AUTHOR : PUMPKIN KORE

DATE : 20/12/2023

The Indian beer market has witnessed a substantial growth spurt in recent years, with an increasing number of consumers opting for monthly beer subscriptions. As the demand for such services rises, businesses face the crucial task of finding a payment provider that can cater to the unique needs of monthly beer shipments In this article, we will explore the challenges, the role of payment providers, and guide businesses in choosing the right partner for seamless transactions.

Monthly Subscription Model Challenges

Running a Monthly Beer Shipments subscription model for beer shipments comes with its set of challenges. From managing recurring payments to handling changes in subscription plans, businesses need a payment provider that can adapt to the dynamic nature of subscription-based services .payment provider for Monthly beer shipments In India

Diverse Payment Preferences in India

India is known for its diverse payment[1] landscape, with preferences ranging from credit cards to UPI and digital wallets. Navigating through these preferences requires a payment provider that supports a wide array of payment methods[2], ensuring that customers can choose what suits them best.

Popular Payment Providers in India

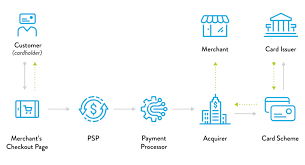

Overview of Leading Payment Providers

India boasts several leading payment providers, each with its strengths and specialties. Understanding the offerings of these providers is essential for businesses looking to streamline their monthly beer shipment payments[4].

Not all Automated Payment Provider[3] are created equal, and businesses need to evaluate which ones align with the specific requirements of monthly beer shipments. Factors such as transaction fees, integration capabilities, and customer support are crucial in making this determination.

User Experience in Payment Processing

A smooth payment in India contributes significantly to overall customer satisfaction. Payment providers that offer a seamless user experience contribute to positive customer perceptions, fostering loyalty and repeat business.

User interfaces play a crucial role in the payment process. Businesses should prioritize payment providers[5] that offer intuitive and user-friendly interfaces, reducing friction in the customer’s journey from selection to payment confirmation.

Integration with E-commerce Platforms

For businesses with an online presence, integrating payment solutions with e-commerce platforms is essential. This integration streamlines the entire customer journey, from product selection to payment, enhancing the overall shopping experience.

Successful integration with e-commerce platforms leads to increased efficiency and reduced operational complexities. Case studies highlighting businesses that have seamlessly integrated payment solutions can serve as valuable insights for others.

Regulatory Compliance

Navigating the regulatory landscape is crucial for businesses and payment providers alike. Payment providers must adhere to the existing payment industry regulations in India, ensuring legal compliance and building trust with customers.

Businesses should inquire about the measures payment providers take to ensure regulatory compliance. This includes staying updated on changes in regulations, implementing necessary safeguards, and conducting regular audits.

Real-Life Experiences with Payment Providers in the Beer Industry

To gauge the effectiveness of payment providers, businesses should seek real-life testimonials from others in the beer industry. Insights into the experiences of peers can provide valuable information and aid in decision-making.

Testimonials should not only focus on the technical aspects of payment processing but also highlight the positive impact on overall business operations and customer relationships.

Future Trends in Beer Subscription Payments

The payment landscape is constantly evolving, and businesses should be aware of emerging technologies. From blockchain to contactless payments, understanding future trends ensures that businesses remain at the forefront of payment innovations.

Anticipated Changes in the Beer Subscription Market

As the beer subscription market matures, changes in consumer behavior and preferences are inevitable. Payment providers should be capable of adapting to these changes, offering flexibility and scalability to meet evolving demands.

Conclusion

In conclusion, the choice of a payment provider for monthly beer shipments in India is a critical decision that can significantly impact the success of a business. By understanding the challenges, considering the role of payment providers, and carefully evaluating options, businesses can make informed decisions that contribute to seamless transactions and overall customer satisfaction.

FAQs

- Q: How do payment providers ensure the security of online transactions?

- A: Payment providers employ advanced technologies like encryption and tokenization to secure online transactions, ensuring customer data remains confidential.

- Q: What factors should businesses prioritize when choosing a payment provider?

- A: Businesses should prioritize factors such as transaction speed, security measures, scalability, and compatibility with existing systems.

- Q: Are there specific payment methods preferred by customers in the Indian beer market?

- A: The Indian market has diverse payment preferences, including credit cards, UPI, and digital wallets. Businesses should offer a variety of options to cater to customer preferences.

- Q: How can businesses integrate payment solutions with e-commerce platforms successfully?

- A: Successful integration involves choosing payment providers with seamless integration capabilities and ensuring compatibility with the chosen e-commerce platform.

- Q: What future trends are expected in beer subscription payments?

- A: Emerging technologies like blockchain and contactless payments are anticipated trends. Businesses should stay updated to remain at the forefront of payment innovations.