AUTHOR : PUMPKIN KORE

DATE : 13/12/2023

Digital payment solutions in India have undergone a remarkable evolution, transforming the way transactions[1] are conducted in the country. From traditional cash transactions to the latest innovative payment technologies,[2] the landscape has witnessed significant changes. In this article, we delve into the intricacies of payment providers offering digital payment [3]solutions in India, exploring their evolution, advantages, challenges, and the broader impact on the financial ecosystem.[4]

Evolution of Digital Payment Solutions in India

The journey of digital payments in India dates back to the early forms of electronic fund transfers[5]. Initially, it involved online banking and credit/debit card transactions. However, with advancements in technology and the growing need for seamless transactions, the landscape saw a transition to more modern and efficient solutions.

Key Players in the Digital Payment Industry

Several prominent players dominate the digital payment[1] industry in India, each contributing to the ecosystem in unique ways. From established banks offering digital services to specialized digital wallet providers, the market is dynamic and competitive. Understanding the key players and their market share provides insights into the evolving industry[2].

Advantages of Digital Payment Solutions

The widespread adoption of digital payment solutions can be attributed to the numerous advantages they offer. The convenience[3] they bring to users, coupled with enhanced security features and the promotion of financial inclusion, has led to a significant shift from traditional payment methods.[4]

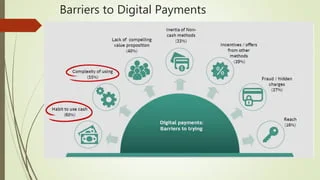

Challenges Faced by Digital Payment Providers

While the benefits are substantial, digital payment providers encounter challenges such as security concerns, technological [5]barriers, and navigating complex regulatory landscapes. Addressing these challenges is crucial for the sustained growth of digital payment solutions in India.

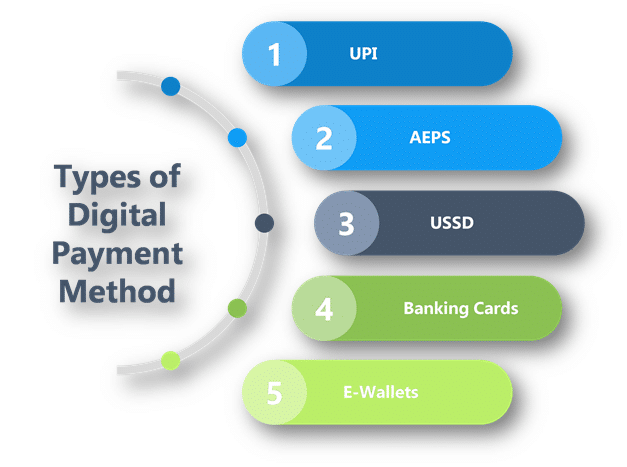

Innovations in Digital Payment Technologies

Innovations in digital payment technologies have played a pivotal role in shaping the industry. The introduction of UPI has revolutionized peer-to-peer transactions, while mobile wallets and contactless payment solutions offer alternatives to traditional methods.

Government Initiatives and Policies

The Indian authorities have been proactively championing the cause of digital transactions, implementing a range of initiatives and policies to foster the widespread adoption of electronic payment methods.. A robust regulatory framework ensures the security and legitimacy of transactions, fostering trust among users.

Impact on Traditional Banking

The rise of digital payment solutions has not only affected consumer behavior but has also prompted traditional banks to adapt. Collaborations between banks and digital payment providers aim to create a seamless financial ecosystem.

Digital Payment Solutions for Businesses

For businesses, integrating digital payment systems into their operations has become imperative. The ease of transactions and benefits for both merchants and entrepreneurs contribute to the widespread adoption of digital payment solutions.

User Experience and Interface Design

User experience and interface design play a crucial role in the success of digital payment solutions. Examining successful case studies highlights the importance of user-friendly interfaces in promoting adoption.

Security Measures in Digital Payments

As digital transactions increase, ensuring the security of these transactions becomes paramount. Encryption and authentication protocols, along with robust fraud prevention strategies, are essential components of secure digital payment systems.

Future Trends in Digital Payment Solutions

Looking ahead, the future of digital payment solutions holds exciting possibilities. Emerging technologies such as blockchain and artificial intelligence are expected to further enhance the efficiency and security of digital transactions.

Social Impact of Digital Payments

Beyond financial transactions, digital payments contribute to social impact by empowering individuals financially and reducing dependence on cash. The broader societal implications of widespread digital adoption are significant.

Global Perspective on Digital Payment Solutions

Comparing digital payment trends in India with global perspectives provides insights into the country’s position in the international landscape. Understanding global trends helps anticipate future developments in the Indian digital payment industry.

Conclusion

In conclusion, the evolution of digital payment solutions in India has been a transformative journey. From overcoming challenges to embracing innovations, the industry has significantly shaped the financial landscape. The impact on traditional banking, the advantages for businesses, and the social implications highlight the multifaceted nature of this revolution.

Frequently Asked Questions (FAQs)

- Are digital payment solutions secure for online transactions?

- Yes, digital payment solutions employ robust security measures, including encryption and authentication protocols, to ensure the safety of online transactions.

- How have digital payment solutions impacted traditional banking?

- The rise of digital payment solutions has prompted traditional banks to adapt and collaborate, creating a seamless financial ecosystem that benefits both consumers and financial institutions.

- What role does the government play in promoting digital payments?

- The government actively promotes digital payments through initiatives and policies, establishing a regulatory framework that ensures the security and legitimacy of transactions.

- How do digital payment solutions contribute to financial inclusion?

- Digital payment solutions promote financial inclusion by providing access to financial services for individuals who were previously excluded from the traditional banking system.

- What are the future trends in digital payment solutions?

- The future of digital payment solutions involves the integration of emerging technologies like blockchain and artificial intelligence, promising increased efficiency and security in transactions.