NAME : JASMINE

DATE : 14/12/2023

Introduction

Mobile payment apps have become an integral part of India’s digital landscape, transforming the way people transact and manage their finances. In this article, we delve into the evolutcxion, impact, and future prospects of payment providers in Indian market. In a country witnessing rapid digitalization, the prevalence of mobile payment apps has surged, offering users a seamless and convenient way to make transactions. This transformation has not only affected individuals but has also reshaped the business landscape, creating opportunities and challenges.

Evolution of Payment Providers in India

Key Players in the Indian Market

The journey of digital payments in India dates back to the early stages of internet banking. However, the real turning point came with the rise of mobile payment apps. These apps revolutionized the way people perceive and use digital currency, bringing forth a wave of financial inclusion. As the demand for mobile payment solutions skyrocketed, several key players emerged, each vying for a significant share of the market. From established banking institutions to innovative startups, the competition has given consumers a plethora of choices, leading to diverse preferences among users.

Features and Functionalities

The success mobile payment apps lies in their user-friendly interfaces, robust security features, and additional functionalities. Whether it’s seamless peer-to-peer transactions, utility bill payments, or online shopping, these apps offer a one-stop solution, simplifying the financial lives of millions.

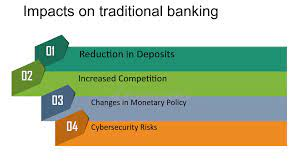

Impact on Traditional Banking

The surge in mobile Mobile payments[1] in India as prompted traditional banks to adapt to the changing landscape. While some banks have embraced partnerships with mobile payment providers, others have ventured into developing their own apps, creating a hybrid financial ecosystem.

Government Initiatives and Regulations

Acknowledging the significance of mobile payments, the Indian government has introduced various initiatives to promote digital transactions. Additionally, stringent regulations ensure the safety of users’ financial information, fostering trust and confidence in the payment industry ecosystem[2].

Security Concerns and Solutions

While the convenience of mobile payments[2] is undeniable, concerns about cybersecurity persist. Payment providers have responded by implementing advanced encryption techniques, multi-factor authentication, and continuous monitoring, ensuring a secure environment for users.

Advantages for Businesses

The adoption of mobile payment apps has not only benefited consumers but has also opened new avenues for businesses. Digital Payment Methods[3] Small and medium enterprises can now integrate payment gateways easily, expanding their customer base and streamlining financial transactions.

User Adoption and Behavior

Understanding user behavior is crucial for the sustained growth of mobile Payment system[4] apps. Factors such as ease of use, incentives, and trust in the platform influence user adoption. Analyzing these patterns helps providers tailor their services to meet evolving consumer expectations.

Challenges and Opportunities

Comparison with Global Trends

Despite the widespread acceptance, challenges like network connectivity, awareness, and resistance to change persist. However, these challenges also present opportunities for innovation, pushing Payment service provider[5] to develop solutions that cater to diverse user needs. To gain a comprehensive perspective, it’s essential to compare the Indian mobile payment landscape with global trends. Learning from successful implementations worldwide can offer insights into potential improvements and innovations.

Technological Advancements

Technological advancements play a pivotal role in shaping the future of mobile payments. From blockchain to artificial intelligence, the integration of cutting-edge technologies promises to enhance security, speed, and overall user experience.

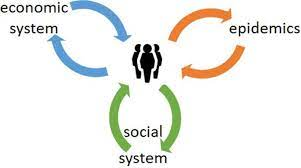

Social and Economic Impacts

The widespread adoption of mobile payments has not only facilitated financial transactions but has also contributed to social and economic changes. Increased financial inclusion, especially in rural areas, has a profound impact on poverty alleviation and economic development.

Case Studies

Examining real-life case studies provides valuable lessons for both providers and users. Success stories highlight best practices, while instances of challenges and failures serve as cautionary tales, guiding the industry toward sustainable growth.

Conclusion

In conclusion, the surge of mobile payment apps in India signifies a transformative shift in the way financial transactions are conducted. The convergence of technology, government support, and consumer demand has paved the way for a digital financial landscape with vast possibilities.

FAQs

- Are mobile payment apps safe to use in India?

- Mobile payment apps in India prioritize security through advanced encryption and authentication methods, ensuring safe transactions for users.

- How do mobile payment apps benefit small businesses?

- Mobile payment apps offer small businesses a convenient way to integrate payment gateways, expanding their reach and streamlining financial transactions.

- What role do government initiatives play in promoting mobile payments?

- Government initiatives in India aim to promote digital transactions, ensuring a secure and regulated environment for users.

- Can traditional banks coexist with mobile payment apps?

- Yes, traditional banks can coexist by adapting to the changing landscape, either through partnerships with mobile payment providers or developing their own apps.

- What are the key technological advancements in mobile payments?

- Technological advancements in mobile payments include the integration of blockchain, artificial intelligence, and other cutting-edge technologies to enhance security and user experience.