AUTHOR:HAZEL DSOUZA

DATE:18/12/2023

Introduction

In the automotive industry, the efficiency of transactions is paramount, especially when dealing with crucial components like serpentine belts. As businesses adapt to online platforms, the choice of a reliable payment provider becomes crucial for seamless operations Let’s delve into the world of payment solutions tailored for serpentine belts in India.

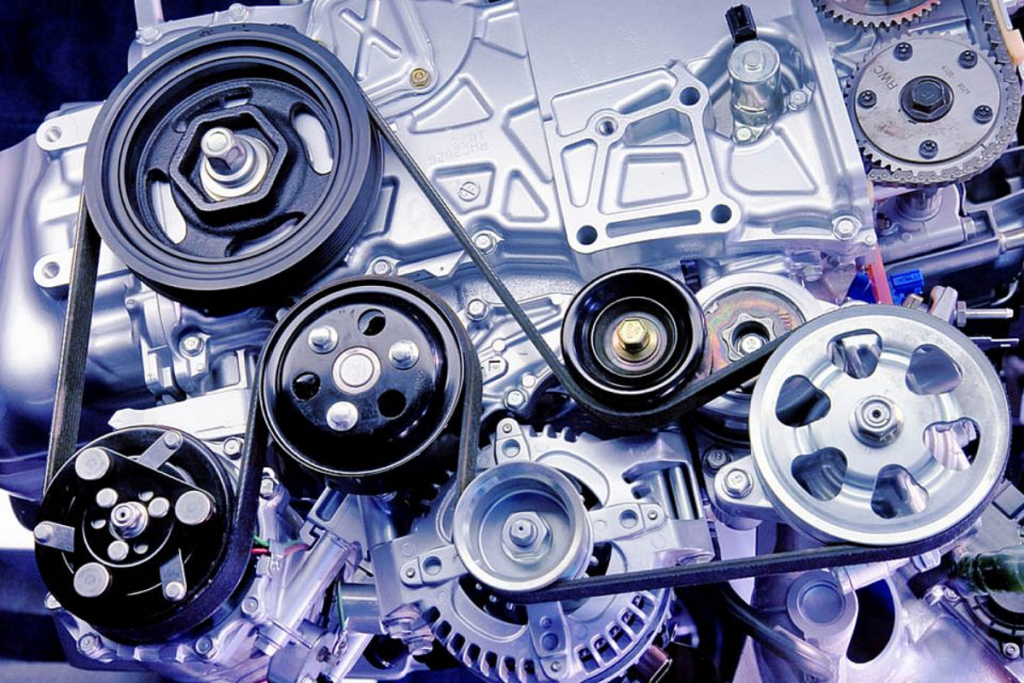

Definition of Serpentine Belts

Serpentine belts are integral components in a vehicle’s engine, responsible for driving multiple accessories. These belts play a pivotal role in ensuring the smooth functioning of various automotive systems.

Importance of Reliable Payment Providers

In an era of digital transactions, having a secure and efficient payment system is essential for businesses dealing with automotive parts. This is particularly true for serpentine belt suppliers and merchants looking to streamline their payment processes.

The Need for Specialized Payment Solutions

Challenges in Traditional Payment Methods

Traditional payment methods often pose challenges such as delays, manual errors, and lack of security. For businesses in the automotive sector, these challenges can result in operational inefficiencies and customer dissatisfaction.

Specific Requirements for Serpentine Belt Transactions

Transactions involving serpentine belts[1] require a specialized approach due to the unique nature of the automotive parts industry. Quick and secure transactions are essential to meet the demands of both merchants and customers.

Choosing the Right Payment Provider

Security and Encryption

Security is a top priority when selecting a payment provider. Encryption protocols and secure payment gateways are crucial to safeguarding sensitive financial information.

Transaction Speed and Efficiency

The automotive industry operates at a fast pace, and transactions should mirror this speed. A reliable payment provider ensures swift and efficient transactions, reducing processing times.

Integration Capabilities

Compatibility with existing systems is vital. A payment provider that seamlessly integrates with e-commerce platforms and inventory[2] management systems streamlines the overall workflow.

Popular Payment Providers in India

A. Provider

Known for its robust security features, Provider A has gained popularity among automotive businesses. The ease of use and reliability make it a top choice for serpentine belt merchants.

B. Provider

Provider B stands out for its lightning-fast transactions. Merchants[3] appreciate the quick processing times, enhancing the overall efficiency of their operations.

C. Provider

Provider C boasts extensive integration capabilities. For businesses with complex inventory management systems, Provider C offers a seamless solution, reducing manual workload.

