AUTHOR:HAZEL DSOUZA

DATE:15/12/2023

Introduction

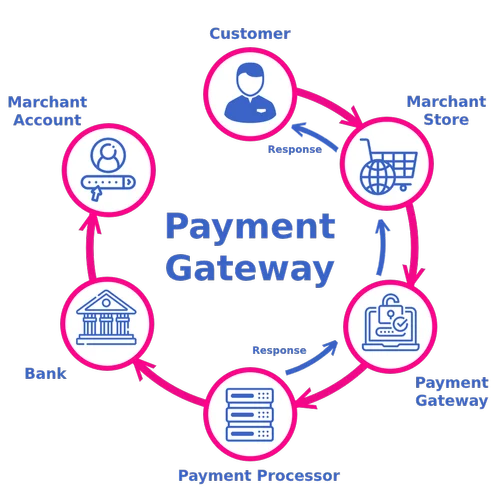

In the ever-evolving landscape of digital transactions, Payment Gateway Security Measures in India ensuring the security of payment gateways has become paramount. As India witnesses a surge in online transactions, the need for robust security measures has never been more critical. The rapid growth of online transactions in India has brought Secure Payment Processing Solutions convenience but also heightened the risk of cyber threats. Payment Gateway Security Measures in India As more users engage in digital payments, understanding the security measures in place becomes crucial.

Evolution of Payment Gateway Security

Historical Perspective

Technological Advancements and Challenges

In the early days of online transactions, Fraud Prevention for Online Payments Measures in India security concerns were relatively modest. However, with the advent of sophisticated cyber threats, the landscape evolved, prompting a paradigm shift in security measures. As technology progressed, so did the challenges. The integration of artificial intelligence and machine learning in cyber attacks necessitated a proactive approach to stay ahead in the security game.

Key Security Features

Encryption Protocols

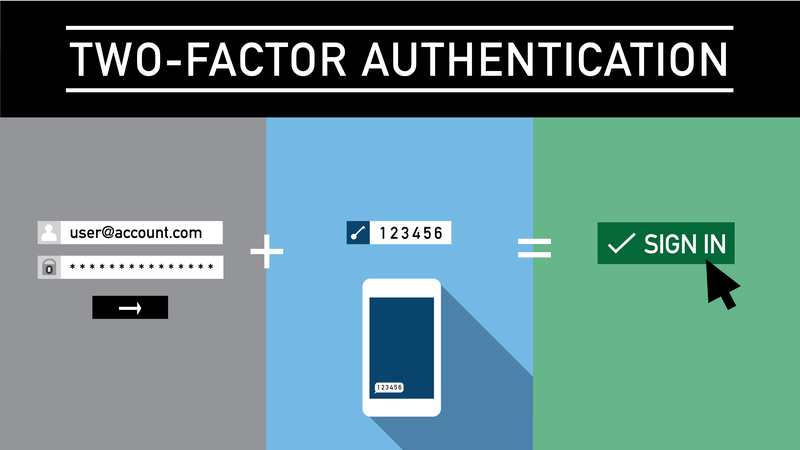

Two-Factor Authentication

Implementing state-of-the-art encryption protocols is the first line of defense against unauthorized access. The use of advanced cryptographic algorithms ensures the confidentiality and integrity of sensitive data. Adding an extra layer of authentication significantly enhances security. Two-factor authentication, combining something the user knows (password) with something they possess (authentication token), is a widely adopted practice.

Regulatory Framework in India

RBI Guidelines

The Reserve Bank Digital Transaction[1] Security Protocols of India (RBI) plays a pivotal role in shaping the security landscape. Strict guidelines are in place to ensure that payment gateways adhere to stringent security standards Payment Gateway Security Measures in India.

Compliance Requirements for Payment Gateways

Adhering to regulations isn’t just a must-do; it’s a smart move for your strategy. Payment gateways must navigate a complex web of regulations Data Protection in Payment Gateways[2] to ensure the seamless flow of transactions within the legal framework.

