AUTHOR : RIVA BLACKLEY

DATE : 14/12/2023

Introduction

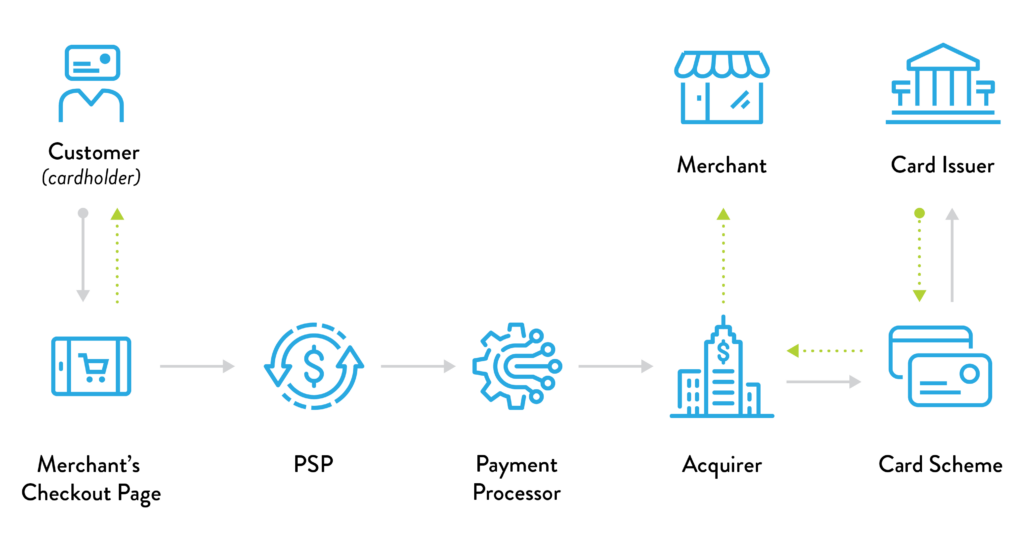

In the dynamic landscape of the Indian business ecosystem, the role of payment processors has become increasingly crucial. Payment processing companies play a pivotal role in facilitating seamless transactions, ensuring the smooth flow of funds in a secure and efficient manner.

Evolution of Payment Processing in India

Understanding the evolution of payment processing in India provides insights into the transformative journey of financial transactions. From traditional methods to embracing cutting-edge technologies, the Indian payment processing landscape has witnessed a remarkable shift.

Key Features of Payment Processing Companies

Security, speed, and integration capabilities are key features that distinguish payment processing companies. Robust security measures ensure the protection of sensitive data, while transaction speed and integration capabilities contribute to a streamlined payment experience.

Popular Payment Processing Companies in India

In the vast landscape of payment processors in India, notable companies such as Company A and Company B have carved their niche. Company A stands out for its diverse services and extensive clientele, while Company B boasts unique features and positive user reviews.

Emerging Trends in Payment Processing

The landscape is ever-evolving, with emerging trends like contactless payments, cryptocurrency integration, and the rise of mobile wallets reshaping how transactions are conducted in India.

Challenges and Solutions

Benefits of Utilizing Payment Processors

Despite the advancements, challenges such as security concerns and regulatory hurdles persist. Effective customer support and proactive solutions are imperative to address these challenges. Efficiency, global transactions, and enhanced customer experiences are among the myriad benefits that businesses can reap by incorporating reliable payment[1] processors into their operations.

Choosing the Right Payment Processor for Your Business

Case Study: Successful Implementation

Selecting the right payment methods[2] is a strategic decision that involves considering various factors. Real-world case studies provide valuable insights into successful implementations and the positive impacts on businesses. Payment processor Payment Processing Companies In India. The experience of Business X serves as a compelling case study, highlighting the seamless integration of a payment processor and the tangible results achieved in terms of efficiency and customer satisfaction.

