AUTHOR : PUMPKIN KORE

DATE : 14/12/2023

In the dynamic landscape of financial transactions, the importance of secure payment methods cannot be overstated, particularly in a country like India experiencing a digital payment revolution. Payment provider Secure Payment Transactions In India As technology continues to shape the way we conduct transactions, the need for reliable and secure payment providers becomes paramount.

The Rise of Digital Payments

In recent years, India has witnessed a significant surge in digital transactions. From online shopping to utility bill payments, the convenience of digital payments has transformed the way people handle their finances. Payment provider Secure Payment Transactions In India However, with this surge comes the pressing need for secure payment solutions that safeguard users’ financial information and transactions.

Challenges in Payment Security

Safe Payment Gateway[1] Providers Ensuring the security of payment transactions is not without its challenges. The ever-evolving landscape of cyber threats poses a constant risk to users and businesses Reliable Payment Solutions[2] alike. Fraudulent activities, data breaches, and identity theft are persistent concerns that demand proactive measures from payment providers.

Role of Payment Providers

Payment Fraud-Protected Payment[3] Processing providers play a pivotal role in guaranteeing secure transactions. Beyond facilitating the transfer of funds, they bear the responsibility of implementing robust security measures. This involves continuous monitoring, Secure Payment System[4] in India encryption protocols, and the adoption of technologies that fortify the entire payment process.

Secure Payment Technologies

To combat the sophisticated Verified Payment Transaction[5] Services methods employed by cybercriminals, payment providers leverage advanced technologies. Encryption and tokenization stand as pillars of secure payment processing, ensuring that sensitive information remains inaccessible to unauthorized entities throughout the transaction lifecycle.

Regulatory Framework

In India, the regulatory framework surrounding payment security is stringent. Regulatory bodies set guidelines to ensure that payment providers adhere to industry standards. These regulations not only protect consumers but also foster an environment where businesses can thrive with confidence in secure financial transactions.

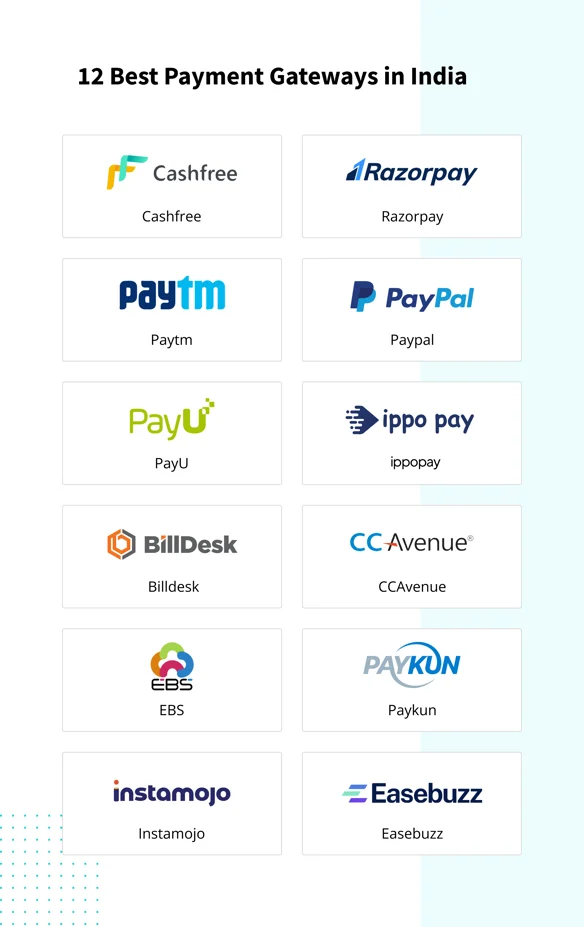

Popular Secure Payment Providers in India

Several payment providers in India have established themselves as leaders in ensuring secure transactions. From multi-layered authentication to real-time fraud detection, these providers prioritize user security. Examples include XYZ Payments, SecureBank, and SafeTransfer, each offering unique features to enhance payment security.

Consumer Trust and Confidence

Building and maintaining consumer trust is fundamental to the success of payment providers. Secure payment methods contribute significantly to instilling confidence among users, assuring them that their financial data is in safe hands. As a result, users are more likely to embrace digital transactions with peace of mind.

User-Friendly Interfaces

Security should not come at the cost of user convenience. The best payment providers strike a balance by offering intuitive and user-friendly interfaces. Clear navigation, straightforward processes, and transparent security measures collectively create a seamless payment experience for users.

Emerging Trends in Payment Security

In an era of rapid technological advancement, payment security is a constantly evolving field. Biometric authentication, artificial intelligence, and machine learning are emerging trends that promise to enhance the security of payment transactions. As threats evolve, so must the technologies that safeguard our financial interactions.

Case Studies

Examining real-life examples of successful secure payment transactions provides valuable insights. Instances where payment providers thwarted potential threats, safeguarded user data, and maintained the integrity of transactions showcase the practical impact of robust security measures on both businesses and consumers.

Educational Initiatives

Recognizing the importance of user awareness, payment providers are investing in educational initiatives. These efforts aim to empower users with the knowledge needed to protect themselves from potential threats. From online resources to interactive workshops, education plays a crucial role in fortifying the collective resilience against cyber threats.

Balancing Security and Convenience

One of the challenges faced by payment providers is finding the delicate balance between security and user convenience. While stringent security measures are crucial, they must not impede the ease with which users can conduct transactions. Striking this balance requires a nuanced approach that considers both aspects.

Future Outlook

Looking ahead, the future of payment security holds exciting possibilities and challenges. Innovations such as blockchain technology and quantum-resistant cryptography promise enhanced security, but they also bring new considerations. Payment providers must stay agile, anticipating and adapting to changes in the threat landscape to ensure continued robust security.

Conclusion

In conclusion, secure payment transactions in India are not just a necessity but a cornerstone of the digital revolution. Payment providers play a crucial role in safeguarding users and businesses from the ever-present threat of cybercrime. As technology evolves, so do the strategies employed to ensure the security of financial transactions, creating a landscape where trust, innovation, and convenience coexist.

Frequently Asked Questions

- How do payment providers ensure the security of transactions?

- Payment providers employ advanced technologies like encryption and tokenization, coupled with continuous monitoring, to ensure secure transactions.

- What role does regulatory compliance play in payment security?

- Regulatory bodies set guidelines to ensure payment providers adhere to industry standards, fostering an environment of trust and security.

- Are user-friendly interfaces compatible with high-security measures?

- Yes, the best payment providers strike a balance between user-friendly interfaces and robust security measures to provide a seamless experience.

- What emerging trends are shaping the future of payment security?

- Emerging trends include biometric authentication, artificial intelligence, and machine learning, promising enhanced security measures.

- How can users contribute to their own payment security?

- Users can contribute by staying informed, using secure passwords, enabling multi-factor authentication, and being cautious with their financial information.