By sayyed nuzat

In today’s digital era, the landscape of business models has evolved, with membership-based services gaining immense popularity. One crucial aspect of managing subscription-based businesses is an efficient payment system[1]. This article explores the dynamics of payment gateway membership billing in India, shedding light on its significance, key features, challenges, and future trends.

The Rise of Subscription Models in India

Growth in subscription-based services

India has witnessed a significant surge in businesses adopting membership models. From streaming services to software solutions[1], consumers are increasingly inclined towards subscription-based offerings.

Need for efficient payment solutions

As membership services become integral to daily life, the need for streamlined payment processes becomes paramount. Payment gateway membership billing in India emerges as a solution that not only facilitates transactions but also ensures a hassle-free experience for both businesses and consumers.

Understanding Payment Gateways

Definition and role in online transactions

Payment portals act as intermediaries in online transactions, facilitating the secure transfer of funds. They play a pivotal role in authorizing payments and also ensuring the confidentiality of sensitive information.

The importance of secure and seamless transactions

In the realm of membership billing, security and seamlessness are non-negotiable. Users expect a frictionless payment experience, and payment portals also serve as the backbone of such transactions.

Key Features of Payment Gateway Subscription Billing

Recurring billing options

Payment gateway membership billing allows businesses to set up recurring payments, ensuring a steady flow of revenue. This feature is particularly beneficial for subscription-based businesses, providing predictability in income.

Multiple payment modes

Catering to diverse consumer preferences, payment portals support various payment modes. Whether it’s credit cards, debit cards, or digital wallets, businesses can offer flexibility to their customers.

Integration capabilities

Seamless integration with existing business systems is a crucial aspect of payment portals. This ensures that membership billing aligns with other operations, creating a cohesive business environment.

Popular Payment Portals in India

Overview of leading platforms

India boasts several prominent payment portals, each with its own unique features. From Razorpay to Paytm, businesses have a plethora of options to choose from.

Comparative analysis

To help businesses make informed decisions, a comparative analysis of popular payment portals is essential. Factors such as transaction fees, user interface, and customer support play a pivotal role in this evaluation.

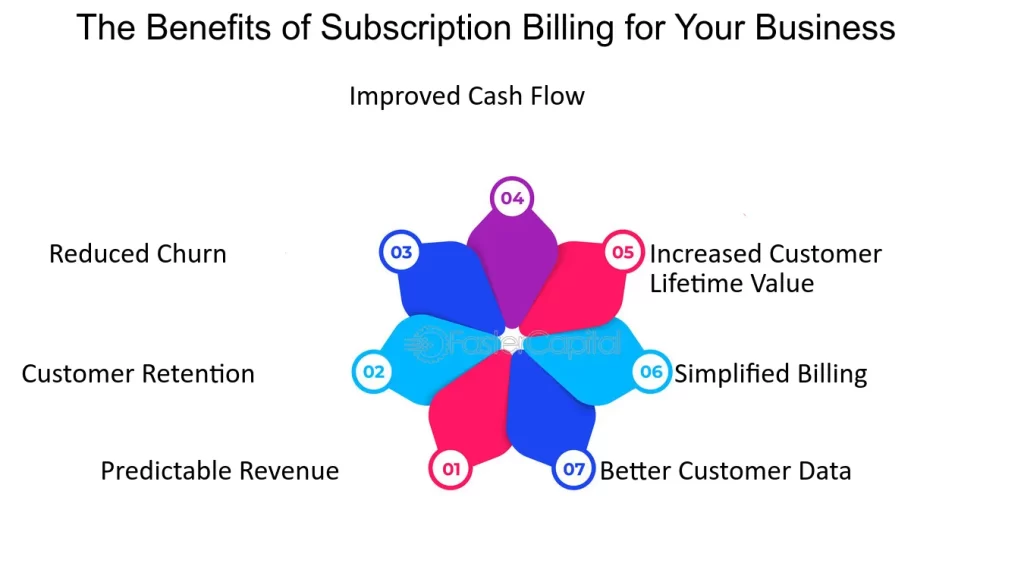

Benefits of Subscription Billing for Businesses

Predictable revenue streams

For businesses, membership billing provides a predictable revenue stream, allowing for better financial planning and stability.

Customer loyalty and retention

Subscription models foster customer loyalty, encouraging users to stick with a service they find valuable. This, in turn, reduces customer churn and also enhances long-term profitability.

Enhanced customer experience

The convenience of automated payments and personalized billing cycles contributes to an enhanced customer experience. This positively impacts brand perception and customer satisfaction.

Challenges and Solutions

Addressing security concerns

Security remains a top concern in online transactions. Payment portals must employ robust encryption and security measures to safeguard sensitive information.

Dealing with subscription cancellations

Businesses must strategize on handling subscription cancellations effectively. Providing users with seamless cancellation processes can mitigate potential issues.

Providing customer support

Responsive customer support is crucial in resolving payment-related queries and concerns. A proactive approach to customer service builds trust and credibility.

The regulatory landscape in India

Compliance with RBI regulations

Payment portals must adhere to regulations set by the Reserve Bank of India (RBI) to ensure legal and ethical business practices.

Data protection and privacy concerns

As data privacy gains prominence, payment portals need to implement stringent measures to protect user information and also comply with data protection laws.

Case Studies

Success stories of businesses implementing subscription billing

Examining real-life case studies provides insights into the effectiveness of payment gateway membership billing. From startups to established enterprises, success stories offer valuable lessons.

Lessons learned

Analyzing both successful and challenging cases helps businesses learn from others’ experiences and refine their membership billing strategies.

Tips for Choosing the Right Payment Gateway

Evaluating business needs

Understanding the unique requirements of a business is crucial in selecting the most suitable payment gateway. Consider factors such as transaction volume, target audience, and industry.

Considering scalability

As businesses grow, scalability becomes a key consideration. Choosing a payment gateway that can scale with the business ensures long-term viability.

Cost-effective solutions

While features and capabilities are essential, businesses must also evaluate the cost-effectiveness of payment gateways. Balancing functionality with affordability is crucial.

Future Trends in Subscription Billing

Innovations in payment technology

Advancements in payment technology, such as blockchain and contactless payments, are poised to influence the future of subscription billing.

Changing consumer preferences

Understanding evolving consumer preferences is vital for businesses to stay ahead. Flexibility and customization in subscription billing models align with changing consumer expectations.

Conclusion

In conclusion, payment gateway subscription billing plays a pivotal role in the success of subscription-based businesses in India. From ensuring secure transactions to providing flexibility in billing cycles, the right payment gateway is a strategic asset. As the subscription economy continues to thrive, businesses must adapt to emerging trends and also leverage efficient payment solutions for sustained growth.

FAQs

- How secure are payment gateway transactions?

- Payment portals employ robust encryption and security measures to ensure the confidentiality of transactions.

- Can businesses customize their subscription billing cycles?

- Yes, businesses can tailor subscription billing cycles to meet their specific needs and customer preferences.

- What happens in the case of subscription cancellations?

- Businesses should provide seamless and user-friendly cancellation processes to retain customer satisfaction.

- How do payment portals comply with data protection laws?

- Payment portals implement stringent measures to protect user information and comply with data protection regulations.

- What is the future of subscription billing in India?

- The future of subscription billing in India is influenced by innovations in payment technology and evolving consumer preferences.