processing Companies

The rise of e-commerce Payment Processing Solutions[3] and digital transactions has amplified the importance of payment processing companies. They streamline the payment process, offering various solutions to meet the needs of diverse businesses. Their services range from enabling online payments to managing recurring billing cycles, catering to both large enterprises and small businesses.

Leading Players in India’s Payment Gateway Arena

India boasts several prominent payment processing companies, each with its unique offerings. Companies like Paytm, Razorpay, and CCAvenue have gained substantial traction due to their user-friendly interfaces, extensive reach, Online Payment Processors[4] and innovative features.

Services Provided by Payment Gateway Companies

These entities offer a spectrum of services, including:

- Payment Integration: Seamless integration with websites and applications.

- Multiple Payment Modes: Support for various payment methods like credit/debit cards, net banking, UPI, and mobile wallets.

- Security Measures: Advanced encryption and fraud detection tools ensuring secure transactions

Factors Influencing Choice of Payment Gateway

For businesses selecting a payment gateway, several factors play a pivotal role:

- Stringent measures for safeguarding sensitive information are embedded within our security protocols to ensure robust protection

- Transaction Costs: Understanding transaction fees, setup charges, and recurring costs.

- Integration Ease: Compatibility Payment Aggregators[5] with existing systems for smooth operations.

Conclusion

Payment gateways and processing companies in India play a pivotal role in shaping the digital economy. Their evolution, services, challenges, and future trends collectively contribute to the dynamic landscape of online transactions.

FAQs

- What is a payment gateway? A payment gateway is a technology that facilitates online transactions by securely transferring funds between buyers and sellers.

- What steps should I take to identify the ideal payment gateway that perfectly suits the needs of my business model? Consider factors such as security features, transaction fees, and integration ease to select a suitable payment gateway for your business needs.

- Which payment gateway company is best for small businesses? Companies like Razorpay and PayU offer user-friendly solutions suitable for small businesses due to their ease of integration and competitive pricing.

- What are the key security measures in payment gateways? Encryption protocols, tokenization, and robust fraud detection mechanisms are crucial security measures in payment gateways.

- How are payment gateways contributing to e-commerce growth in India? Payment gateways enable seamless transactions, thereby enhancing the overall customer experience and driving the growth of e-commerce in India.