AUTHOR:HAZEL DSOUZA

DATE:19/12/2023

The car shipping industry in India is at the crossroads of transformation and one of the pivotal aspects steering this change is the evolution of payment processing methods. In this exploration, we will delve into the intricacies of payment processing for car shipping in India, dissecting the current landscape, the imperative need for digital transformation, and the multitude of benefits derived from embracing modernized payment solutions.

Introduction

India’s car shipping industry, a linchpin in the nation’s logistics sector, is experiencing an escalating demand for vehicle transportation. With this surge in demand comes an equally crucial need for seamless payment processes. In an era where digital advancements are reshaping industries, it becomes imperative for car shipping businesses to adapt to modern payment methods to stay competitive and meet the evolving needs of their clientele.

Traditional Payment Methods in Car Shipping

The traditional payment methods prevalent in the car shipping[1] industry often involve manual processes, leading to inherent drawbacks. Stakeholders grapple with issues such as delayed transactions, lack of transparency, and the heightened risk of financial discrepancies. Recognizing these challenges is the initial step towards acknowledging the necessity for a more efficient and modernized payment ecosystem.

The Digital Revolution

The introduction of digital payment platforms has irrevocably altered the landscape of transactions in the car transport sector. Digital transactions bring with them a plethora of advantages, including speed, transparency, and security. Shipping Corporation of India[2] This section will meticulously explore how the industry is gradually shifting towards modernized payment solutions and the transformative impact it has on the overall efficiency of the payment process.

Leading Players in Digital Payments

Several digital payment providers have established themselves as industry leaders in the Indian market. A comprehensive overview and comparative analysis of these players will aid businesses in making informed decisions about the right platform for their payment needs. Additionally, we will delve into the integration benefits for Car carrier shipping companies[3], shedding light on the advantages of seamless collaboration with these platforms.

Transformative Benefits of Digital Payments

Digital payment processing extends a myriad of benefits to both customers and businesses alike. Streamlined transactions, enhanced security measures, and operational efficiency are just a few of the advantages that contribute to a more seamless experience for all stakeholders involved in the Process of Shipping[4] .

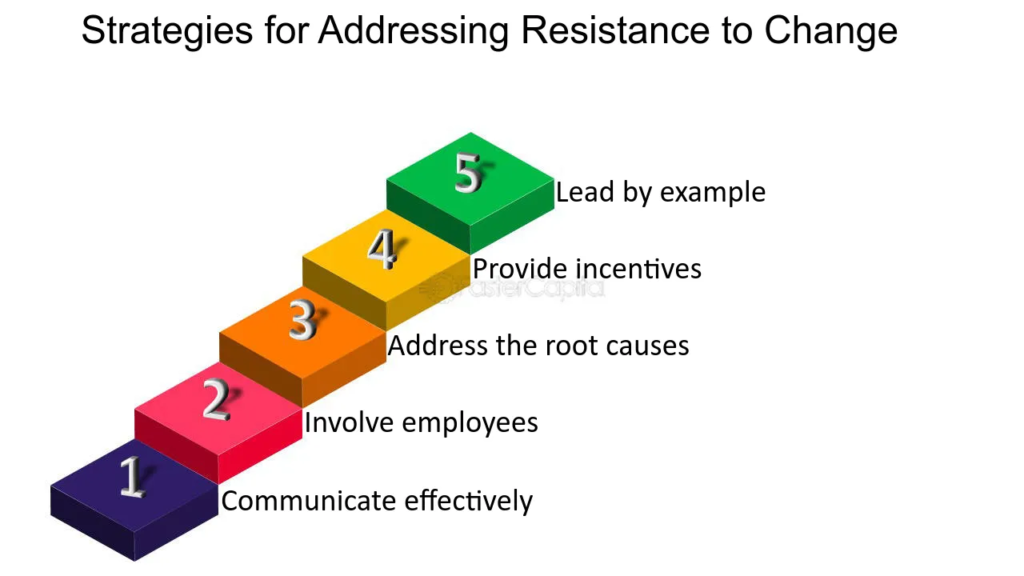

Addressing Challenges and Resistance

While the benefits of digital payments are evident, challenges and concerns may hinder widespread adoption. This section will delve into these issues and propose strategies for overcoming resistance to change. Emphasizing the implementation of robust cybersecurity measures will also be paramount in ensuring the security of digital transactions.

Navigating the Regulatory Landscape

Understanding the regulatory environment is crucial for businesses transitioning to digital payments. This section will provide an in-depth overview of payment regulations in the Indian logistics industry, outlining the compliance requirements for digital payment solutions. Additionally, insights into future trends Shaping the future of payments[5] will be explored, offering businesses a foresight into what lies ahead.

Elevating Customer Experience

User experience is a pivotal aspect of any payment system. This section will explore how digital payment platforms enhance customer experience through user-friendly interfaces, real-time tracking, and notifications. Customer testimonials will provide valuable insights into the improved payment experiences that result from embracing digital solutions.

Successful Integration

A detailed case study will be presented, showcasing a car transport company’s successful transition to digital payments. Metrics highlighting improvements in efficiency and customer satisfaction will be dissected, offering valuable lessons for other companies contemplating a similar shift towards modernized payment solutions.

Future Trends in Payment Processing

The concluding sections of this article will focus on the future outlook of payment processing in the car transport sector. Emerging technologies and predictions for the evolution of digital payment systems will be explored, providing readers with a comprehensive understanding of what the future holds for payment processing in the car transport industry.

Conclusion

seamless payment processing is integral to the success of the car transport industry in India. The shift towards digital solutions is not merely a trend but a necessity for staying competitive and meeting the evolving needs of customers and businesses alike. As the industry continues to evolve, the adoption of digital payment solutions will play a pivotal role in shaping its trajectory.

FAQs

- Q: Are digital payment solutions secure for car transport transactions?

- A: Yes, digital payment solutions employ advanced security measures to ensure the safety of transactions.

- Q: How can car transport companies overcome resistance to adopting digital payments?

- A: Education and showcasing success stories can help concerns and promote acceptance.

- Q: What are the compliance requirements for digital payment solutions in the logistics industry?

- A: Compliance requirements vary, and it’s crucial for companies to stay informed about local regulations.

- Q: Can small car transport businesses benefit from digital payment integration?

- A: Absolutely. Digital payment solutions offer scalability and can be tailored to suit businesses of all sizes.

- Q: How can customers track their payments in real-time with digital solutions?

- A: Most digital payment platforms provide real-time tracking features through user-friendly interfaces.