Author : Sweetie

Date : 14/12/2023

Introduction

In the dynamic landscape of digital transactions, High-Risk Payment Service Providers (PSPs) play a crucial role. These entities navigate through challenges and uncertainties unique to their industry, especially in a country like India, where the payment ecosystem is rapidly evolving. In this article, we’ll delve into the intricacies of high-riskPSP secure payment transactions in India, examining the challenges, strategies, and future prospects.

Definition of High-Risk PSP

High-Risk PSPs are financial entities that operate in sectors prone to a higher probability of financial failure or regulatory non-compliance. Understanding the nuances of these entities is essential for grasping the challenges they face in maintaining secure payment transactions.

Importance of Secure Payment Transactions

In an era dominated by online transactions, secure payment processes are the bedrock of trust between consumers and businesses. The significance of ensuring the security of these transactions cannot be overstated, especially in a high-risk environment.

Overview of the Payment Landscape in India

India’s payment landscape is a dynamic mix of traditional and modern systems. From digital wallets to Unified Payments Interface (UPI), the country has witnessed a rapid shift towards cashless transactions. This evolution brings both opportunities and challenges for high-risk PSPs.

Understanding High-Risk PSP

Characteristics of High-Risk PSPs

High-risk PSPs exhibit specific characteristics that set them apart from their low-risk counterparts. These characteristics often involve the nature of the industries they serve and the level of regulatory scrutiny they undergo.

Common Industries Deemed High-Risk

Certain industries, such as online gaming, adult entertainment, and cryptocurrency, are typically labeled high-risk. Exploring these sectors sheds light on the challenges faced by PSPs operating within them.

Regulatory Framework in India

Navigating the regulatory landscape is a significant aspect of high-risk PSP operations. Understanding the regulatory framework in India is crucial for compliance and successful operations.

Challenges in Payment Transactions

Security Concerns

Security is paramount in the world of high-risk PSPs. From data breaches to cyber attacks, these entities face a constant threat to the integrity of their payment systems. Exploring the security challenges provides insights into potential solutions.

Regulatory Compliance

Compliance with regulations is an ongoing challenge for high-risk PSPs. Staying abreast of changes and ensuring adherence to guidelines is critical for avoiding penalties and maintaining a trustworthy reputation.

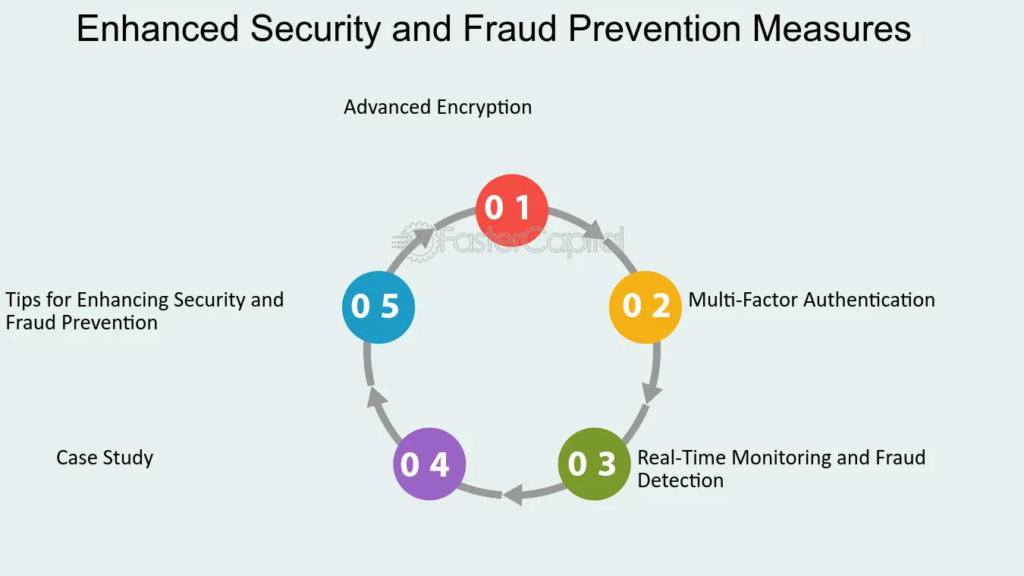

Fraud Prevention Measures

Implementing robust fraud prevention measures is essential for high-risk PSPs. Examining the strategies employed in the industry provides a comprehensive understanding of the efforts undertaken to secure transactions.

Importance of Secure Payment Transactions

Building Trust in Online Transactions

The foundation of secure payment transactions lies in building trust. Consumers must feel confident that their financial information is safeguarded, and businesses must establish themselves as reliable custodians of this data.

Enhancing Customer Confidence

Secure transactions enhance customer confidence, leading to increased adoption of digital payment methods. Exploring the correlation between security and customer trust sheds light on the symbiotic relationship between the two.

Impact on Business Reputation

A secure payment environment directly impacts the reputation of high-risk PSPs. Examining the consequences of security lapses on business reputation underscores the importance of stringent security measures.

Strategies for High-Risk PSPs

Robust Security Protocols

Implementing robust security protocols is non-negotiable[1] for high-risk PSPs. From encryption technologies to multi-factor authentication, exploring the arsenal of security measures is essential for safeguarding transactions.

