AUTHOR : PUMPKIN KORE

DATE : 06/12/2023

Introduction

In recent years, the rapid growth of electronic businesses[1] in India has necessitated a seamless and secure payment infrastructure. As consumers increasingly shift towards online transactions,[2] businesses must adapt to the evolving landscape of payment gateways.[3]

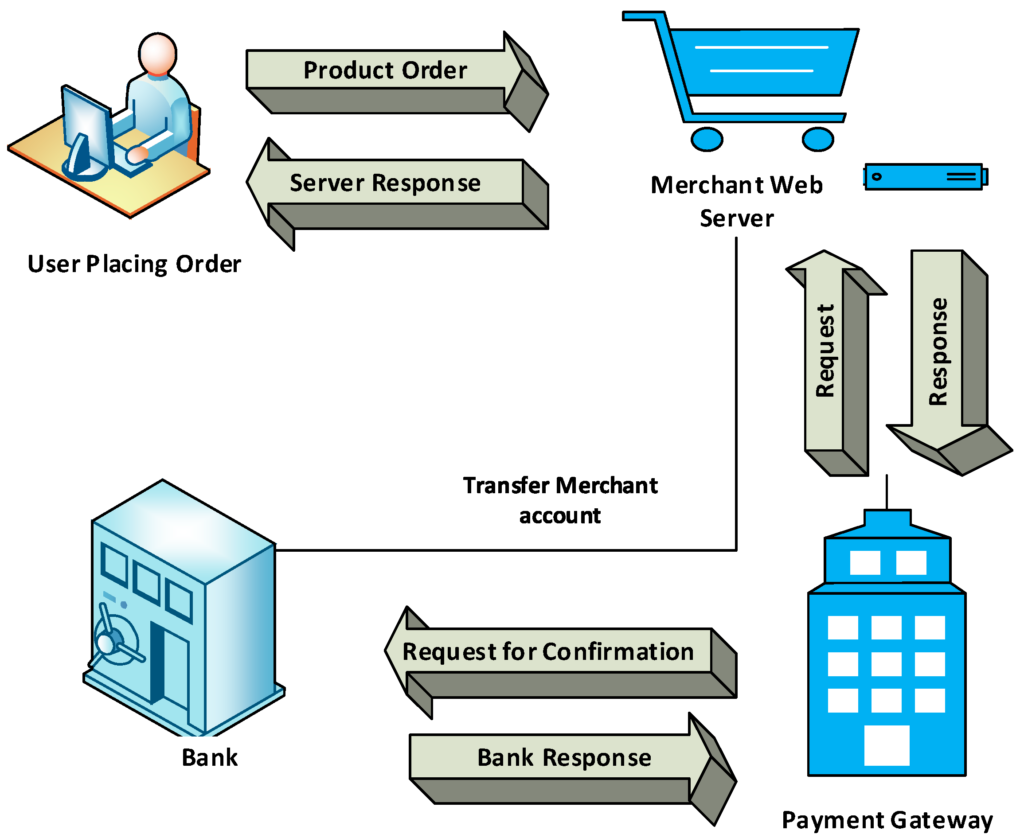

Understanding Payment Gateways

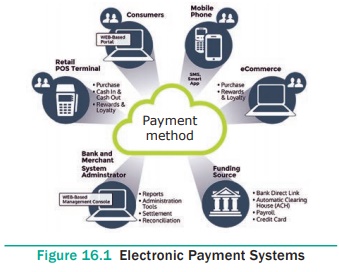

Payment gateways serve as the virtual bridge between customers and also businesses,[4] facilitating secure online transactions.[5] Understanding the types and significance of payment gateways[1] is fundamental for electronics businesses seeking a competitive edge.

Different Types of Payment Gateways

Payment gateways come in various forms, including hosted gateways, API-based gateways, and self-hosted gateways. Each type has its advantages and also considerations, making it essential for businesses to choose the most suitable option.

Critical Attributes to Consider in a Payment Gateway Selection

When selecting a payment gateway for an electronics[2] business, certain features are paramount. Security measures, integration capabilities, user-friendly interfaces, and cost considerations[3] play a crucial role in ensuring a seamless payment process.

