AUTHOR : RIVA BLACKLEY

DATE : 18/12/2023

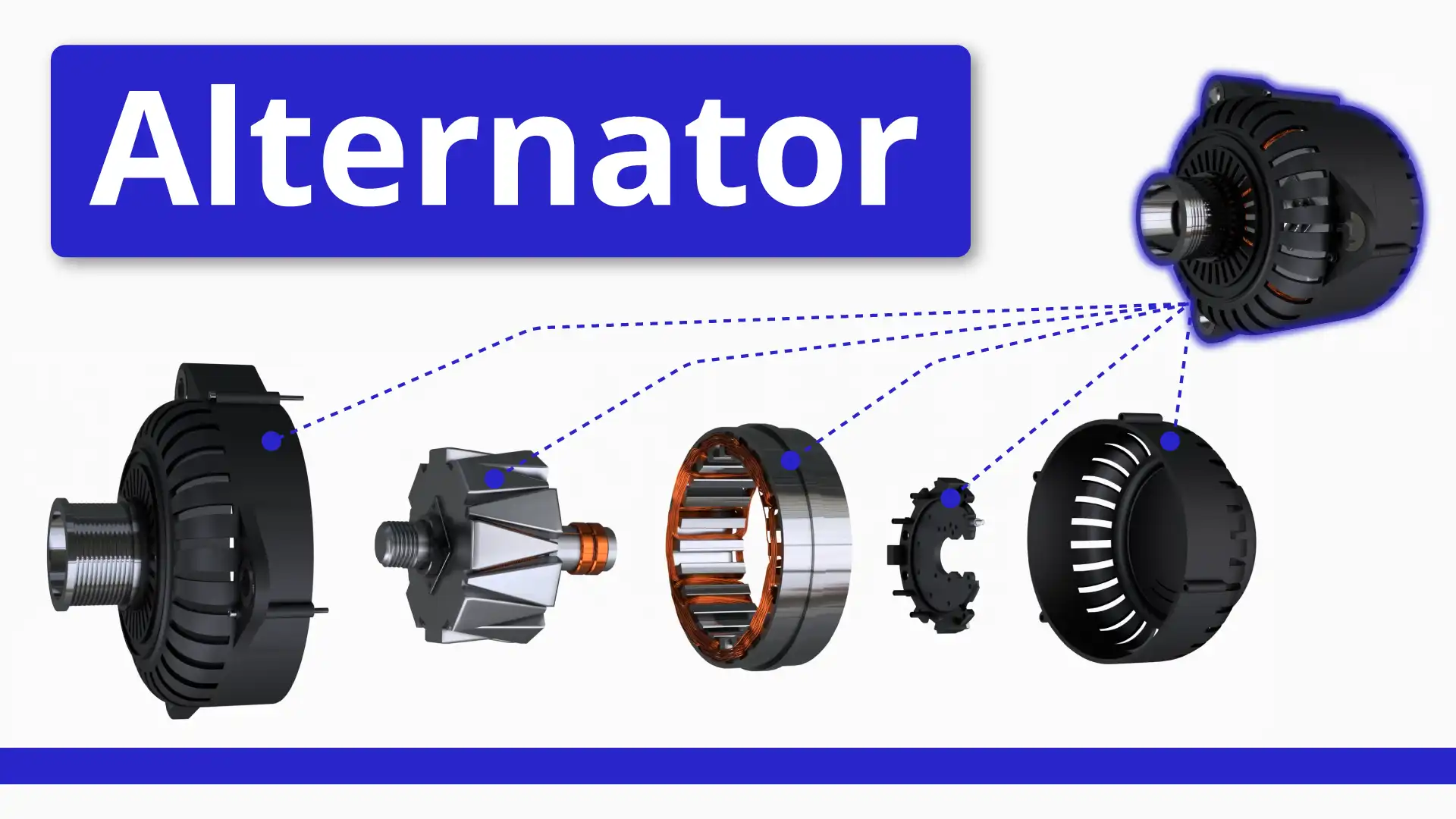

Introduction

In the dynamic landscape of commerce, the role of payment providers for alternators in India cannot be overstated. As businesses shift towards digital transactions, the need for reliable and efficient payment solutions becomes paramount. This article delves into the intricacies of payment providers, emphasizing their significance in the alternator industry. Payment Provider For Alternators In India.

