AUTHOR : ROSE KELLY

DATE : 14-12-2023

Introduction

In the dynamic landscape of Indian e-commerce, payment providers have emerged as the Support of online transactions. The evolution of digital payments in the country has been remarkable, with a significant shift towards Electronic transactions. This article delves into the Details of Online business payment services in India, exploring their role, challenges, innovations, and the key players shaping the industry.

Evolution of E-commerce in India

India has witnessed phenomenal growth in online retail over the past decade. With the increasing penetration of the internet and smartphones, consumers are embracing online shopping The surge in digital transactions has paved the way for the transformation of traditional payment methods.

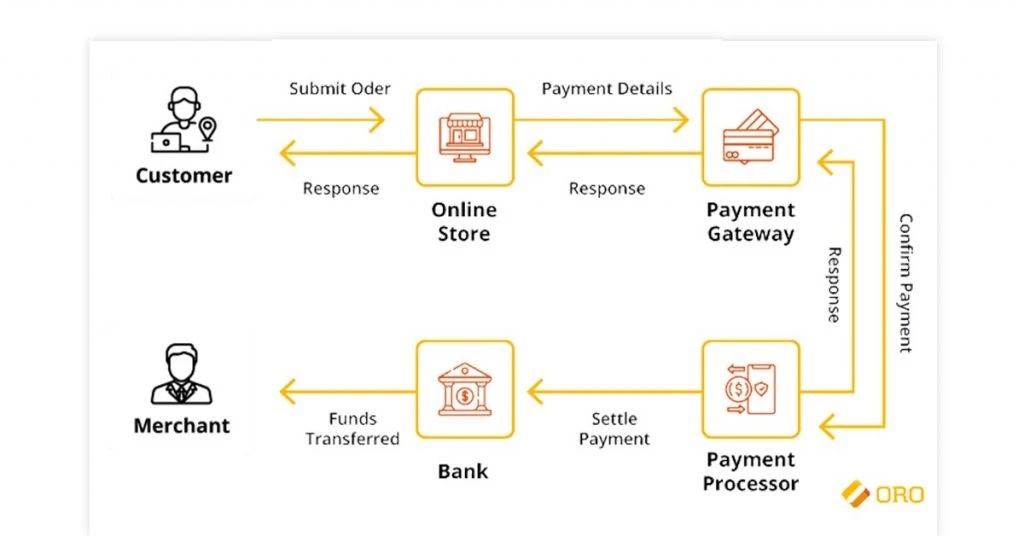

Role of Payment Providers

Payment providers play a crucial role in facilitating seamless and secure transactions. Their responsibility goes beyond merely processing payments; they are the gatekeepers of trust in the online shopping experience. Ensuring that customers feel confident while making transactions is paramount for the continued growth of e-commerce.

Popular Payment Methods in India

When it comes to E-commerce Payment Systems[1] in India, a diverse range of payment methods is prevalent. From traditional credit and debit cards to modern digital wallets and the convenience of UPI (Unified Payments Interface), consumers have a plethora of options to choose from. This diversity caters to the varied preferences of the Indian consumer base.

Challenges Faced by E-commerce Payment Services

Despite the rapid growth, e-commerce Payment Processing[2] services encounter challenges such as security concerns and transaction failures. Tackling these obstacles is crucial for ensuring ongoing progress in the long-term development of the industry. A robust payment infrastructure that can withstand the burstiness of transactions and ensures perplexity in security measures is crucial.

Prominent Payment Providers in India

In the Indian market, several international payment gateways[3] providers have established themselves as key players. From industry giants to innovative startups, each contributes to the ecosystem in its unique way. Let’s take a closer look at some of the prominent players shaping the e-commerce payment landscape in India.

- Provider A

- Providing a concise overview, this includes a brief profile highlighting their market share, as well as key features that set them apart in the industry.

- Provider B

- An overview of their contribution to the evolution of Digital Payment[4] . Offering insight into their role, this encompasses an overview of their significant contribution to the evolution of digital payments.

Innovations in E-commerce Payments

Innovation is at the forefront of the e-commerce Payments Industry Landscape[5]. Technological advancements, such as the integration of artificial intelligence and blockchain, are reshaping the landscape. These innovations not only enhance the user experience but also address security concerns, ensuring a seamless payment journey for consumers.

Government Initiatives and Regulations

The Indian government plays a crucial role in regulating e-commerce payments. Understanding the regulatory landscape is essential for both consumers and providers. This section explores key government initiatives and regulations governing the e-commerce payment sector.

Consumer Trust and Security

Building trust is paramount in the e-commerce payment industry. Consumers need surety that their financial information is secure. Payment providers invest heavily in robust security measures, including encryption and two-factor authentication, to build and maintain trust.

Future Trends in E-commerce Payments

The future of e-commerce payments holds exciting possibilities. Predictions indicate a surge in contactless payments, further integration of AI in fraud detection, and the exploration of blockchain for enhanced security. Staying abreast of these trends is crucial for businesses and consumers alike.

Comparison of Payment Providers

Choosing the right payment provider is a critical decision for businesses. This section provides a comparative analysis of different providers, weighing their strengths and weaknesses. Armed with this information, businesses can make informed decisions aligned with their specific needs.

Impact of Demonetization

Demonetization in India had a profound impact on the adoption of digital payments. The sudden shift towards cashless transactions accelerated the growth of e-commerce payments. Examining the post-demonetization scenario provides insights into changing consumer behavior and the resilience of digital payment systems.

E-commerce Payment Case Studies

Real-world examples showcase successful implementations of e-commerce payment systems. Examining case studies provides valuable insights into industry best practices, helping businesses enhance their payment processes.

The Importance of Mobile Payments

Mobile payments have become increasingly popular in India. The convenience of making payments through mobile apps has contributed to their widespread adoption. This section explores the surge in mobile-based transactions and the role of mobile payment apps in shaping the e-commerce payment landscape.

Conclusion

In conclusion, the landscape of e-commerce payments in India is vibrant and ever-evolving. Payment providers play a pivotal role in ensuring the smooth functioning of online transactions. As technology continues to advance, and consumer preferences shift, the e-commerce payment sector will witness further innovations. Businesses and consumers alike should stay informed and adapt to these changes for a seamless and secure payment experience.

FAQs

- How secure are e-commerce payments in India?

- E-commerce payments in India are notably secure, as providers diligently implement advanced encryption and authentication measures to safeguard users’ financial transactions.

- What role does the government play in regulating e-commerce payments?

- Within the Indian context, the government plays a pivotal role in the regulation of e-commerce payments, actively ensuring consumer protection and the promotion of fair practices.

- Are mobile payments popular in India?

- Yes, mobile payments have gained immense popularity in India due to their convenience and accessibility.

- How do payment providers ensure the security of transactions?

- Payment providers diligently implement robust security measures, such as encryption and two-factor authentication, in order to effectively safeguard transactions against potential threats.

- What trends can we expect in the future of e-commerce payments in India?

- Anticipated future trends encompass a significant surge in contactless payments, a heightened utilization of AI in fraud detection, and the exploration of blockchain technology for an advanced level of security.