AUTHOR : RIVA BLACKLEY

DATE : 05/12/2023

Introduction

In the dynamic landscape of the digital age, the Payment Gateway Business[1] has emerged as a linchpin in facilitating online transactions. Its significance goes beyond mere transaction processing; it plays a pivotal role in ensuring the smooth flow of financial operations, especially in the Business to Business (B2B) sector.

Evolution of Payment Gateways in India

The journey of payment gateways in India has been marked by early challenges and subsequent growth, particularly in the B2B space. Overcoming initial hurdles, these gateways have become integral to the functioning of businesses, streamlining financial processes and enabling seamless transactions.

Key Players in the Indian B2B Payment Gateway Market

As the B2B payment gateway sector flourishes, several key players have emerged. Companies like XYZ Payment Solutions and ABC Financial Services dominate the market, each offering unique services. A comparative analysis businesses[2] make informed choices based on their specific needs.

Advantages of Using Payment Gateways in B2B Transactions

The advantages of employing payment gateways in B2B transactions are manifold. Not only do they streamline financial processes, but they also enhance security, reducing the risk of fraudulent activities. Businesses find themselves operating more efficiently and securely with the integration of these gateways.

Challenges and Solutions in B2B Payment Gateway Integration

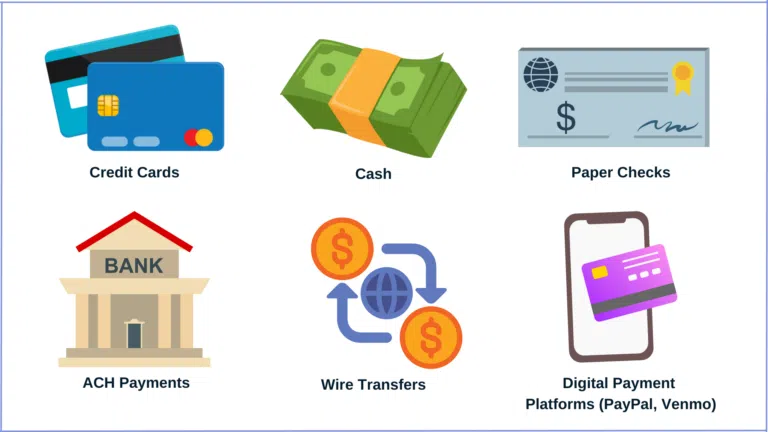

Large-scale B2B transactions often come with complexities that traditional payment methods struggle to address. Innovative solutions, such as blockchain integration, Payment Gateway Integration[3] have proven effective in overcoming these challenges, ensuring a seamless payment experience for businesses.

Regulatory Landscape in India

The regulatory landscape in India significantly impacts the B2B payment gateway industry. Compliance requirements for businesses are stringent, necessitating a thorough understanding of the legal framework to ensure smooth operations and also transactions.

Technological Innovations Shaping the B2B Payment Gateway Industry

Technological innovations, particularly blockchain, are reshaping the B2B payment gateway[4] industry. The integration of these technologies ensures enhanced security and transparency in transactions, providing businesses with a reliable and efficient financial ecosystem.

Successful Implementations in B2B Transactions

Real-world examples of successful B2B transactions showcase the effectiveness of payment gateways. Companies like PQR Enterprises and LMN Corporations have implemented these gateways seamlessly, providing valuable lessons for businesses contemplating integration.

Tips for Choosing the Right B2B Payment Gateway Provider

Selecting the right B2B payment[5] gateway provider is crucial for businesses. Factors such as transaction fees, security features, and scalability must be considered. Tailoring the choice to specific business needs ensures a seamless and customized payment experience.

Future Trends in B2B Payment Gateway Industry

The B2B payment gateway industry is poised for significant advancements. Anticipated developments include the integration of artificial intelligence, further streamlining transaction processing and enhancing the overall efficiency of financial operations.

Customer Testimonials: Experiences with B2B Payment Gateways

Payment Gateway Business to Business in India Businesses that have embraced B2B payment gateways share their experiences. These testimonials provide insights into the real-world benefits and challenges, offering valuable perspectives for businesses considering the adoption of payment gateways.

Educational Resources for Businesses

Guides on integrating payment gateways and training materials for secure transactions are essential resources for businesses. These educational materials empower businesses to navigate the complexities of payment gateway integration, ensuring a smooth and secure transition.

The Global Perspective: B2B Payment Gateway Trends Worldwide

A comparative look at international B2B payment gateway trends provides valuable insights. Examining global practices helps identify best practices and lessons that the Indian market can incorporate for continuous improvement.

The Impact of B2B Payment Gateways on Small and Medium Enterprises (SMEs)

Payment Gateway Business to Business in India B2B payment gateways play a transformative role in empowering SMEs. By facilitating digital transactions, these gateways help SMEs overcome financial barriers, fostering growth and sustainability in a competitive business environment.

Can you provide examples of successful B2B transactions using payment gateways?

Real-world examples from companies like PQR Enterprises and LMN Corporations the successful implementation of B2B payment gateways, offering valuable insights for businesses. These educational materials empower businesses to navigate the complexities of payment gateway integration, ensuring a smooth and secure transition.

How do B2B payment gateways empower small and medium enterprises (SMEs)?

B2B payment gateways play a transformative role in SMEs by digital transactions, helping them overcome financial barriers for growth and sustainability digital transactions, these gateways help SMEs overcome. These educational materials empower businesses to navigate the complexities of payment gateway integration, ensuring a smooth and secure transition.

Conclusion

In conclusion, the Business in India is a dynamic and essential aspect of modern commerce. As businesses continue to embrace digital transformation, the role of payment gateways becomes increasingly vital. From overcoming challenges to harnessing technological innovations, the B2B payment gateway industry is evolving rapidly, providing businesses with secure and efficient financial solutions.

FAQS

- What are the key benefits of using B2B payment gateways in India?

- B2B payment gateways streamline financial processes and enhance security, reducing the risk of fraud.

- How can businesses overcome the challenges of large-scale B2B transactions?

- Innovative solutions, such as blockchain integration, prove effective in addressing the complexities of large-scale transactions.

- What factors should businesses consider when choosing a B2B payment gateway provider?

- Factors such as transaction fees, security features, and scalability are crucial considerations for businesses.

- What is the regulatory landscape for B2B payment gateways in India?

- The regulatory landscape in India