AUTHOR : RUBBY PATEL

DATE : 12/18/23

Introduction

In recent years, the landscape of financial transactions in India has undergone a significant transformation, Payment Processor Cashless Payment Options In India with a notable surge in the adoption of cashless payment options. As we navigate through the complexities of payment processors and their role in shaping the future of transactions, it’s crucial to understand the evolution of these systems.

Evolution of Payment Processors

The journey of payment processors in India dates back to the traditional methods of currency exchange. However, Payment Processor Cashless Payment Options In India the real revolution began with the advent of digital payment systems, marking a shift from physical cash transactions to the virtual realm.

Major Cashless Payment Players in India

Today, several companies play a pivotal role in driving the cashless payment culture in India. From industry giants to innovative startups, Payment Processor Cashless Payment Options In India each contributes uniquely to the diverse ecosystem. Let’s delve into a comparative analysis of some leading payment processors shaping the financial landscape.

Benefits of Cashless Payments

The advantages of cashless payments extend beyond mere convenience. Payment Processor Cashless Payment Options In India For consumers, it means quick and hassle-free payment[1], while businesses benefit from streamlined financial processes. The efficiency of cashless systems has become a driving force behind their widespread adoption.

Challenges Faced by Payment Processors in India

Despite the evident advantages, payment processors face challenges in the Indian market. Security concerns and regulatory hurdles pose obstacles that need to be addressed for sustained growth[2] in the cashless payment sector.

Innovations in Cashless Payment Technologies

The continuous evolution of technology brings forth innovations in cashless payment options. Contactless payments and biometric authentication[3] are among the latest trends that enhance the security and efficiency of transactions.

Impact on Small Businesses

Government Initiatives and Policies

While large corporations readily embrace cashless payments, small businesses encounter unique challenges. Accessibility, affordability, and integration hurdles need strategic solutions to ensure that cashless transactions benefit businesses of all sizes. The Indian government plays a crucial role in steering the nation towards a cashless economy. Initiatives and policies designed to support digital payments and incentivize businesses contribute[4] significantly to this paradigm shift.

Consumer Adoption and Awareness

Understanding the shift in consumer behavior[5] is essential for the successful implementation of cashless payment systems. Educational initiatives play a pivotal role in increasing awareness and encouraging consumers to embrace digital transactions.

Future Trends in Cashless Payments

Security Measures in Cashless Transactions

As technology advances, the future of cashless payments holds exciting possibilities. Emerging technologies, such as blockchain and artificial intelligence, are poised to reshape the payment landscape, offering new avenues for innovation. Ensuring the security of cashless transactions is paramount. Encryption, secure gateways, and robust fraud prevention mechanisms are integral components of a trustworthy payment ecosystem.

Comparison with Global Payment Trends

India’s position in the global context of payment trends is a crucial aspect to consider. Learning from successful international models can provide valuable insights for further refining and expanding the Indian cashless payment infrastructure.

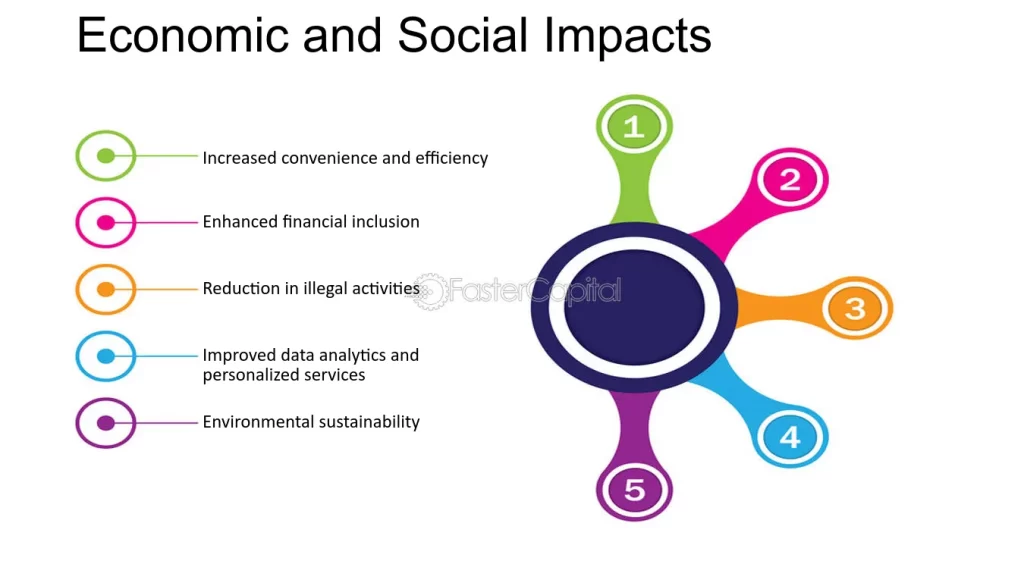

Social Impact of Cashless Payments

Beyond the financial realm, cashless payments contribute to social goals such as financial inclusion and reducing the digital divide. The accessibility of digital transactions has the potential to empower individuals and communities.

Case Studies: Payment Processor: Cashless Payment Options In India

Examining the success stories of businesses that have successfully embraced cashless payments sheds light on the practical challenges overcome and the tangible benefits reaped.

Conclusion

In conclusion, the journey of payment processors and cashless payment options in India reflects a dynamic and evolving landscape. While challenges exist, the potential benefits for consumers, businesses, and society as a whole make the transition to a cashless economy a compelling prospect.

FAQS

- Are cashless payments secure for everyday transactions?

- Absolutely. The use of encryption and secure gateways ensures the security of cashless transactions, making them as secure as traditional methods.

- How can small businesses overcome challenges in adopting cashless payments?

- Small businesses can overcome challenges through affordable and user-friendly cashless payment solutions, along with government support and incentives.

- What role does the government play in promoting cashless payments?

- The government plays a crucial role by introducing policies and initiatives that incentivize digital payments and create a supportive ecosystem.

- What are the future trends in cashless payments in India?

- Emerging technologies like blockchain and AI are expected to shape the future of cashless payments, offering more advanced and secure solutions.

- How do cashless payments contribute to financial inclusion?

- Cashless payments increase financial access, allowing individuals without traditional banking access to participate in the formal economy