AUTHOR : RUBBY PATEL

DATE :21/12/23

Introduction

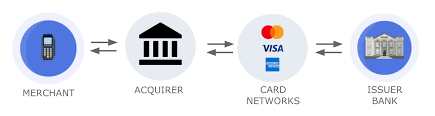

In the dynamic landscape of corporate acquisitions, the pursuit of high-risk PSP (Payment Service Provider) acquisitions in India demands a nuanced understanding of challenges and opportunities. This article explores the intricacies of such acquisitions, shedding light on the complexities, strategies for mitigation, and the potential for success .

Understanding High-Risk PSP Corporate Acquisitions

High-risk PSP corporate acquisitions involve transactions with elevated uncertainties and potential pitfalls. These may include volatile market conditions, regulatory challenges, and financial intricacies. In essence, navigating these acquisitions demands a strategic approach to mitigate risks effectively.

Challenges in PSP Corporate Acquisitions in India

Regulatory Hurdles

India’s regulatory framework poses a significant challenge for PSP acquisitions. Understanding and complying with diverse regulations in the financial sector is crucial for a successful acquisition.

Cultural and Market Differences

Cultural nuances and variations in the Indian market can be a stumbling block for PSP acquisitions. Adapting to local practices and consumer behavior [1] is essential for seamless integration.

Financial and Legal Complexities

Navigating the financial and legal landscape in India[2] requires meticulous planning. Issues such as taxation, compliance, and financial due diligence demand thorough attention.

Case Studies of High-Risk PSP Acquisitions in India

XYZ Corporation

XYZ Corporation’s ambitious PSP acquisition faced regulatory roadblocks, leading to delays and increased costs. The case highlights the importance of proactive regulatory compliance.

ABC Enterprises

ABC Enterprises successfully navigated market[3] differences through cultural integration strategies, showcasing the significance of understanding local dynamics.

Strategies to Mitigate Risks in PSP Acquisitions

Thorough Due Diligence

Comprehensive due diligence is the bedrock of successful PSP[4] acquisitions. Analyzing financial, legal, and operational aspects is vital for risk mitigation[5].

Legal and Financial Advisors

Engaging experienced legal and financial advisors provides invaluable insights and guidance throughout the acquisition process.

Cultural Integration Planning

Strategic planning for cultural integration is imperative. Acknowledging and respecting cultural differences ensures a smooth transition post-acquisition.

Benefits and Opportunities in High-Risk PSP Acquisitions

Potential for High Returns

Despite the risks, high-risk PSP acquisitions present opportunities for substantial returns, especially in a growing market like India.

Market Expansion Opportunities

Acquiring a PSP in India opens doors to a vast market, providing avenues for expanding the business footprint.

Success Stories in High-Risk PSP Acquisitions

Learning from Successful Cases

Analyzing success stories offers valuable lessons for aspiring companies. Identifying commonalities in their approaches can inform strategic decision-making.

Adapting Strategies for Success

Tailoring strategies based on successful cases ensures a more informed and targeted approach to high-risk PSP acquisitions.

Future Trends in PSP Acquisitions in India

Emerging Sectors and Industries

As technology evolves, certain sectors within PSPs may emerge as focal points for acquisitions. Staying abreast of industry trends is crucial for strategic decision-making.

Technological Advancements

Advancements in technology will likely shape the future of PSP acquisitions. Companies must be prepared to embrace innovation for sustained success.

Expert Insights and Opinions

Interviews with Industry Experts

Insights from industry experts provide a holistic view of the landscape, helping companies anticipate challenges and devise effective strategies.

Opinions on Mitigating Risks

Experts share their opinions on mitigating risks, offering practical advice for companies embarking on high-risk PSP acquisitions in India.

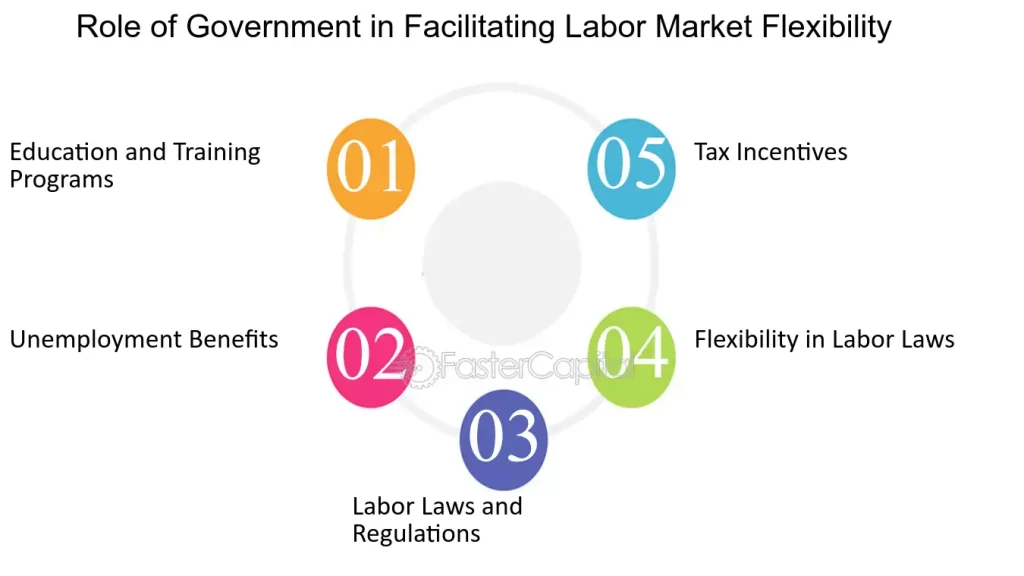

The Role of Government in Facilitating PSP Acquisitions

Regulatory Support

Government support and regulatory frameworks play a pivotal role in fostering a conducive environment for PSP acquisitions.

Policy Changes

Potential policy changes can impact the landscape of PSP acquisitions, emphasizing the need for companies to stay informed and adaptable.

Conclusion

In conclusion, high-risk PSP corporate acquisitions in India are intricate endeavors that demand meticulous planning, strategic foresight, and adaptability. Navigating challenges while capitalizing on opportunities is key to achieving success in this dynamic market.

FAQs

- Q: What makes PSP acquisitions in India high-risk? A: Factors such as regulatory complexities, cultural differences, and financial intricacies contribute to the elevated risk in PSP acquisitions.

- Q: How can companies mitigate the risks associated with PSP acquisitions? A: Thorough due diligence, engagement with legal and financial advisors, and strategic cultural integration planning are essential for risk mitigation.

- Q: Are there success stories of companies overcoming challenges in PSP acquisitions in India? A: Yes, successful cases highlight the importance of proactive regulatory compliance, cultural integration, and strategic planning.

- Q: What role does the government play in facilitating PSP acquisitions in India? A: Government support through regulatory frameworks and potential policy changes significantly impacts the landscape of PSP acquisitions.

- Q: How can companies stay abreast of future trends in PSP acquisitions? A: Keeping an eye on emerging sectors, industry trends, and technological advancements is crucial for anticipating future opportunities and challenges.