AUTHOR : KHOKHO

DATE : 21/12/2023

Introduction

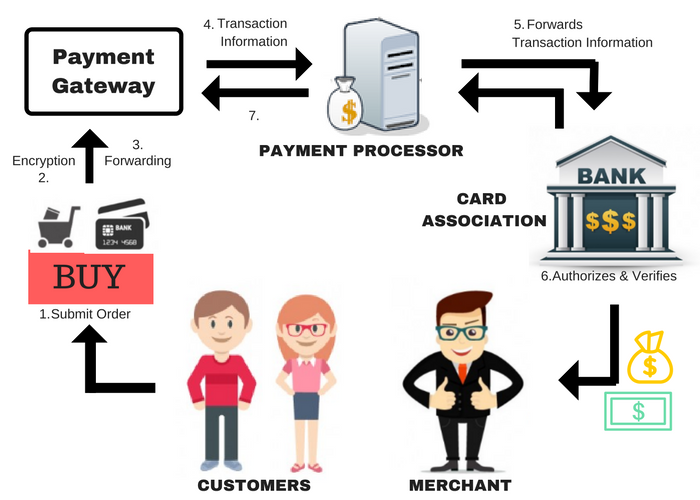

Navigating the dynamic landscape of high-risk payment service providers (PSPs) in India is no small feat. As the financial sector evolves, the need for services catering to high-risk corporate clientele has become increasingly apparent. In this article, we’ll delve into the intricacies of high-risk PSPs[1] in the Indian market, exploring their challenges, benefits, and also strategies for success

Understanding High-Risk PSPs

High-risk PSPs Corporate Clientele In India are entities that operate in industries prone to regulatory scrutiny and financial instability These industries may include online gaming, adult entertainment, and also cryptocurrency[2], among others. Identifying such sectors is crucial for comprehending the unique challenges faced by PSPs Corporate Clientele operating within them.

Challenges Faced by High-Risk PSPs in India

Regulatory Compliance High-risk PSPs Corporate Clientele In India encounter stringent regulatory requirements, necessitating robust compliance protocols. The article will explore the specific regulations affecting these entities and also how they can navigate the complex regulatory landscape in India.

Security Concerns Security is paramount in the world of high-risk PSP Corporate[3] transactions. We’ll discuss the heightened security measures that PSPs must implement to protect both themselves and also their clients.

Financial Risks The financial landscape for high-risk PSPs Corporate is inherently volatile. Examining the financial risks associated[4] with these businesses is crucial for understanding their resilience and also sustainability.

Benefits of High-Risk PSPs in India

Market Opportunities Contrary to the challenges, high-risk PSPs Corporate Clientele In India have unique market opportunities. We’ll explore the niche markets and also untapped potentials that make these services attractive in the Indian context.

Revenue Generation Despite the risks, successful high-risk PSPs can generate substantial revenue. We’ll delve into the revenue models and also financial incentives that drive these businesses.

Niche Markets Identifying and also catering to niche Corporate markets is a key strategy for high-risk PSPs. The article will provide examples of successful ventures that have capitalized on specific market segments[5].

Strategies for Success

Establishing Robust Compliance Protocols Navigating the regulatory landscape requires a proactive approach. We’ll discuss the importance of establishing and maintaining robust compliance protocols.

Building Trust with Stakeholders In an industry where trust is paramount, building and also maintaining relationships with stakeholders is crucial. The article will provide insights into effective strategies for gaining trust in high-risk PSP Corporate Clientele In India sectors.

Leveraging Technology Solutions The integration of cutting-edge technology is pivotal for high-risk PSPs. We’ll explore how advancements in technology, such as AI and also machine learning, can be leveraged for enhanced efficiency and also security.

Case Studies of Successful High-Risk PSPs in India

Future Trends in High-Risk PSPs

Emerging Industries Identifying emerging industries that may become high-risk in the future is crucial for the long-term success of PSPs. We’ll explore potential trends and industries on the horizon.

Technological Advancements Continued technological advancements will shape the future of high-risk PSPs. The article will discuss how technologies like blockchain and also digital identity verification may impact these entities.

Regulatory Changes Anticipating and also adapting to regulatory changes is essential for the sustained success of high-risk PSPs. We’ll explore potential regulatory shifts and also their implications.

The Role of Digital Transformation

Adapting to Digital Platforms The digital landscape is evolving rapidly. We’ll discuss how high-risk PSPs can adapt to and capitalize on digital platforms for increased reach and efficiency.

Integration of AI and Machine Learning The integration of AI and machine learning can revolutionize high-risk PSP operations. We’ll explore specific use cases and the potential benefits of these technologies.

Challenges and Opportunities for Investors

Evaluating Risk Factors Investors must carefully evaluate the risk factors associated with high-risk PSPs. We’ll provide a comprehensive guide on assessing risks and making informed investment decisions.

Identifying Lucrative Investment Opportunities Despite the challenges, high-risk PSPs can offer lucrative investment opportunities. We’ll highlight key indicators and factors that investors should consider.

Conclusion

In conclusion, the realm of high-risk PSP corporate clientele in India is both challenging and promising. From regulatory hurdles to financial risks, these entities navigate a complex landscape. However, with strategic planning, technological integration, and a proactive approach to compliance, success is attainable.

FAQs on High-Risk PSP Corporate Clientele in India

- How does the Indian market define high-risk industries? High-risk industries in India are typically those that pose regulatory challenges and financial instability. Examples include online gaming, adult entertainment, and cryptocurrency.

- What strategies can high-risk PSPs employ for regulatory compliance? High-risk PSPs should establish robust compliance protocols, stay abreast of regulatory changes, and engage with relevant authorities to ensure adherence to regulations.

- Are there specific technological solutions for enhancing security in high-risk PSPs? Yes, high-risk PSPs can leverage advanced technologies such as encryption, biometrics, and AI-driven fraud detection systems to enhance security measures.

- How can investors assess the potential risks and rewards of investing in high-risk PSPs? Investors should evaluate the specific risk factors associated with the industry, assess the company’s compliance measures, and identify growth opportunities within niche markets.

- What are the key factors contributing to the success of high-risk PSPs in India? Successful high-risk PSPs in India often attribute their success to a combination of robust compliance, innovative security measures, and also strategic market positioning.