The Current Payment Landscape

Traditionally, alternator transactions in India have relied on conventional payment methods. However, this approach poses challenges for both businesses and consumers. Delays in processing, lack of transparency, and security concerns have prompted the industry to explore more advanced alternatives.

Emergence of Digital Payment Solutions

The advent of digital payment solutions has revolutionized the way transactions are conducted. With the ease of online payments, businesses dealing in alternators can streamline their processes and provide customers with a convenient way to make purchases. The benefits range from faster transactions to enhanced record-keeping.

Security stands out as a foremost consideration in the realm of digital transactions.

When selecting a payment provider, alternator businesses must prioritize certain features. Security measures, a user-friendly interface, and seamless integration with existing systems are crucial factors. Choosing a provider that aligns with these requirements ensures a smooth and secure payment experience.

Popular Payment Providers in India

In the vast landscape of payment providers in India, several key players stand out. From industry[1] giants to innovative startups, each has its strengths and weaknesses. Understanding these nuances can help alternator businesses make informed decisions about which provider best suits their needs.

Customized Solutions for Alternator Businesses

Generic payment solutions may not cater to the specific needs of alternator businesses. Tailored payment solutions that integrate seamlessly with the industry’s processes can significantly enhance efficiency. Case studies of successful implementations highlight the positive impact of customized solutions.

Security Concerns and Solutions

One of the primary concerns with digital transactions[2] is security. Addressing common issues and exploring the security [3]measures implemented by payment providers are essential steps in building trust with consumers. This section provides insights into ensuring secure alternator transactions.

User Experience and Accessibility

A seamless user experience is crucial for the success of any payment provider. This includes accessibility features to accommodate users with diverse needs. Exploring the user interface and accessibility features ensures that the payment process is inclusive and user-friendly.

Cost-Effectiveness of Payment Providers

While efficiency is vital, businesses must also consider the costs associated with different payment providers. Analyzing transaction fees, processing costs, and exploring ways to minimize expenses can contribute to the overall profitability of alternator businesses.

Integration with E-commerce Platforms

In an era where online transactions are predominant, integrating payment solutions with popular e-commerce platforms is a strategic move. This section explores the possibilities and benefits of seamless integration, simplifying the alternator purchasing process for consumers.

Customer Support and Conflict Resolution

Effective customer support is indispensable in the realm of payment providers. Evaluating the responsiveness and conflict resolution strategies of providers ensures that businesses can address issues promptly, maintaining a positive relationship with consumers.

Adapting to Changing Technologies

Technological advancements in the payment sector are constant. Alternator businesses must stay informed about the latest developments to remain competitive. Future-proofing operations ensures that businesses can adapt to evolving technologies seamlessly.

Case Studies: Success Stories in the Alternator Industry

Real-world [4]examples of businesses that have successfully implemented efficient payment solutions offer valuable insights. These case studies showcase the tangible benefits of choosing the right payment provider for alternators.

Regulatory Compliance

Navigating the regulatory landscape is essential for ethical and legal business [5] practices. Understanding and adhering to payment-related regulations ensures that alternator businesses operate within the boundaries of the law.

Conclusion

In conclusion, the choice of a payment provider significantly impacts alternator businesses in India. From security and user experience to cost-effectiveness and regulatory compliance, businesses must carefully weigh their options. By embracing digital payment solutions and selecting providers aligned with their specific needs, alternator businesses can thrive in an evolving market.

FAQS

- What are the key features to consider when choosing a payment provider for alternators?

- Security measures, user-friendly interface, and integration capabilities are crucial considerations.

- How can alternator businesses ensure the security of online transactions?

- Implementing robust security measures and choosing reputable payment providers are essential steps.

- Are there specific payment providers tailored for the alternator industry?

- Yes, some providers offer customized solutions designed to meet the unique needs of alternator businesses.

- What role does regulatory compliance play in the choice of a payment provider?

- Adhering to payment-related regulations ensures ethical and legal business practices.

- How can businesses stay updated on changing payment technologies?

- Regularly monitoring industry trends and developments helps businesses stay informed and adapt to new technologies.