User Experiences and Reviews

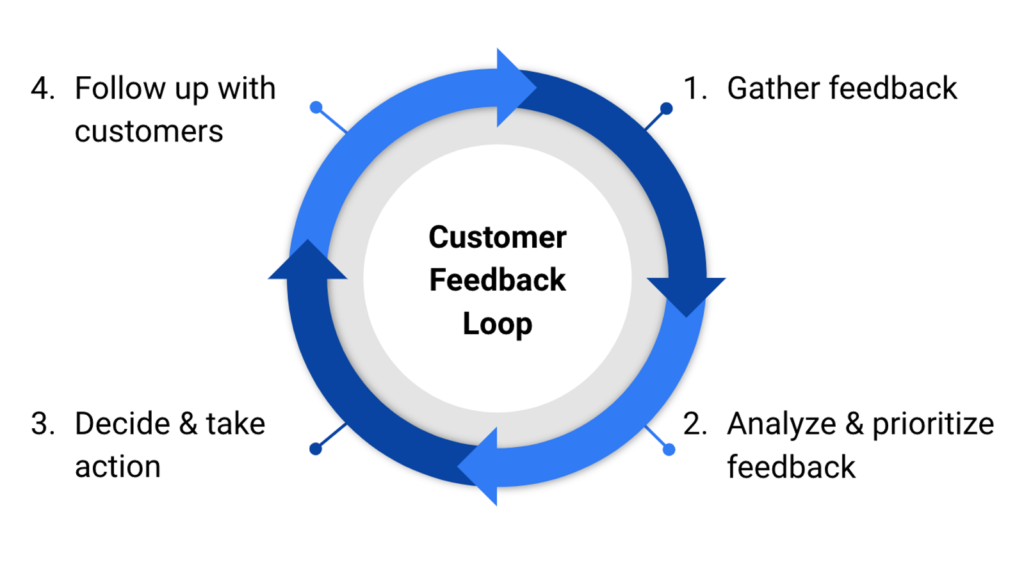

Customer Feedback on Provider

Customers praise Provider A for its secure transactions and responsive customer support. Positive experiences contribute to the provider’s credibility in the market.

Success Stories with Provider

Merchants share success stories of increased sales and streamlined[4] processes after adopting Provider B. The efficiency of transactions has positively impacted their bottom line.

Challenges Faced with Provider

While Provider C offers excellent integration, some users report challenges in the initial setup. Addressing these concerns would further enhance its reputation.

Cost Considerations

Transaction Fees

Understanding the cost structure is crucial. While some providers charge flat fees, others may have tiered pricing based on transaction volume.

Hidden Costs to Watch Out For

Merchants should be wary of hidden costs, such as setup fees and maintenance charges. A transparent pricing model ensures businesses can accurately budget for their payment processing.

Future Trends in Payment Solutions for Serpentine Belts

Innovations in Payment Technologies

Advancements like blockchain and contactless[5] payments are shaping the future of online transactions. Providers embracing these technologies stay ahead of the curve.

Emerging Providers and Technologies

New players in the payment industry may bring innovative solutions tailored for the automotive sector. Exploring these options can lead to enhanced efficiency and reduced costs.

How to Set Up Payments for Serpentine Belts

Step-by-Step Guide for Merchants

Setting up payments should be a straightforward process. A step-by-step guide assists merchants in seamlessly integrating their chosen payment provider into their business operations.

User-Friendly Platforms

Payment platforms should prioritize user-friendliness. Intuitive interfaces benefit both merchants and customers, ensuring a positive experience during transactions.

Conclusion

Selecting the right payment provider is critical for businesses dealing with serpentine belts. Security, efficiency, and integration capabilities are key factors to consider The Future of Payment Solutions for Serpentine Belts As technology continues to evolve, payment solutions will follow suit. Businesses should stay informed about emerging trends to remain competitive in the automotive market.

FAQs

A. What are the key features to look for in a payment provider for serpentine belts?

When choosing a payment provider, prioritize security, transaction speed, and integration capabilities to meet the unique needs of the automotive industry.

B. How secure are online transactions for automotive parts in India?

Reputable payment providers employ advanced encryption and security measures to ensure the confidentiality of online transactions in the automotive sector.

C. Can I use international payment providers for my serpentine belt business?

Yes, many international payment providers offer services in India. Ensure compliance with local regulations and consider currency conversion fees.

D. Are there any government regulations regarding online payments in the automotive industry?

Stay informed about government regulations and compliance requirements to ensure a seamless and legal payment process for automotive parts.

E. What steps can merchants take to enhance the security of their payment transactions?

Merchants should implement secure payment gateways, regularly update security protocols, and educate employees on best practices to enhance transaction security.