Compliance with Regulatory Standards

Adhering to regulatory standards is a strategic imperative. Delving into the strategies employed by high-risk PSPs to navigate complex regulatory landscapes provides insights into their commitment to compliance.

Utilizing Advanced Technologies

High-risk PSPs often leverage cutting-edge technologies to stay ahead of security threats. Exploring the role of technologies like artificial intelligence[2] and machine learning in securing transactions sheds light on the industry’s innovative approaches.

Case Studies

Successful Implementation of Secure Transactions

Examining case studies of high-risk PSPs successfully implementing secure transactions provides practical insights. Understanding the factors contributing to their success can serve as a roadmap for others in the industry.

Lessons Learned from Failures

Learning from failures is equally crucial. Analyzing case studies where high-risk PSPs faced challenges in securing transactions offers valuable lessons for the industry at large.

Best Practices for High-Risk PSPs

Compiling best practices based on successful case studies provides actionable guidelines[3] for high-risk PSPs striving to enhance their payment security measures.

The Future of Secure Payment Transactions in India

Technological Advancements

The future of secure payment transactions in India is intertwined with technological advancements. Exploring emerging technologies and their potential impact on payment security offers a glimpse into what lies ahead.

Evolving Regulatory Landscape

As technology evolves, so does the regulatory landscape. Examining anticipated changes in regulations and their implications for high-risk PSPs provides foresight into future compliance challenges.

Anticipated Challenges and Solutions

Predicting challenges on the horizon and exploring potential solutions equips high-risk PSPs with the knowledge to proactively address future issues. This forward-thinking[4] approach is vital for sustained success.

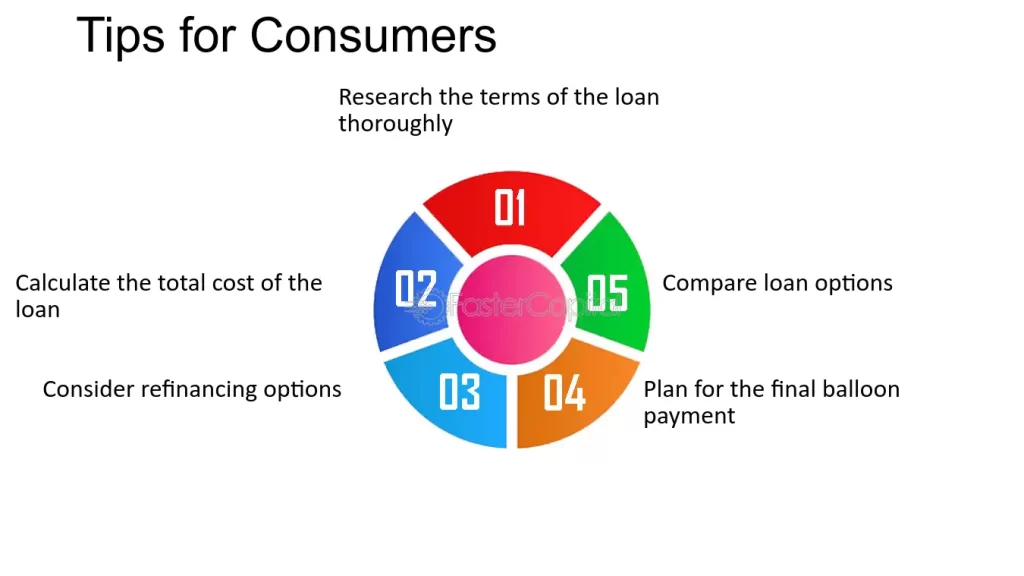

Tips for Consumers

Ensuring Secure Online Transactions

Empowering consumers with tips for ensuring secure online transactions contributes to a safer digital ecosystem. Providing practical advice enhances consumer awareness and resilience against potential threats.

Recognizing and Avoiding Potential Risks

Educating consumers on recognizing and avoiding potential risks adds an extra layer of protection. Awareness is a potent tool in the fight against fraudulent activities.

Staying Informed about Payment Security

Encouraging consumers to stay informed about payment security trends and best practices fosters a collective responsibility for a secure digital environment[5].

Conclusion

In conclusion, high-risk PSP secure payment transactions in India present a multifaceted landscape. From navigating regulatory challenges to implementing advanced security measures, the industry’s journey is both complex and fascinating. As we move forward, a collaborative effort between stakeholders, consumers, and regulatory bodies is crucial for fostering a secure and trustworthy payment ecosystem.

FAQs

- What makes a PSP high-risk in the context of payment transactions?

- Answer: High-risk PSPs often operate in industries prone to financial volatility or regulatory scrutiny, such as online gaming or cryptocurrency.

- How can consumers ensure the security of their online transactions with high-risk PSPs?

- Answer: Consumers can enhance security by using strong passwords, enabling two-factor authentication, and staying informed about the latest security practices.

- What role do technological advancements play in securing payment transactions?

- Answer: Technological advancements, such as encryption and AI, play a pivotal role in fortifying the security measures implemented by high-risk PSPs.

- Are there specific regulations governing high-risk PSPs in India?

- Answer: Yes, high-risk PSPs in India are subject to specific regulations that vary based on the industry they operate in. Staying compliant is crucial for their operations.

- How can high-risk PSPs balance the need for security with the demand for seamless payment experiences?

- Answer: High-risk PSPs can achieve this balance by investing in user-friendly interfaces without compromising on the robustness of their security protocols.