Author : Sweetie

Date : 19/12/2023

Introduction

International car shipping is a complex process that involves various logistical challenges, and one critical aspect that often gets overlooked is the payment gateway. In the vast landscape of cross-border transactions, having a reliable and efficient payment gateway is crucial for businesses engaged in international car shipping in India.

The Significance of Payment Gateways

Ensuring Secure Transactions

Security is paramount when it comes to financial transactions, especially in the international shipping industry. A robust payment gateway ensures that customer payments are processed securely, reducing the risk of data breaches and fraudulent activities.

Streamlining the Payment Process for Customers

Challenges in International Car Shipping Payments

A seamless payment process contributes to a positive customer experience. An efficient payment gateway simplifies the transaction for customers, making it easy for them to complete their purchase without unnecessary complications.

Currency Conversion Complexities

Cross-Border Transaction Issues

International payments[1] involve multiple currencies, leading to complexities in currency conversion. An ideal payment gateway for car shipping addresses these challenges, providing real-time currency conversion to offer transparency to both businesses and customers.

Navigating cross-border transactions requires careful consideration of regulations and compliance. international payment gateways[2] ensures that businesses can smoothly process payments without running afoul of international financial regulations.

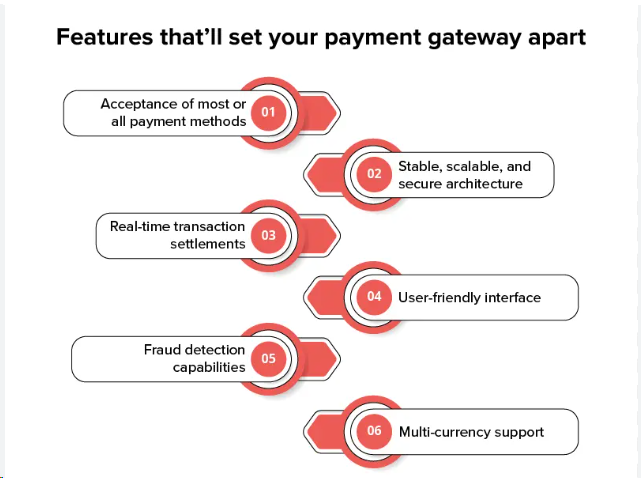

Features of an Ideal Payment Gateway

Fraud Protection Measures

An efficient payment gateway for International Car Shipping [3] must support multiple currencies. This feature allows businesses to cater to a global customer base without the hassle of currency conversion uncertainties. Security against fraud is a top priority. The payment gateway should employ advanced fraud protection measures, such as machine learning algorithms, to detect and prevent fraudulent activities.

User-Friendly Interface

Popular Payment Gateways for International Car Shipping in India

A user-friendly interface is crucial for both businesses and customers. An intuitive payment gateway interface simplifies the payment process, reducing the chances of transaction abandonment.

PayPal

As a widely recognized payment gateway, PayPal offers seamless international transactions with its robust security features and support for multiple currencies.

Stripe

Known for its developer-friendly platform, Stripe provides businesses with the tools to customize their payment processes and accept payments from around the world.

Razorpay

Razorpay is gaining popularity in India for its easy integration and comprehensive features, including international payment support.

Integrating Payment Gateways with Shipping Platforms

How It Enhances the Overall Customer Experience

Integrating payment gateways with shipping platforms[4] streamlines the entire process. This integration enhances order fulfillment efficiency and provides real-time tracking, contributing to an improved overall customer experience.

Customers appreciate a seamless experience from purchase to delivery. international payments gateway in India[5] with shipping platforms ensures that customers can easily track their shipments and receive timely updates, fostering trust and satisfaction.

Future Trends in Payment Gateways for Car Shipping

Emerging Innovations for Smoother Transactions

The payment gateway landscape is evolving with technological advancements, including blockchain and artificial intelligence, promising even more secure and efficient transactions in the future.

Continuous innovations in payment gateway technology aim to provide businesses with tools to navigate the complexities of international transactions with ease.

Tips for Businesses Engaged in International Car Shipping

Mitigating Risks Associated with Cross-Border Transactions

Businesses must carefully evaluate their options and choose a payment gateway that aligns with their specific needs, considering factors like transaction fees, security features, and global reach.

Understanding and mitigating risks associated with cross-border transactions is essential. Businesses should stay informed about international financial regulations and adapt their processes accordingly.