Future Prospects of Payment Processing in India

With market projections pointing towards continued growth, the future of payment processing in India holds exciting possibilities. Innovations such as advanced security measures and novel transaction methods are on the horizon. Businesses of all sizes can reap numerous benefits by incorporating reliable online payment processing[3] into their operations. Let’s delve into the advantages that come with embracing these financial facilitators.

Efficiency at Its Core

One of the primary advantages of using payment processors is the enhanced efficiency they bring to financial transactions. Unlike traditional methods that may involve manual processing and delayed clearance, payment processors automate the entire payment cycle. This not only reduces the risk of errors but also accelerates the speed at which transactions are completed. Payment Processing Services[4] Payment Processing Companies In India.

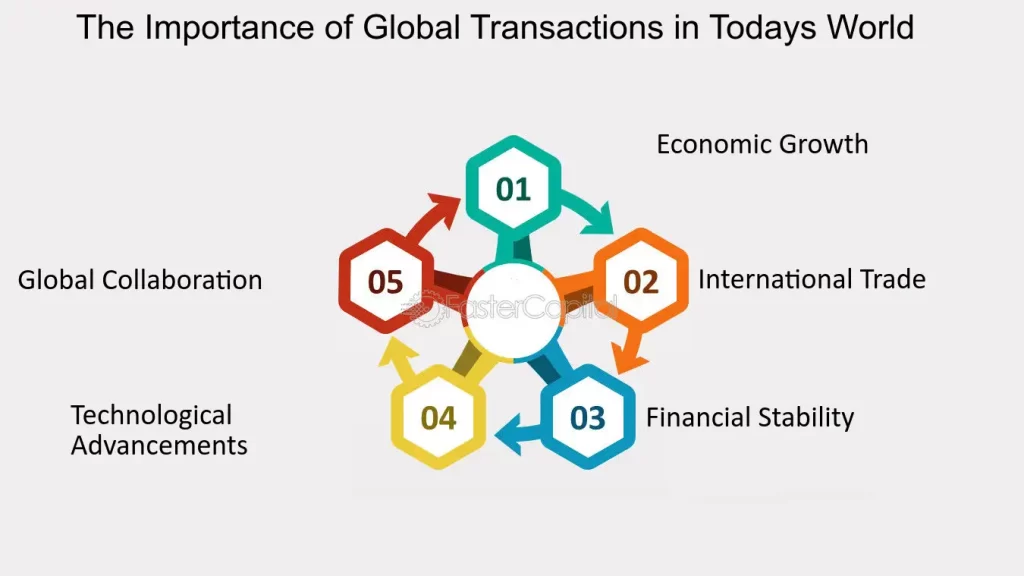

Global Transactions Made Easy

In an increasingly globalized world, businesses often engage in transactions with international partners and customers. Payment processors simplify this process by providing a seamless platform for cross-border payments. They handle currency conversions, ensuring that businesses can effortlessly transact with entities worldwide without the complexities associated with traditional banking systems.

Enhanced Customer Experience

Customer satisfaction is paramount in today’s competitive market, and payment processors contribute significantly to enhancing the overall customer experience. By offering various Digital Payment Methods[5]

, including credit card s, digital wallets, and other online payment methods, businesses cater to the diverse preferences of their customer base. This flexibility results in a positive perception of the brand and encourages repeat business.

Conclusion

In conclusion, payment processors have become indispensable in the Indian business landscape. Businesses that embrace secure and efficient payment processing solutions position themselves for success in a rapidly evolving digital economy.

FAQs

- Are payment processors safe for online transactions?

- Yes, reputable payment processors implement stringent security measures to safeguard transactions.

- What factors should businesses consider when choosing a payment processor?

- Consider transaction fees, security features, integration capabilities, and customer support.

- Can small businesses benefit from payment processors?

- Absolutely, payment processors offer scalable solutions suitable for businesses of all sizes.

- How do emerging trends like contactless payments impact businesses?

- They enhance customer convenience and contribute to a faster and more streamlined payment experience.

- Is cryptocurrency integration a viable option for businesses in India?

- It depends on the nature of the business; some industries find value in adopting cryptocurrency payments.