AUTHOR : RIVA BLACKLEY

DATE : 20/12/2023

Introduction

In the dynamic landscape of India’s business ecosystem, the role of payment gateways has evolved significantly over the years. As technology continues to shape the way transactions occur, the need for effective collaboration in the payment gateway sector has become more apparent than ever. This article explores the intricacies of payment gateway business collaboration in India, shedding light on its evolution, current state, challenges, and the potential benefits for businesses.

Evolution of Payment Gateway in India

The journey of payment gateways in India has been marked by a fascinating evolution. From the initial days of digital transactions to the present era of seamless online payments, Payment Collaboration the sector has witnessed transformative changes. Technological advancements have played a pivotal role, making transactions faster, more secure, and accessible to a wider audience.

Current Payment Gateway Landscape

As of today, India boasts a diverse landscape of payment gateway providers. From industry giants to innovative startups, the market is bustling with competition Collaboration In India. Statistics reveal a substantial increase in online transactions, emphasizing the growing reliance on digital payment methods. Understanding this landscape is crucial for businesses contemplating collaboration.

Challenges in the Payment Gateway Sector

Despite the remarkable growth, the payment gateway sector faces its share of challenges. Business Collaboration In India Regulatory hurdles, security concerns, and intense competition create a complex environment for businesses. It is within this context that the concept of collaboration emerges as a potential solution to overcome these challenges and drive collective growth Gateway to Seamless Payments[2].

Business Collaboration as a Solution

Collaboration in the payment gateway sector offers a myriad of advantages Business ecosystem[1]. Shared resources, combined expertise, and a broader reach are just a few benefits that businesses can reap from working together. Digital Payments[2] Examining successful case studies provides valuable insights into how collaboration can foster innovation and address industry challenges effectively.

Strategies for Effective Collaboration

For businesses considering collaboration, it is imperative to adopt effective strategies. Identifying compatible partners, establishing mutual goals, and addressing potential challenges are crucial steps in ensuring a successful partnership. This section explores practical approaches for businesses looking to embark on collaborative ventures Integrated payments[3].

Impact on Small and Medium Enterprises (SMEs)

Small and medium enterprises stand to gain significantly from collaborative payment gateways[4]. Accessibility to a wider audience, reduced operational costs, and enhanced financial stability are among the key benefits. This section examines how SMEs can leverage collaborative ventures to strengthen their market presence.

Government Initiatives and Support

The Indian government has recognized the importance of collaboration in fostering economic growth. Policies encouraging collaboration and incentives for businesses have been implemented to support the payment gateway sector. Understanding the government’s stance is essential for businesses navigating the collaborative landscape.

Case Studies

Highlighting real-world examples of successful collaborations provides tangible evidence of the benefits. Case studies showcase how businesses, both large and small, have navigated challenges, leveraged opportunities, and achieved mutual success through collaborative payment gateway ventures.

The Role of Technology in Collaboration

Technology plays a pivotal role in shaping collaborative ventures. Integration of innovative technologies not only enhances the efficiency of payment gateways but also improves the overall user experience. This section delves into the technological aspects that contribute to successful collaborations.

Future Prospects

What does the future hold for collaborative payment gateways in India? This section explores predictions and emerging trends, offering insights into how businesses can prepare for the evolving landscape and stay ahead of the curve.

Consumer Trust in Collaborative Payment Gateways

Building consumer trust is paramount in the payment gateway industry[5]. This section discusses the importance of transparency, customer testimonials, and other strategies that contribute to establishing and maintaining trust in collaborative payment gateways.

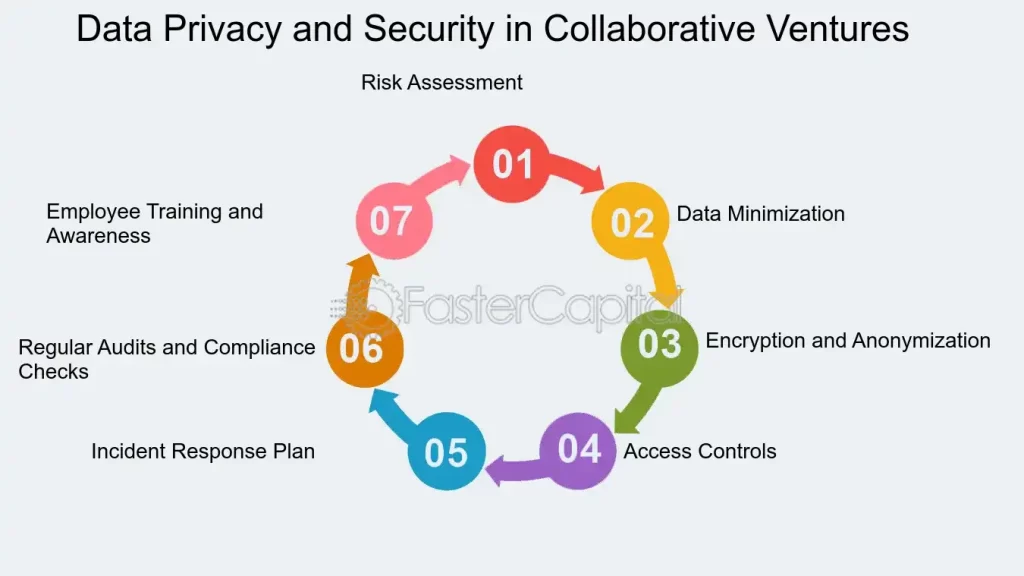

The Importance of Security in Collaborative Ventures

Security is a top priority in the payment gateway sector. This section emphasizes the need for robust security measures and regulatory compliance in collaborative ventures. Businesses must prioritize security to build confidence among users and stakeholders.

Conclusion

In conclusion, payment gateway business collaboration in India holds immense potential for driving innovation, overcoming challenges, and fostering collective growth. Businesses, regardless of their size, can benefit from strategically exploring and embracing collaborative opportunities. As the payment gateway landscape continues to evolve, proactive collaboration emerges as a key driver for sustainable success.

FAQS

- How can small businesses benefit from collaborative payment gateways?

- Exploring the advantages for SMEs in collaborative ventures.

- What role does government support play in collaborative payment gateways?

- Understanding the impact of government initiatives on collaborative efforts.

- How can businesses ensure security in collaborative payment gateway ventures?

- Exploring strategies for maintaining security in collaborative ventures.

- Are there any specific technologies that enhance collaborative payment gateways?

- Discussing the technological aspects that contribute to successful collaborations.

- What are the predicted trends for collaborative payment gateways in the future?

- Offering insights into the expected trends and developments in the industry.