Threat Landscape

Common Cyber Threats

From phishing attacks to ransomware, payment gateways face an array of cyber threats. Understanding the common tactics employed by cybercriminals Cybersecurity for E-Commerce Payments[3] is crucial for developing effective countermeasures Payment Gateway Security Measures in India.

Trends Specific to the Indian Market

The Indian market presents unique challenges, with localized cyber threats and evolving tactics. Staying abreast of these trends is essential for tailoring security measures to the specific needs of the Indian digital landscape.

Case Studies

Noteworthy Security Breaches

Lessons Learned and Preventive Measures

Examining past security breaches provides valuable insights. High-profile incidents serve as cautionary tales, highlighting vulnerabilities Secure Payment Authentication[4] Methods that must be addressed. Analysing the aftermath of security breaches allows us to identify gaps in existing security measures and implement preventive strategies Payment Gateway Security Measures in India.

Best Practices for Merchants

Regular Security Audits and Updates

Developers play a crucial role in fortifying payment gateways. Adhering to secure coding practices ensures that vulnerabilities are minimized from the ground up. Security is an ongoing process. Regular audits and updates are necessary to identify and patch vulnerabilities promptly.

Future Trends

Emerging Technologies in Payment Security

Anticipated Regulatory Changes

The future holds promises of innovative security technologies, from biometric authentication India Digital Payment[5] Safety Practices to blockchain integration. As the digital landscape evolves, so will regulations. Anticipating and adapting to regulatory changes is essential for long-term security planning.

Customer Confidence and Trust

Impact of Security on User Confidence

Users are more likely to engage in online transactions if they have confidence in the security measures in place. Building and maintaining this confidence is a continuous effort.

Building Trust Through Transparent Security Measures

Balancing Security and User Experience

Transparency in communication regarding security measures fosters trust. Users appreciate knowing how their data is protected and what measures are in place to ensure their safety. Striking the right balance between stringent security measures and a seamless user experience is a perpetual challenge. Innovative solutions are emerging to optimize security without causing friction in the transaction process. Finding the right mix is key to success.

Strategies for Optimizing Security Without Hindering Transactions

Industry Collaborations for Enhancing Security

Tackling online dangers is a team effort. Industry collaborations enable the sharing of best practices and intelligence to strengthen security across the board. Governments and financial institutions play a crucial role in shaping the security landscape through regulations and initiatives.

International Standards vs. Local Adaptations

Tailoring Security Measures to the Indian Context

While international standards provide a benchmark, adapting them to the local context is essential for effective implementation. Customizing security measures to align with the nuances of the Indian market ensures relevance and effectiveness.

Continuous Improvement

Learning From Incidents and Refining Security Protocols

The dynamic nature of cyber threats requires continuous adaptation. Implementing adaptive security strategies is essential for staying ahead. incident response is as critical as prevention. Learning from security incidents helps refine protocols and enhances overall security.

Conclusion

the landscape of payment gateway security in India is dynamic and challenging. With a proactive approach, collaborative efforts, and a commitment to continuous improvement, the industry can navigate these challenges successfully. The future holds exciting prospects for innovative security measures that will not only safeguard transactions but also enhance the overall user experience.

FAQs

- Q: How often should a payment gateway undergo a security audit?

- A: Regular security audits should be conducted at least annually, with more frequent assessments for high-traffic gateways.

- Q: What role do merchants play in ensuring payment gateway security?

- A: Merchants play a crucial role in implementing secure coding practices, educating employees, and adhering to compliance requirements.

- Q: How can users verify the security of a payment gateway before making transactions?

- A: Users should look for secure connection indicators (https://), check for two-factor authentication options, and review the gateway’s security certifications.

- Q: Are there specific security measures tailored for small businesses using payment gateways?

- A: Yes, small businesses should focus on secure payment integrations, employee training, and leveraging payment gateways with robust security features.

- Q: What should be the immediate steps taken in the event of a security breach?

- A: In the event of a security breach, immediate steps include isolating affected systems, notifying relevant authorities, and conducting a thorough investigation.