AUTHOR : RIVA BLACKLEY

DATE : 11/12/2023

Introduction

In the fast-paced world of auto transportation in India, the role of payment processors has become increasingly pivotal. As businesses strive for efficiency and seamless transactions, the evolution of payment processors has significantly impacted the industry. This article delves into the nuances of payment processors in the context of auto transportation, examining their evolution, benefits, challenges, and the role they play in enhancing customer experience.

Evolution of Payment Processors in Auto Transportation

Over the years, payment processors have evolved to meet the dynamic needs of the auto transportation sector. From traditional cash transactions to sophisticated digital platforms, the journey has been transformative. This section explores the historical context and development of payment processors in the industry, highlighting key milestones.

Key Features of Modern Payment Processors

Modern payment[1] processors offer a range of features that contribute to their widespread adoption. Security, ease of use, and integration capabilities are paramount. In this section, we’ll delve into the essential features that make these processors indispensable for auto transportation businesses[2].

Benefits for Auto Transportation Businesses

The adoption of payment processors brings a multitude of benefits for businesses involved in auto transportation. From improved operational efficiency to reduced costs and enhanced customer experience, the advantages are substantial. We’ll explore these benefits and their impact on the industry.

Challenges Faced by Auto Transporters

Despite the evident advantages, auto transporters face challenges in the realm of payment processing. Security concerns, transaction delays, and adapting to evolving technologies pose significant hurdles. This section sheds light on these challenges and suggests ways to navigate them effectively.

Popular Payment Processors in India

India boasts several prominent payment processors that cater specifically to the auto transportation sector. A comprehensive overview of these platforms, their features, and user experiences will guide businesses[3] in making informed decisions.

How Payment Processors Impact Customer Experience

The integration of payment processors has a profound impact on customer experience in the auto transportation industry. Streamlined transactions, increased trust, and enhanced reliability contribute to overall customer satisfaction. We’ll explore how these processors positively influence customer interactions.

Security Measures in Payment Processing

Security is a paramount concern in payment processing. Encryption, fraud detection[4], and compliance with industry standards play a crucial role in safeguarding transactions. This section details the security measures implemented by leading payment processors in the auto transportation sector.

Integration of Payment Processors with Auto Transportation Platforms

Seamless integration with existing auto transportation platforms is key to maximizing the benefits of payment processors. This section outlines the advantages of integration and offers insights into the implementation process.

Case Studies

Real-world examples of successful payment processor implementation in the auto transportation industry provide valuable insights. Case studies highlight the positive outcomes and lessons learned from various businesses that have embraced digital payment solutions.

Future Trends in Payment Processing for Auto Transportation

The future holds exciting possibilities for payment processing in auto transportation. Predictions and emerging technologies, such as blockchain and contactless payments, are explored in this section, offering a glimpse into what lies ahead.

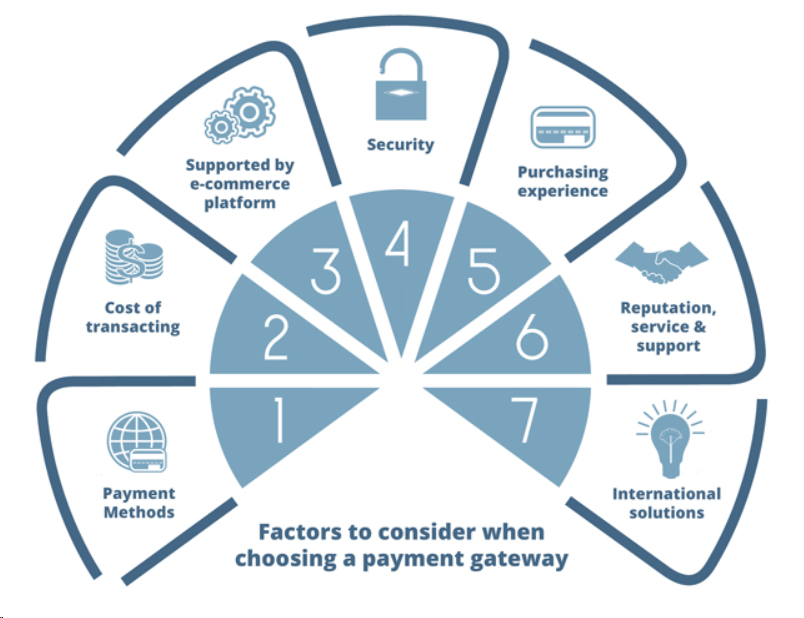

Tips for Choosing the Right Payment Processor

Selecting the right payment processor is critical for auto transportation businesses. Considerations such as transaction fees, security features, and scalability are discussed, providing a guide for businesses in their decision-making process.

Success Stories

Profiles of companies that have successfully integrated payment[5] processors into their operations showcase the tangible benefits of embracing digital payment solutions. These success stories serve as inspiration for other businesses considering similar implementations.

Regulatory Compliance

Navigating the regulatory landscape is essential when integrating payment processors into auto transportation operations. Understanding and adhering to legal requirements ensure a smooth and compliant transaction process.

Conclusion

In conclusion, the integration of payment processors has revolutionized the auto transportation industry in India. From historical developments to future trends, the journey has been marked by innovation and positive transformation. Businesses that embrace digital payment solutions stand to gain significantly in terms of efficiency, cost-effectiveness, and customer satisfaction.

FAQS

- Is it mandatory for auto transportation businesses in India to use payment processors?

- While not mandatory, the use of payment processors is highly recommended for efficiency and security.

- What security measures should auto transporters look for in a payment processor?

- Encryption, fraud detection, and compliance with industry standards are crucial security features.

- Can small-scale auto transportation businesses benefit from payment processors?

- Yes, payment processors offer scalability, making them suitable for businesses of all sizes.

- Are there any government regulations regarding payment processing in the auto transportation sector?

- Businesses must adhere to relevant financial regulations and data protection laws.

- How quickly can a business integrate a payment processor into its operations?

- The integration process varies but can be relatively quick with proper planning and support