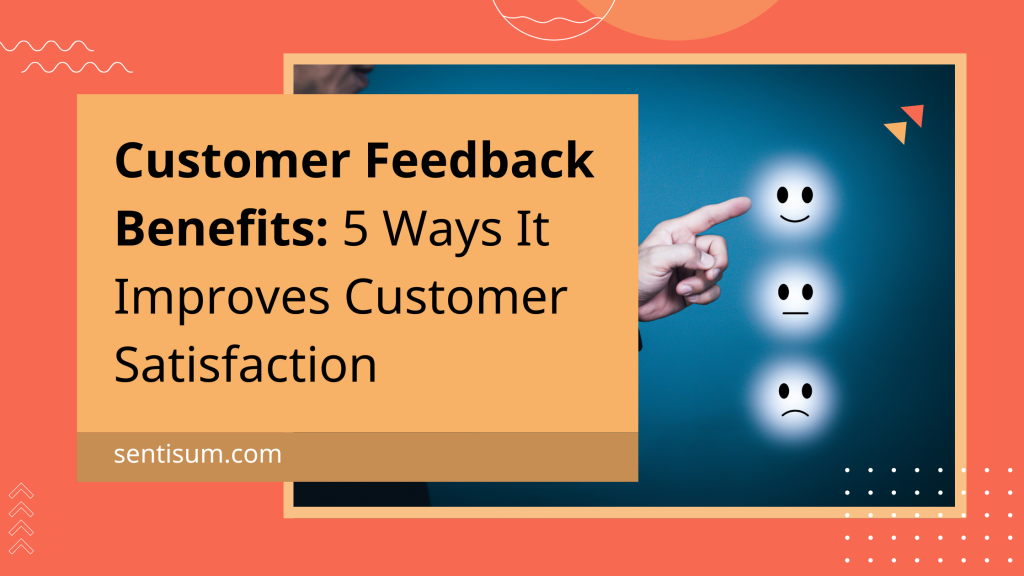

Customer Feedback and Satisfaction

Importance of Feedback in Improving Payment Processes

Feedback from customers provides valuable insights into the effectiveness of the chosen payment gateway. Businesses should actively seek and analyze feedback to continuously improve their payment processes.

Building Trust Through Positive Customer Experiences

Regulatory Compliance in International Transactions

Building trust is crucial in the international car shipping industry. Positive customer experiences, facilitated by a reliable payment gateway, contribute significantly to establishing trust and credibility.

International transactions involve various legal requirements. Businesses must navigate these regulations to ensure compliance and avoid legal complications.

Ensuring Adherence to International Financial Regulations

Overcoming Language Barriers in Payment Processing

Providing Multilingual Support

Adhering to international financial regulations is non-negotiable. Businesses should stay informed about changes in regulations and update their processes accordingly to avoid legal repercussions.

Language should not be a barrier to successful transactions. Offering multilingual support in the payment process ensures that customers from different linguistic backgrounds can easily navigate and complete their payments.

Enhancing Communication for Better Customer Understanding

Clear communication is key. Businesses should focus on providing concise and easily understandable information during the payment process to avoid misunderstandings and enhance customer satisfaction.

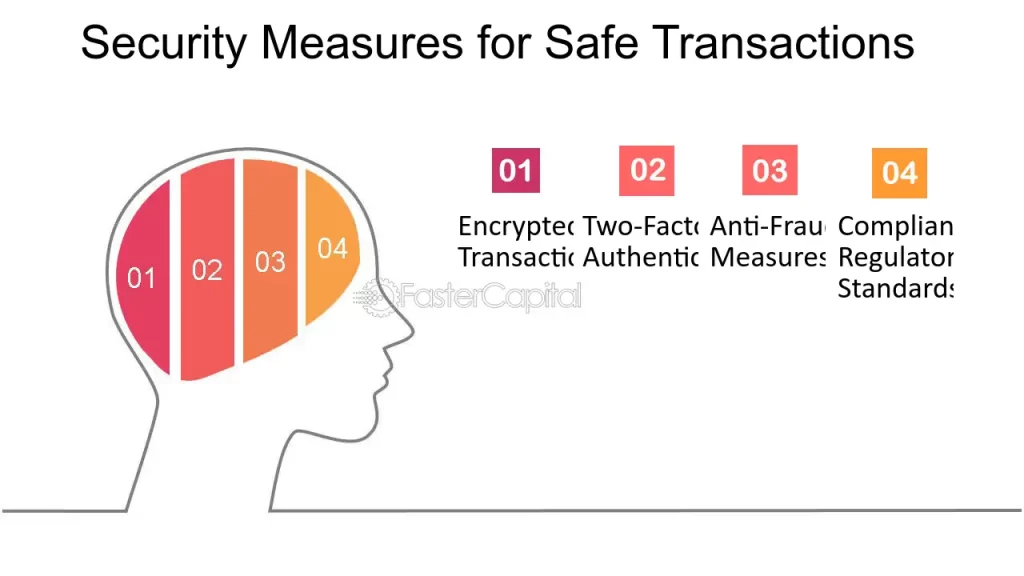

Security Measures for Safe Transactions

SSL Encryption

In the intricate tapestry of cybersecurity, Secure Sockets Layer (SSL) encryption emerges as an indispensable linchpin, weaving an elemental safeguard into the fabric of digital security . Businesses must ensure that their payment gateways utilize SSL encryption to protect customer data during transactions.

Two-Factor Authentication

Fortifying digital defenses, the integration of two-factor authentication fortuitously bolsters security by introducing an additional protective stratum. Businesses should encourage customers to enable this feature for enhanced protection against unauthorized access.

Cost Analysis of Using Payment Gateways

Assessing the Value for Money

A thorough cost analysis is essential. Businesses should compare the fees associated with different payment gateways and choose the option that offers the best value for money while meeting their specific requirements.

While cost is a crucial factor, businesses should also assess the overall value for money, considering the features, security, and support provided by the chosen payment gateway.

Conclusion

In the ever-expanding landscape of international car shipping, a reliable and efficient payment gateway is the linchpin that ensures smooth transactions and customer satisfaction. Businesses must prioritize the selection of a payment gateway that not only meets their operational needs but also aligns with the expectations of their global customer base.

FAQs

- What are the key features to look for in a payment gateway for international car shipping?

- Look for multi-currency support, robust fraud protection measures, and a user-friendly interface.

- Which payment gateways are popular for international transactions in India?

- PayPal, Stripe, and Razorpay are widely used and trusted options.

- How can businesses improve customer trust through payment processes?

- By choosing a reliable payment gateway, actively seeking customer feedback, and ensuring clear communication.

- What role does regulatory compliance play in international transactions?

- Regulatory compliance is crucial to avoid legal complications and ensure smooth cross-border transactions.

- Is it necessary to offer multilingual support in payment processes?

- Yes, providing multilingual support enhances accessibility for customers from different linguistic backgrounds.