AUTHOR : RIVA BLACKLEY

DATE : 13/12/2023

Introduction

In the past few years, India has undergone a noteworthy evolution in its payment terrain, experiencing a significant transformation .Payment provider Cashless Payment Options In India. The shift from traditional cash transactions to cashless payment options has been both rapid and revolutionary. This article delves into the evolution of payment methods in India, emphasizing the growing prominence of cashless transactions.

Traditional Payment Methods

India, like many other countries, has a long history of relying on conventional payment methods such as cash and checks. However, these methods come with their own set of challenges, including security concerns and inefficiencies. As technology advances, the need for more efficient and secure payment options becomes evident. Payment provider Cashless Payment Options In India

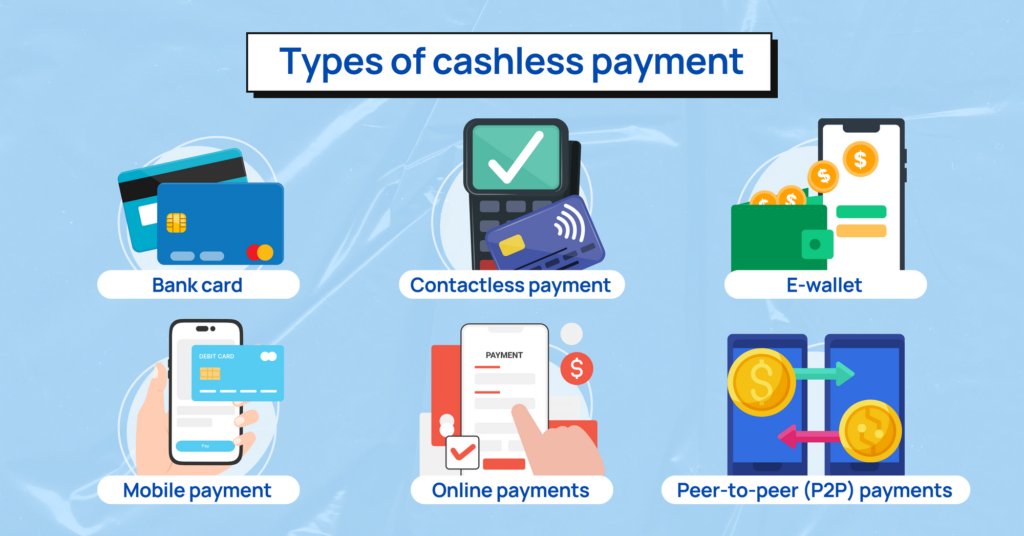

Rise of Cashless Payment Options

The rise of digital wallets and the widespread use of mobile banking have been pivotal in transforming the Payment service provider[1] landscape. Digital wallets, in particular, offer users a convenient and secure way to make transactions, eliminating the need for physical currency. Mobile banking has further extended the reach of cashless payments, making financial transactions accessible at the fingertips of millions.

Key Players in the Indian Cashless Payment Market

Several key players dominate the Indian cashless Digital Payment[2] Methods market. From well-established banking institutions to innovative fintech startups, each contributes to the diversity and competitiveness of the market. Understanding the influence and market share of these players is crucial for navigating the cashless payment landscape.

Advantages of Cashless Payments

The adoption of Cashless society[3] options comes with numerous advantages. Users benefit from the convenience of making transactions anytime, anywhere, and the enhanced security measures reduce the risk of fraud and theft. The seamless integration of digital wallets into everyday life has significantly improved the overall user experience.

Challenges and Concerns

Despite the advantages, there are challenges and concerns associated with the widespread adoption of cashless payments. Payment Gateways in India[4] Issues of privacy and data security are at the forefront, as users become more conscious of the information they share online. Additionally, there are still segments of the population facing challenges related to awareness and accessibility.

Government Initiatives

Recognizing the potential benefits of a cashless economy[5], the Indian government has implemented various initiatives to promote digital transactions. Policies and incentives aimed at both consumers and businesses have played a crucial role in shaping the current payment landscape.

Future Trends

The future of cashless payments in India holds exciting possibilities. Technological advancements, including the integration of artificial intelligence and blockchain, are expected to further enhance the efficiency and security of transactions. Predicting these trends is essential for businesses and consumers alike to stay ahead in this dynamic landscape.

Case Studies

Examining successful case studies of businesses that have embraced cashless transactions provides valuable insights. From large corporations to small enterprises, understanding the strategies and challenges faced by these businesses can guide

others in their journey towards adopting cashless payment options.

Tips for Choosing a Payment Provider

Selecting the right payment provider is crucial for businesses and consumers alike. Factors such as security features, transaction[5] fees, and user experience play a pivotal role in the decision-making process. This section offers practical tips for individuals and businesses to consider when choosing a cashless payment service.

Conclusion

In conclusion, the evolution of payment methods in India towards cashless transactions marks a significant milestone. The advantages, challenges, and future trends discussed in this article underscore the transformative nature of this shift. As individuals and businesses embrace the digital era, the seamless integration of cashless payments into everyday life is set to redefine the way transactions are conducted.

FAQS

- Are cashless payments completely secure?

- Cashless payments come with robust security measures, but users should follow best practices such as using secure networks and regularly updating their payment apps.

- How can small businesses benefit from cashless transactions?

- Small businesses can benefit from cashless transactions by offering convenient payment options, reaching a wider customer base, and streamlining their financial processes.

- What government initiatives support cashless transactions?

- The government has introduced initiatives like Digital India and demonetization to encourage cashless transactions, offering incentives and creating a favorable environment.

- What role do digital wallets play in the cashless ecosystem?

- Digital wallets act as a virtual substitute for physical wallets, allowing users to store and transact money securely using their smartphones.

- How can consumers contribute to a cashless society?

- Consumers can contribute by embracing cashless payment options, staying informed about security measures, and promoting awareness in their communities.