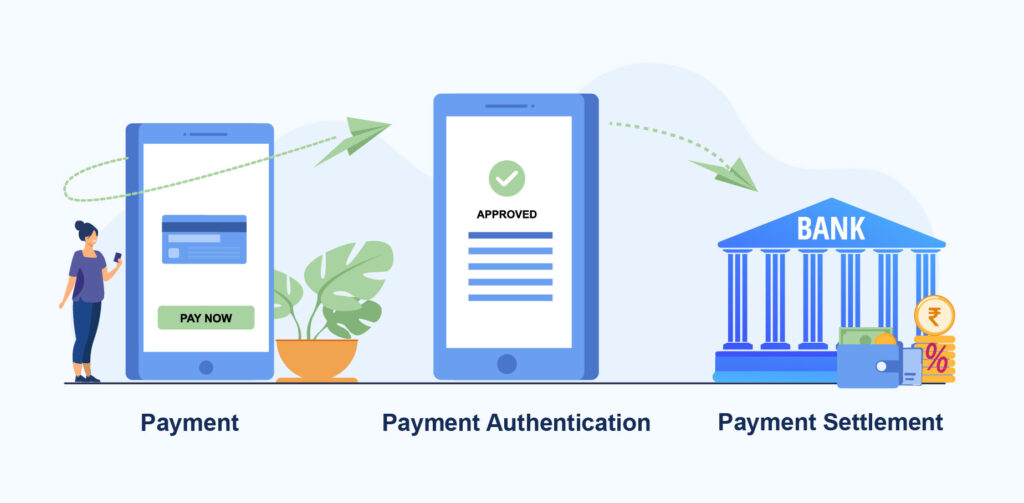

Security Measures

Given the sensitive nature of financial transactions, robust security measures are non-negotiable. Businesses must prioritize payment gateways with encryption protocols, two-factor authentication[4], and also compliance with industry security standards.

Popular Payment Gateways in India

The Indian market boasts several prominent payment gateways, each offering unique features. A comparative analysis of major players and case studies on successful implementations provide insights into choosing the right gateway for an electronics business.[5]

Comparative Analysis of Major Players

Examining the strengths and also weaknesses of popular payment gateways like Razorpay, PayU, and Instamojo helps businesses make informed decisions. Real-world examples of successful implementations showcase the practical benefits of each platform.

Challenges Faced by Electronics Businesses in India

Despite the growth in electronic transactions, businesses in India encounter specific challenges. Addressing security concerns, overcoming technological barriers, and gaining customer trust pose formidable obstacles for the electronics sector.

Technological Barriers

The fast-paced evolution of technology often leaves businesses struggling to keep up. Electronics businesses must adopt agile strategies to stay ahead, integrating the latest innovations to provide a seamless customer experience.

Strategies to Overcome Challenges

To thrive in the competitive electronics market, businesses must implement strategies to overcome challenges. Robust cybersecurity measures, continuous technological updates, and transparent communication are essential components of a successful approach.

Building Customer Trust Through Transparency

In a digital era rife with cybersecurity threats, gaining customer trust is paramount. Electronics businesses can build trust by transparently communicating their security measures, providing clear terms of service, and promptly addressing customer concerns.

The Future of Payment Gateways in Indian Electronics Business

As technology continues to advance, the future of payment gateways holds exciting possibilities for the electronics business in India. Emerging trends, anticipated advancements, and also their impact on the electronic business landscape are explored in this section.

Tips for Selecting the Right Payment Gateway for Your Electronics Business

Choosing the right payment gateway requires a comprehensive understanding of specific business needs. Seeking expert advice, considering scalability, and assessing the unique requirements of an electronics business are crucial factors in the decision-making process.

Considering Scalability

As an electronics business grows, scalability becomes a key consideration. Selecting a payment gateway that can seamlessly adapt to increased transaction volumes ensures a smooth and also sustainable business expansion.

Importance of Mobile Payments in the Electronics Sector

The rise of mobile commerce has transformed consumer behavior, making mobile payments a crucial consideration for electronics businesses. Optimizing payment gateways for mobile users is imperative for a seamless user experience.

Case Studies on Successful Mobile Payment Implementations

Companies that have successfully implemented mobile payment solutions, such as ABC Electronics, exemplify the benefits of adapting to changing consumer preferences. These case studies provide valuable insights for businesses considering mobile payment integration.

Regulatory Compliance in Electronic Transactions

Ensuring compliance with regulatory standards is a legal imperative for electronics businesses in India. An overview of regulations, the importance of compliance for secure transactions, and also the impact on business operations are discussed in this section.

Ensuring Compliance for Secure Transactions

Strict adherence to regulatory standards not only ensures legal compliance but also enhances the security of electronic transactions. Electronics businesses must stay informed about and implement measures to comply with relevant regulations.

Conclusion

In conclusion, the payment gateway landscape for businesses in India is evolving rapidly. Selecting the right payment gateway is a critical decision that can impact the success and longevity of a business. By understanding key features, learning from success stories, and preparing for the future, businesses can navigate the complexities of payment gateway integration with confidence.

FAQs

- What are the primary security measures to look for in a payment gateway?

- Encryption protocols, two-factor authentication, and also compliance with industry security standards are crucial security measures to consider.

- How can electronics businesses build customer trust in online transactions?

- Transparency in communication, clear terms of service, and also promptly addressing customer concerns contribute to building customer trust.

- What role do emerging technologies play in the future of payment gateways?

- Artificial intelligence, blockchain, and also contactless payment technologies are expected to revolutionize the payment gateway landscape, offering new possibilities for businesses.

- Why is scalability important when choosing a payment gateway for an electronics business?

- Scalability ensures that the payment gateway can adapt to increased transaction volumes as business grows, preventing hindrances to expansion.

- How can businesses enhance the user experience through seamless payments?

- Prioritizing frictionless payment processes, as exemplified by companies like DEF Electronics, contributes to a positive user experience, fostering customer loyalty.